Market analysis from Bitstamp

GM bitcoin enthusiasts, Yesterday, Bitcoin hit a new all-time high of $110,730 on Bitstamp, with a record daily close at $109,682. 🚀 Today, BTC is continuing its upward momentum, seemingly unfazed by resistance at the previous all-time high around the $109K level. Bulls remain in control—for now. So the question is: - Is this a true breakout signaling...

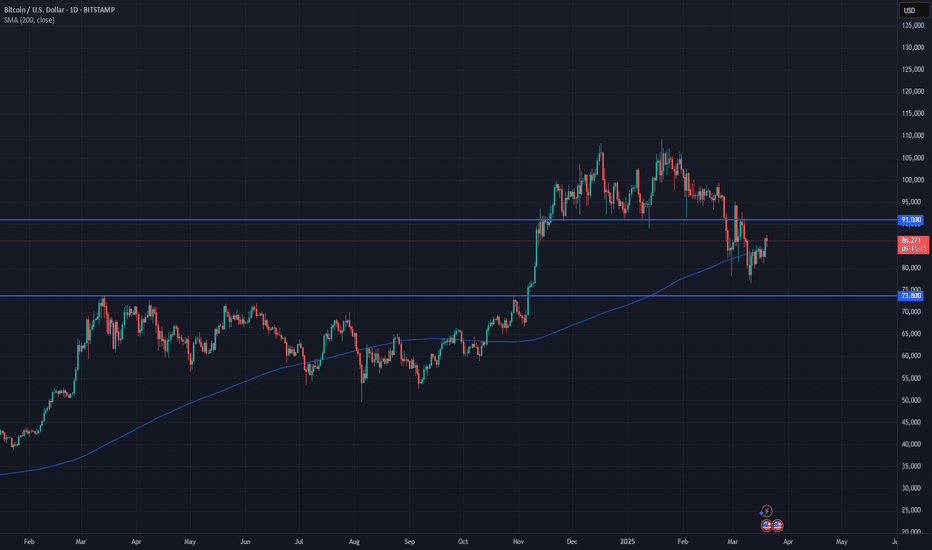

GM Market Enthusiasts, In today’s update, we turn our attention to Bitcoin’s evolving trend. Since the end of February, BTC has been tracing a steady pattern of lower highs and lower lows. Currently, it remains below the 200-day simple moving average , consolidating around the 85K mark — a zone that has served as a resistance in recent days. The big questions...

GM, Bitstampers! In today’s update, we’re diving into Bitcoin’s recent price action, analyzing its current trend, and identifying key support and resistance levels . Bitcoin Market Commentary Bitcoin reached a new all-time high (ATH) of $109.4K on January 20, 2025, on Bitstamp. Since then, the price has been in a sustained downtrend, marking 50 consecutive...

GM Market Enthusiasts! We’re excited to be back and posting! In today’s update, we’ll dive into Bitcoin’s recent price action and discuss what might be next for the world’s leading cryptocurrency. Price Action After trading within a range from March to October, Bitcoin began a strong uptrend, climbing steadily for over 10 weeks without any meaningful...

Hi Market Enthusiasts! Bitcoin approached the 100k price mark and is experiencing its first decrease in momentum after four consecutive green weeks. In this post, we'll examine where we stand in the four-year cycle and the significance of the pivotal 100k milestone for Bitcoin. Bitcoin position in the 4 year cycle In our post about Bitcoin cycles , we...

Hi market enthusiasts, we have discussed the importance of trends in many of our educational posts. Today, we’ll put our knowledge to the use and focus on the current price action of Bitcoin. BTC/USD Since the low on Aug 5th, Bitcoin has established a pattern of higher local highs and lows, signaling a potential change of regime. Price of BTC increased by +30%...

GM kings and queens, in our previous post , we zoomed out to 13 years of Bitcoin trading at Bitstamp. In this post, we’ll shed light on the benefits of long-term charts and how and when to use them. Introduction The daily bar chart is the most commonly used tool for forecasting and trading. However, for a comprehensive trend analysis, it's important to...

GM Bitstampers, In this post, we're not going to deep dive into the recent price action. Instead, let's zoom out and take a moment to reflect on the incredible journey of 13 years of Bitcoin trading on Bitstamp! Since our launch in 2011, Bitstamp has witnessed Bitcoin's evolution from an innovative network to a globally recognized asset. Whether you've been with...

GM crypto bulls and bears, Bitcoin has been trading range bound for the last 5 months. Market participants seem eager for market to tip it's hand, as Bitcoin has visited both the range lows and range highs for several times. We have described basic concepts of ranges in our posts devoted to ranges and support and resistance. BTC/USD chart After deviating...

GM Bitstampers! In January 2024, we posted about the tailwinds and headwinds for Ethereum in the coming year. In this post, we'll focus on some of the factors that contributed to a +50% increase in price since the beginning of the year. The tailwinds we noted in January included the release of EIP-4844, the potential deflationary nature of Ethereum, and the...

GM market enthusiasts! In our previous post about Volume and Open Interest , we introduced the use of Volume and OI as confirming indicators. Today, we are going to discuss the relationship between trend, volume, OI, and the strength of the market, and apply the knowledge from both posts to the chart. How can Volume and OI help us understand the strength of...

GM Bitstampers! In this week's post, we'll dive into a multidimensional approach to market analysis, focusing on tracking the movement of three sets of figures: price, volume, and open interest. Volume and open interest are commonly referred to as secondary or confirming indicators. TL;DR: - Volume and open interest (OI) are considered secondary (confirming)...

GM Bitstampers! In our previous post , we described the basic concept of support and resistance . Now, we'll explore the significance of round numbers in acting as support and resistance. Importance of Round Numbers as Support and Resistance John J. Murphy highlights the relevance of round numbers as support and resistance in his book "Technical Analysis of...

GM Bitstampers! Today, we're diving deeper into the topic of identifying support and resistance levels—a subject we've briefly touched upon in our post about ranges . Support and resistance Support and resistance are pivotal concepts in technical analysis. John J. Murphy describes these concepts vividly in his book Technical Analysis of the Financial Markets:...

GM Bitstampers, Solana Manlets, market enthusiast and everyone reading this post! Today we will discuss how news and events can impact markets. Perception of positive and negative events in different market conditions Market reactions to news/events, both good and bad, vary significantly between bull and bear markets. In bull markets, optimism can minimize the...

GM market enthusiasts! The year 2024 started off eventfully, and we are delighted to be back posting our thoughts about the markets. Today, we are examining the ETH/USD daily chart. As ETH is situated just below the 2023 yearly high, we took a look at some tailwinds and headwinds for/against ETH in 2024. Tailwinds we observed include: - The expected release of...

GM fellow crypto enthusiasts! Today we are going to discuss how to identify and trade ranges. How to identify a trading range? A trading range is formed when an asset trades between consistent high and low prices for a period of time. The top of the trading range often provides price resistance, where as the bottom of the trading range typically offers price...

Hello, market enthusiasts! In previous post , we described a group of technical indicators - Oscillators, providing a solid foundation for today's discussion on RSI. The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Calculating RSI: RS = Average of x days' up...