Market analysis from ActivTrades

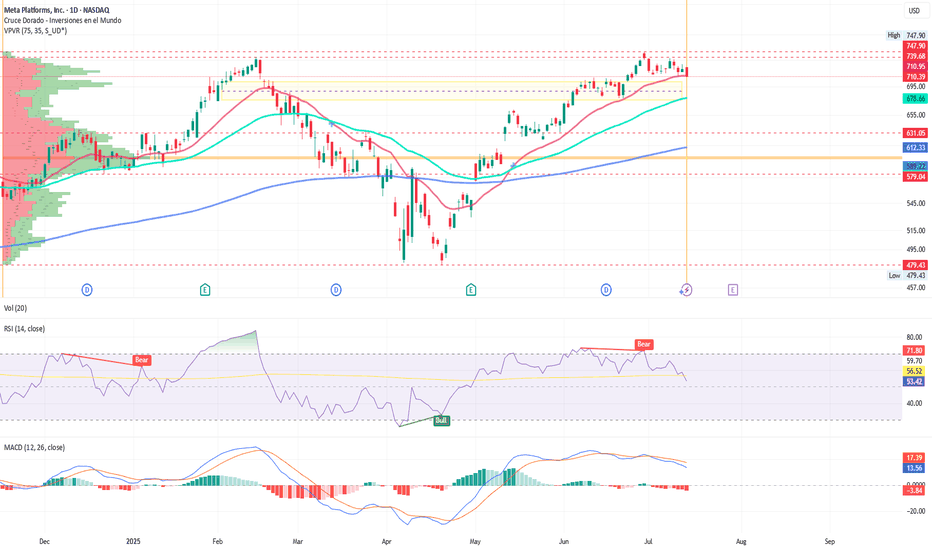

Ion Jauregui – Analyst at ActivTrades Zuckerberg Takes the Stand This week, Mark Zuckerberg appears as a witness in a civil lawsuit worth $8 billion, in which the governance of Meta Platforms (NASDAQ: META) is under scrutiny following the well-known Cambridge Analytica scandal. The plaintiffs — shareholders of the company — argue that decisions were made...

Nvidia at a Crossroads: Unstoppable Growth, Geopolitical Tensions, and Fears of Talent Drain to China Ion Jauregui – Analyst at ActivTrades Nvidia’s rise as a central player in the artificial intelligence revolution has not been a solitary journey. The company, now valued at over $4 trillion, has built a complex network of suppliers, strategic clients, and...

Ion Jauregui – Analyst at ActivTrades Gold posted a slight gain during Monday's Asian session, driven by renewed safe-haven demand amid escalating trade tensions between the United States and several key economies, as well as rising geopolitical uncertainty surrounding Russia and Ukraine. The initial uptick in gold was supported by the announcement of 30%...

Bank Mergers in Check: Between Brussels and National Interests Ion Jauregui – Analyst at ActivTrades Banking consolidation plans in Europe have gained momentum in 2025, driven by the Draghi and Letta reports, which advocate for the creation of pan-European banks capable of competing globally with U.S. and Chinese giants. However, the recent BBVA-Sabadell and...

By Ion Jauregui – Analyst at ActivTrades Consolidation and Vertigo at Peak Levels In 2025, the IBEX 35 has staged a moderate yet consistent rally, reaching levels not seen since 2015, recently hitting 14,373 points. After a strong start to the year, fueled by the stabilization of interest rates in the eurozone and a recovery in the banking sector, the index...

Europe Shudders over Winter Gas Fears: Germany Puts Market on Edge By Ion Jauregui – Analyst at ActivTrades Europe is once again sounding the alarm over a potential energy crunch this coming winter. The continent’s gas reserves—particularly Germany’s—are significantly below normal levels for this time of year, amid soaring energy demand, heatwaves, and weaker...

BTCUSD on Alert: Whales Move 80,000 BTC, Shaking the Market By Ion Jauregui – Analyst at ActivTrades The cryptocurrency market witnessed one of the year’s most puzzling moves this week. Over 80,000 Bitcoins—worth more than $8.6 billion—were transferred from wallets that had been inactive since the early years of the crypto ecosystem. These transfers,...

Threat or Catalyst? Impact of the Upcoming MasOrange IPO on Telefónica By Ion Jauregui – Analyst at ActivTrades The potential IPO of MasOrange, valued between €5.37 and €9.44 billion based on applied EV/EBITDA multiples (ranging from 7x to 8.4x), could significantly reshape the competitive landscape of Spain’s telecommunications sector. The new entity, formed...

NaTran, Enagás and Terega Join Forces to Develop the BarMar Hydrogen Pipeline Ion Jauregui – ActivTrades Analyst French company NaTran, a subsidiary of energy giant Engie, has announced the creation of a joint venture with Spanish firm Enagás and gas infrastructure operator Terega to develop the BarMar hydrogen pipeline—a key connection for the transport of...

Ion Jauregui - ActivTrades Analyst Iberdrola is accelerating its international expansion with a historic investment of over €33 billion in power grid infrastructure across the United States and the United Kingdom. Through its subsidiaries New York State Electric & Gas (NYSEG) and Rochester Gas and Electric (RG&E), the company has launched the "Power New York"...

LCrude Oil: Bearish Pressure as Brazil Emerges as an Energy Powerhouse By Ion Jauregui – Analyst at ActivTrades LCrude (Ticker AT:Lcrude), which replicates the West Texas Intermediate (WTI) futures contract, has been one of the most volatile assets in 2025. It faces mounting pressure from a growing global supply, cautious demand, and a renewed wave of investment...

Blackstone Leads the Revival of IPOs in Spain with Cirsa and HIP Ion Jauregui – Analyst at ActivTrades Blackstone, the world’s largest investment fund, has strongly reactivated the IPO market in Spain with two of its most prominent portfolio companies: Cirsa, a gaming industry giant, and Hotel Investment Partners (HIP), a leader in vacation resorts in Southern...

By Ion Jauregui – Analyst at ActivTrades Rental market regulations in Catalonia are triggering a real capital flight among major international funds. Following Patrizia’s moves, Blackstone and Azora have also begun divesting from the region’s rental housing market, prioritizing unit-by-unit property sales amid growing legal uncertainty. From Investors to...

Trump Warns of Trade Reprisals Against Spain for Refusing NATO's 5% Target: Direct Impact on the IBEX 35 By Ion Jauregui – Analyst at ActivTrades The recent NATO summit in The Hague concluded with an ambitious proposal: raise defense spending to 5% of GDP by 2035. However, Spain distanced itself from the consensus, triggering a diplomatic storm led by former...

Lagarde Boosts the Euro and the DAX: Is the ECB Putting an End to the Rate-Cut Cycle? Ion Jauregui - ActivTrades Analyst European Central Bank President Christine Lagarde delivered a key speech before the European Parliament that has shaken financial markets, pushing the euro to multi-year highs and boosting stock market optimism in Germany. Her message, full of...

Can Netflix Reach One Trillion Dollars? The Market Already Bets on It By Ion Jauregui – Analyst at ActivTrades Netflix, the giant of digital entertainment, continues to cement its position as the global benchmark in streaming. With a market capitalization exceeding $515 billion, the platform is halfway to the trillion-dollar milestone, but more and more...

Ion Jauregui – Analyst at ActivTrades Amazon announced on Tuesday an ambitious £40 billion investment in the United Kingdom over the next three years. The goal: to boost technological innovation, expand its logistics network, and strengthen the infrastructure needed for artificial intelligence development across Europe. According to the company, this investment...

Crude Oil Surges Amid Geopolitical Risk: Correction or Structural Rally? Brent crude oil prices surged sharply in response to the U.S. attack on nuclear facilities in Iran, spiking to $80 per barrel in early Monday trading. Although prices later corrected toward $76.71, the threat of a potential blockade of the Strait of Hormuz — through which one-third of the...