Market analysis from ActivTrades

By Ion Jauregui – Analyst at ActivTrades Booking Raises Its Voice U.S. tourism is facing a concerning slowdown. Glenn Fogel, CEO of Booking Holdings (NASDAQ: BKNG), has warned that the United States is losing competitiveness as an international destination due to slow border control procedures. Between January and July 2025, the country received 1.1 million...

Ion Jauregui – Analyst at ActivTrades Airbnb Inc. (NASDAQ: ABNB) recently released its quarterly results, significantly exceeding market expectations and reaffirming its position as a leader in the tourism sector, which continues to recover following the impacts of the pandemic. Fundamental Analysis During the last quarter, Airbnb reported revenues of 3.1...

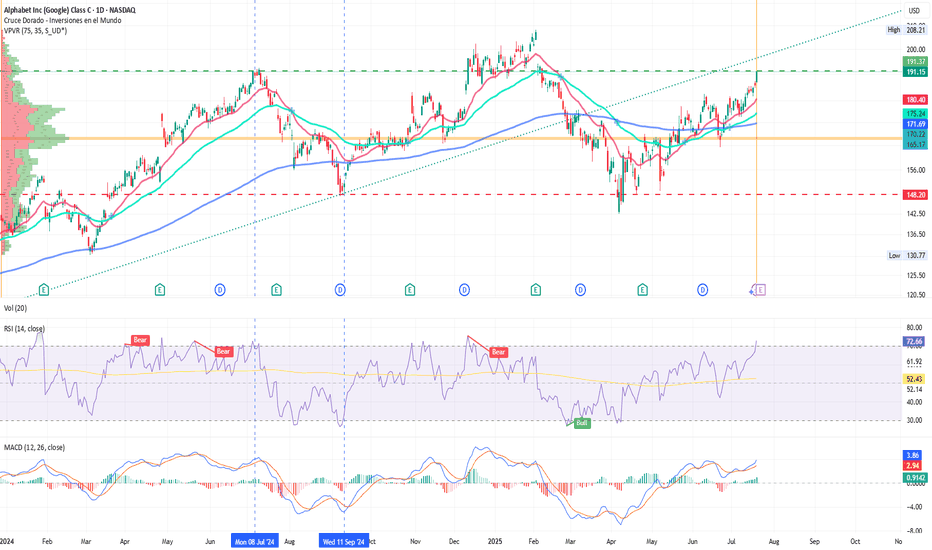

Markets in Rotation: Cyclical Stocks Take the Lead in 2025 Ion Jauregui – Analyst at ActivTrades In a 2025 marked by tariff uncertainty, persistent geopolitical tensions, and stock markets that started the year at record highs, it seemed reasonable to favor defensive stocks. However, market behavior has made it clear that the rotation toward cyclical sectors has...

British Banks Dodge a Legal Bullet, but Still Face Billion-Pound Costs Ion Jauregui – Analyst at ActivTrades The UK Supreme Court relieves financial institutions from paying up to £44 billion over the car finance scandal. The FCA is preparing compensation plans that could cost up to £18 billion. British banks have narrowly avoided a legal blow that...

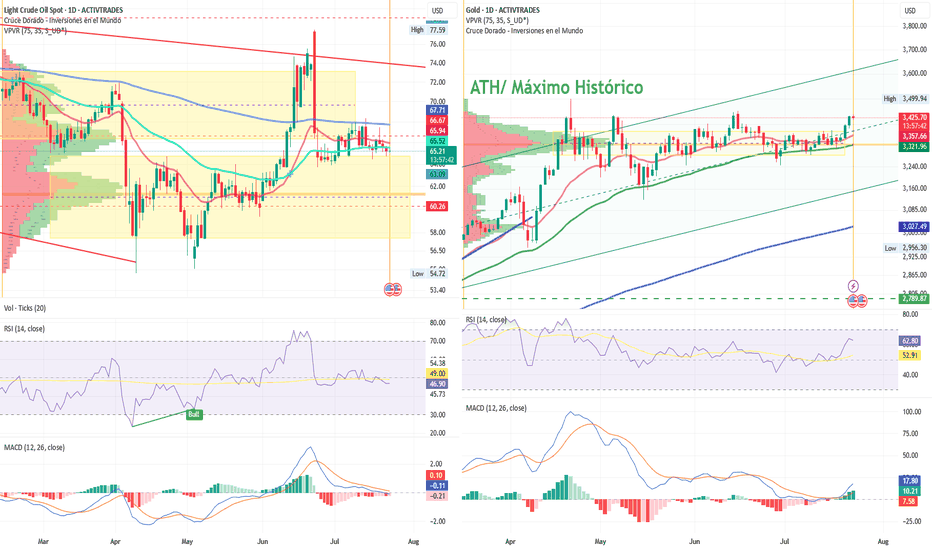

Ion Jauregui – Analyst at ActivTrades The oil market is bracing for a new episode of high tension. With Brent stabilizing around $70 per barrel, OPEC+ has made a decisive move: starting in September, it will increase production by 547,000 barrels per day—a decision that could significantly alter the global supply-demand balance. The announcement comes at a...

Nikkei Nears Historic Highs One Year After Its Steepest Drop in Three Decades Ion Jauregui – Analyst at ActivTrades The Nikkei 225 enters August trading above 41,500 points, approaching its all-time highs after recovering 26% from the lows recorded one year ago. In August 2024, the Japanese benchmark suffered its sharpest monthly drop in over 35 years, falling...

Ion Jauregui – Analyst at ActivTrades Fundamental Analysis In 2025, gold has appreciated around 27% year-to-date, reaching a peak of 33.37% at the end of April, driven by structural factors. Its strength is based on global de-dollarization, central bank purchases, persistent inflation, and expectations of real rate cuts in the U.S. Since real interest rates...

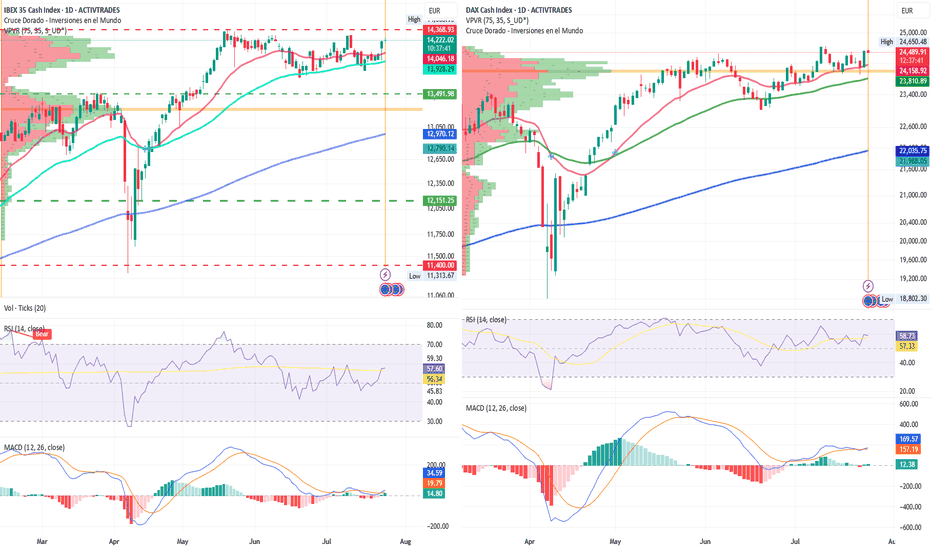

Will the IBEX 35 End July at New Highs? Futures Point Up Despite Tariff Threat By Ion Jauregui – Analyst at ActivTrades The IBEX 35 could end July near record highs following a strong opening across European markets. At 08:10 CET, futures on the Spanish benchmark were up 0.54% to 14,445 points, showing more strength than their peers: Euro Stoxx 50 futures rose...

By Ion Jauregui – Analyst at ActivTrades The European Central Bank has decided to pause its rate-cutting cycle after seven consecutive reductions over the past twelve months, leaving the deposit rate at 2%, the refinancing rate at 2.15%, and the marginal lending facility at 2.4%. This move, largely priced in by the markets, reflects the ECB’s growing caution in...

By Ion Jauregui – Analyst at ActivTrades Meta Platforms (TICKER AT: META.US) has posted strong quarterly results that significantly exceeded market expectations, driven by its solid positioning in artificial intelligence, advertising monetization, and the resilience of its digital ecosystem. Key Financial Highlights In the second quarter of 2025, Meta...

By Ion Jauregui – Analyst at ActivTrades Bearish pressure is intensifying in the oil market, with Brent crude leading the liquidation among major investment funds. The expiration of U.S. tariff exemptions on August 1st, combined with a global economic slowdown, has triggered a wave of risk aversion across energy commodities. Funds Exit Oil: Alarming Figures ...

Ethereum gains momentum: SEC green light and JPMorgan’s historic shift By Ion Jauregui – Analyst at ActivTrades Ethereum once again takes center stage in financial markets after a week full of positive signals: on one hand, the long-awaited clarification of its regulatory status by the SEC; on the other, the unexpected opening of JPMorgan to cryptocurrencies....

IBEX 35 lider of european bullish advances in the tariff agreements By Ion Jauregui – Analyst at ActivTrades European markets kick off the day with strong gains, driven by renewed optimism over trade negotiations between the United States and China. In this context, IBEX 35 futures surge by 1.52% to 14,273 points, positioning the index as one of the top...

Canadian Crude and Gold Under Pressure as Trump Threatens New Tariffs Unless Market Access Improves By Ion Jauregui – Analyst at ActivTrades Trade tensions between the United States and Canada are once again on the rise following Donald Trump's return to office. The president has set August 1st as the deadline to impose a 35% tariff on Canadian products unless...

Silicon Valley Shaken by China’s Free AI Offensive By Ion Jauregui – Analyst at ActivTrades Artificial intelligence is undergoing its first major geopolitical fracture. While OpenAI strengthens its infrastructure by renting servers from Google Cloud, China’s advance with free generative models threatens to redefine the balance of power in the sector. Names like...

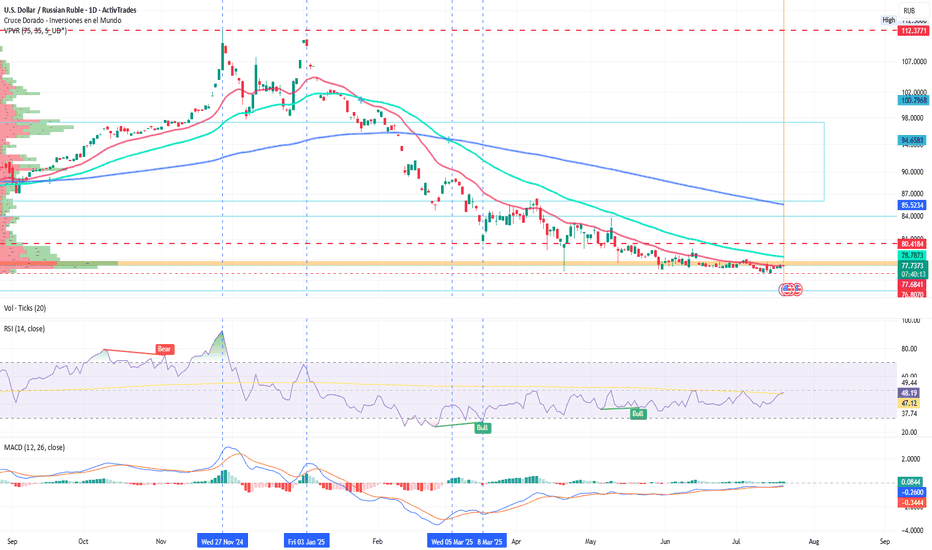

Ion Jauregui – Analyst at ActivTrades The ruble is under the spotlight as Russian banks prepare to request a bailout amid a growing wave of loan defaults. 1. Russian banks falter behind the scenes Although the Central Bank of Russia maintains a narrative of stability, the actual state of the financial system could be far more fragile. According to Bloomberg,...

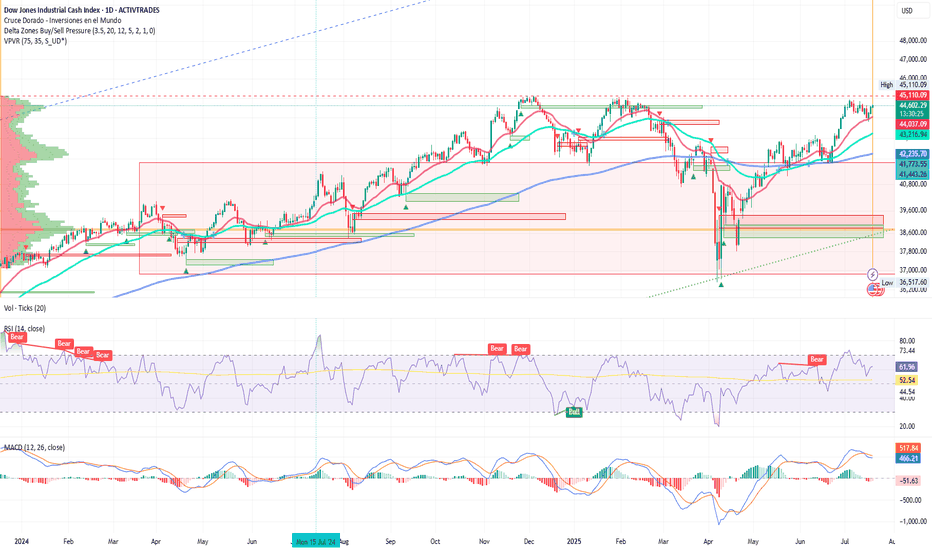

Ion Jauregui – Analyst at ActivTrades The main Wall Street indices closed Thursday’s session with mixed results. Comments from Trump stating he had no plans to fire Powell but “doesn’t rule anything out” except in cases of fraud, along with Powell’s declaration that he will serve his full term until mid-2026, pressured the market. The U.S. market has been...

Congressional Crypto Week: Bitcoin Hits All-Time Highs in a Decisive Week for the U.S. Ion Jauregui – Analyst at ActivTrades Bitcoin (BTCUSD) is back in global headlines after breaking above $123,203 this Tuesday, setting a new all-time high in the same week. So far in July, the leading cryptocurrency has surged 17%, fueled by a combination of institutional...