Market analysis from BlackBull Markets

Markets are narrowly leaning toward no rate cut from the Bank of Canada this Wednesday. Markets were pricing a 58% chance of a pause as of Friday last week. With traders nearly evenly split, short-term volatility in USD/CAD is possible. While the Bank had previously signaled it would "proceed carefully" on future rate cuts, that guidance came before the...

We're definitely seeing a massive uptick in risk appetite in recent sessions as investors celebrate a reprieve from tariff intensification. At the same time, the broader trade war narrative has not gone away. And though we are getting a boost in risk assets, we're also seeing the US dollar suffer across the board. Indeed, there is an expectation the Fed will need...

Goldman Sachs and UBS have issued another round of bullish forecasts for gold, citing ongoing market uncertainty (i.e., tariffs). Goldman analysts now expect gold to reach $3,700 per ounce by the end of 2025, with a potential rise to $4,000 by mid-2026. UBS holds a slightly more conservative view, projecting $3,500 by December 2025. Technically, gold has...

Markets will be closely watching the European Central Bank’s (ECB) interest rate decision on April 17, with expectations for a seventh consecutive rate cut. Despite this expectation, the euro surged to a three-year high against the US dollar last week, as traders continued to pull away from US assets. The dollar index has dropped 4% since President Trump’s...

Despite pressure stemming from President Donald Trump’s recent tariffs, analysts at Bernstein note Bitcoin’s relative resilience, particularly on shorter-term time frames where a double bottom pattern suggests underlying bullish interest. Bitcoin’s ‘safe haven’ appeal may be resonating with investors more than previously. However, the longer-term chart reveals...

President Trump announced a 90-day pause on reciprocal tariffs for countries that have not retaliated, sparking a sharp rally in U.S. markets. The Nasdaq 100 led gains with a 12.2% surge. The U.S. dollar also strengthened against safe-haven currencies such as the Japanese yen and Swiss franc. Crude oil prices rebounded alongside equities, with oil futures rising...

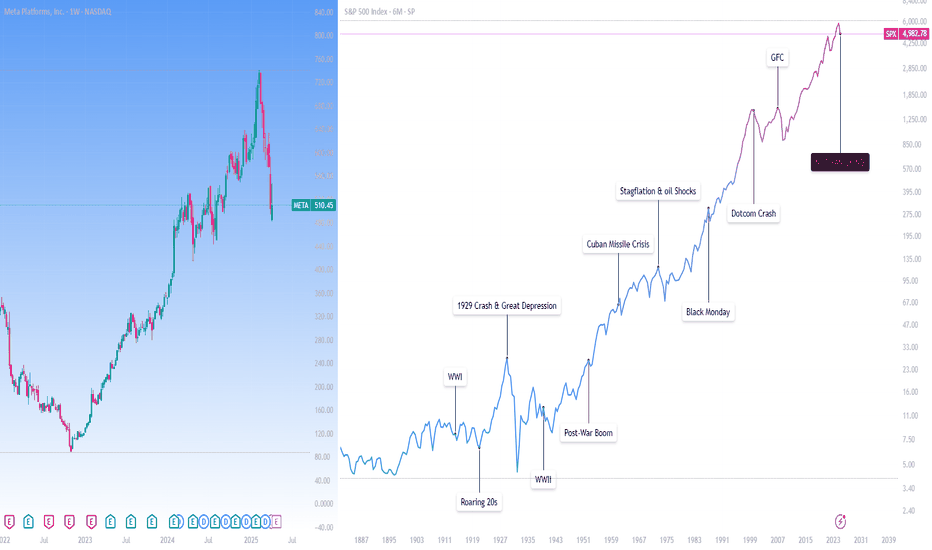

This analysis is provided by Eden Bradfeld at BlackBull Research. Listen, the US has survived the depression of WWI, the Great Depression, the depression of WWII, oil shocks, the dot com bubble, the GFC, the COVID-sell off. It’ll likely survive this. In the scope of history, that $1 survived very well indeed. Panicking and running for the hills does not do so...

Apple alone has shed nearly $640 billion in market capitalisation over just three days. The S&P 500 has fallen more than 10% during the same stretch—its worst performance since the onset of the COVID-19 pandemic. In Asia, the selloff is even more severe, with Japan's Nikkei 225 down nearly 8%, South Korea’s Kospi 200 off almost 6%, and Taiwan equities falling...

Risk aversion intensified on Friday, sending the Australian dollar down 4.56% and the New Zealand dollar 3.53% lower. The declines followed a move by US President Donald Trump to impose a 10% tariff on imports from both Australia and New Zealand. Australian Prime Minister Anthony Albanese confirmed there would be no retaliation, noting the US represents less...

It's being viewed as a watershed, historic moment for global trade. The US Liberation Day tariffs have certainly shaken up financial markets. In the immediate aftermath, investors have lost confidence in the US dollar, which has come under pressure across the board—particularly against other major currencies, which are being seen as attractive...

Yesterday, President Donald Trump announced his "Liberation Day" tariff strategy, introducing a universal 10% tariff on all imports, with higher rates for specific countries. Despite Commerce Secretary Howard Lutnick’s claim that President Trump “won’t back off,” several pressures could still force a reversal before their April 9 implementation. Markets have...

This analysis is provided by Eden Bradfeld at BlackBull Research. Kering is trading under the 200 EUR mark, at 190 EUR per share. That’s roughly 1.57x price/book and 1.4x price/sales. Remember — Kering not only owns Gucci, but also Bottega, Saint Laurent, Balenciaga, McQueen, Brioni, Boucheron, etc. It is not a one trick pony. Mr. Market hated Demna’s...

We are less than hour out from the Liberation Day tariff announcements. The U.S. is preparing to roll out reciprocal tariffs on all countries, with rates set at 10%, 15%, and 20%, according to Sky News. Investors hoping for certainty may be disappointed—this could mark the start of a longer phase of trade battles. Mexico, once again, is reading the room....

In addition to tariff rumors, reports, and retaliations, this week’s Nonfarm Payrolls (NFP) could add even more volatility to markets. Gold continues to hit record-high after record-high (best quarterly performance since 1986), could be the most important asset to watch. The market consensus expects the US economy to have added 128,000 jobs in March, down...

This analysis is provided by Eden Bradfeld at BlackBull Research. The stock market doesn’t really give a damn about what you think. It’s unemotional. DIS or META does not care about your feelings about them, believe it or not. You should be excited that stocks are on sale. If they are on sale even more, you should be even more excited. You should see it as a...

The Reserve Bank of Australia should cut rates today, argues James Glynn in the Wall Street Journal . Markets, however, expect the central bank to wait until May for its next move. RBA Governor Michele Bullock remains cautious, citing lingering inflation. But Glynn contends that global uncertainty now outweighs the RBA’s desire to wait for marginal...

Reactions are emerging following the U.S. announcement of a 25% import tax on foreign made cars. The tariffs target approximately $217 billion in annual vehicle imports. The largest contributors are Mexico (23%), Japan (18%), South Korea (17%), and Canada (13%). Mexico is seeking an exemption. Mexico’s Economy Minister Marcelo Ebrard said negotiations are...

This analysis is provided by Eden Bradfeld at BlackBull Research. One of the things I find interesting is that a lot of people say “why do you like booze stocks so much Eden” and yet many of these same people are at the pub, or buying En primeur from Glengarry Wines. The short answer is — I like stocks that trade at multi-year lows with a predictable product....