Market analysis from BlackBull Markets

The Reserve Bank of Australia is expected to keep its rate on hold in its meeting today, so there might not be anything interesting here. Do we think this rate decision is going to make more of an impact on the Aussie than the Australian GDP (Gross Domestic Product) figures that are released tomorrow? There has been talk of the Australian dollar being undervalued,...

Focus is growing on the upcoming nonfarm payrolls (NFP) report. In August, it's expected that there will be about 170,000 new jobs (compared to 187,000 in July). The days leading up to this report have had some not-so-great job-related data, like the JOLTS and ADP reports. This has heightened expectations that the NFP might show fewer jobs than expected. The US...

The 4-hour chart on the EUR/USD displays a possible bearish bias, but there are some indications of consolidation after the small rebound observed on Friday. At present, the price is lingering around the 20-day Simple Moving Average (SMA). To improve its bullish outlook, it would be necessary for the Euro to hit 1.0840 and for other technical indicators (that have...

Gold is possibly still within its descending channel, though it has discovered a foothold at $1885 and demonstrated an upward shift this week due to a decline in bond yields. However, the anticipation is for the Fed funds rate to remain higher for longer, so gold’s upside potential might be short-lived. Butting up against this hypothesis is the very recent...

With treasury yields hovering close to their highest point in the past 15 years, attention is squarely focused on the forthcoming policy speech by Fed Chair Jay Powell this Friday at the Jackson Hole event. The primary interest lies in gauging the current level of hawkishness exhibited by the Federal Reserve. Anticipations are that Fed Chair Jay Powell will...

The Yen's struggle against the US Dollar persists this week, as the USDJPY settles above 143.00 and reaches a new high for the third consecutive day. After some sideways trading, traders are now resuming a bullish push aimed at reaching the recent high of 143.9000, followed by potential targets at 144.00 and 145.050. Last week, the Bank of Japan (BoJ) surprised...

Will US Inflation Data Spark EUR/USD Recovery? In Monday's early trading session, the euro showed a slight weakening against the U.S. dollar, influenced by a prevailing sense of pessimism following disappointing industrial production figures in Germany. As the largest economy in the eurozone, Germany's struggles in the manufacturing sector have been evident...

Gold's Reaction to Upcoming Non-Farm Payrolls Gold trading faced headwinds on Wednesday as the U.S. dollar strengthened despite Fitch's downgrade of the U.S. credit rating to AA+ from AAA. Investors seemed unfazed and focused on positive data from the ADP National Employment report that might possibly indicate a larger-than-expected Non-Farm Payrolls report this...

For Gold (XAU/USD), the 4-hour chart suggests a neutral-to-bearish stance. While the pair is currently above its moving averages, the 50-day moving average is closely trailing its price. The Relative Strength Index (RSI) is dropping towards a neutral level, indicating a potential pause in buyer activity. If Gold drops below $1,945, there is a risk of prices...

The Federal Reserve has decided to increase interest rates by 25 basis points, reaching a range of 5.25% to 5.50%, marking the highest level seen in 22 years. Market participants widely anticipated this move as the Fed resumed its tightening campaign. In their statement, the Fed expressed a positive outlook on economic growth, acknowledging that economic...

This week, three of the world's most watched central banks are scheduled to announce their monetary policy decisions. The Federal Reserve will be the first to make its announcement on Wednesday at 2:00 pm, followed by the ECB on Thursday at 8:15 am, and the Bank of Japan later on Thursday at 11:00 pm (NY time). This convergence of central bank activities may lead...

The Australian dollar has surged, driven by an impressive employment report that far exceeded expectations. In the month of June, Australia's net employment rose by a staggering 32,600 compared to the previous month, surpassing estimates by more than double. This development propelled the Aussie currency up by over 0.9%, reaching an intra-day high of $0.6834....

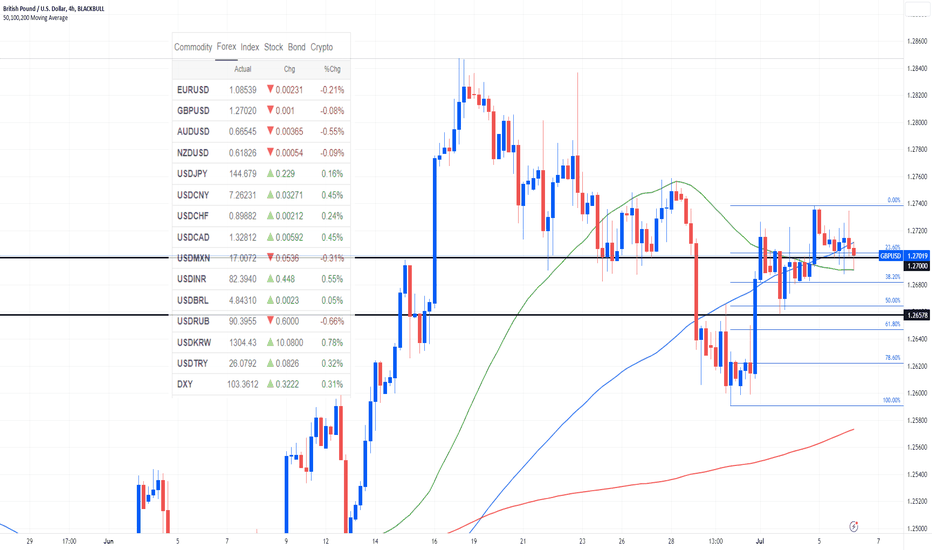

Traders are heavily bullish on the British pound, with net long positions exceeding a whopping $4.7 billion as of July 11, the highest level since mid-2014. Traders are ramping up their expectations for the Bank of England to implement additional interest rate hikes while increasingly under the impression that U.S. rates are on the verge of reaching their peak....

In June, the United States inflation fell to 3%, which is the lowest since March 2021. This was slightly below the market's expectations of 3.1% and a significant decline from May's rate of 4%. Additionally, the core inflation rate unexpectedly dropped to 4.8%, marking its lowest level since October 2021. The implication of this deceleration is that it could...

USDJPY – What's the intervention threshold? In September of last year, the Bank of Japan (BOJ) made a move in the market to strengthen its currency when it reached 145 against the USD, marking the first such intervention since 1998. This action was taken following the BOJ's decision to maintain an extremely accommodative policy (a policy that is yet to change...

During their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which...

Yesterday, the AUD/USD experienced its third consecutive day of growth. However, the upward trend is expected to face obstacles during Tuesday's trading session due to the impending Reserve Bank of Australia meeting. Despite some analysts adopting a more hawkish stance and predicting a rate hike as the most likely outcome of today's meeting, money market traders...

The US dollar rose on Wednesday after the gathering of central bank leaders worldwide, which included Federal Reserve Chair Jerome Powell. During the meeting, Powell left open the possibility of the Federal Reserve implementing two more rate hikes this year. Furthermore, Powell stated that he does not anticipate inflation reaching the Federal Reserve's target of...