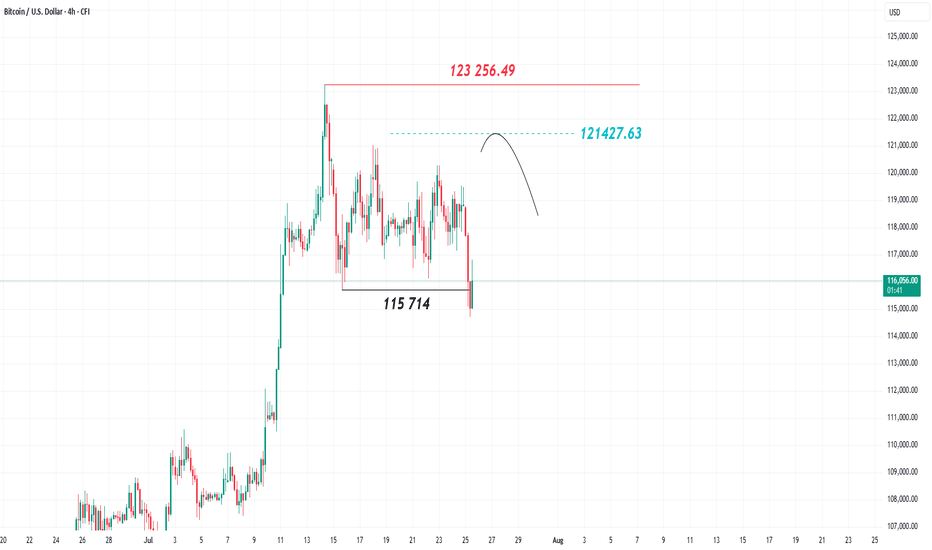

After hitting a new all-time high at 123,256.49, Bitcoin, the world’s leading cryptocurrency, pulled back this week, closing on the 4-hour chart below the 115,714 level. This indicates a shift in trend from bullish to bearish and increases the likelihood of a short-to-medium-term decline. The recent price rise appears to be corrective, and the 121,427 level is...

The GBP/USD pair is trading in a general upward trend after seeing some pullbacks due to the renewed strength of the US dollar. However, it failed to close below the 1.33649 level on both the 4-hour and daily timeframes, thus maintaining a positive outlook. The next target for this pair is at the 1.3690 level. The bullish scenario will remain valid unless the...

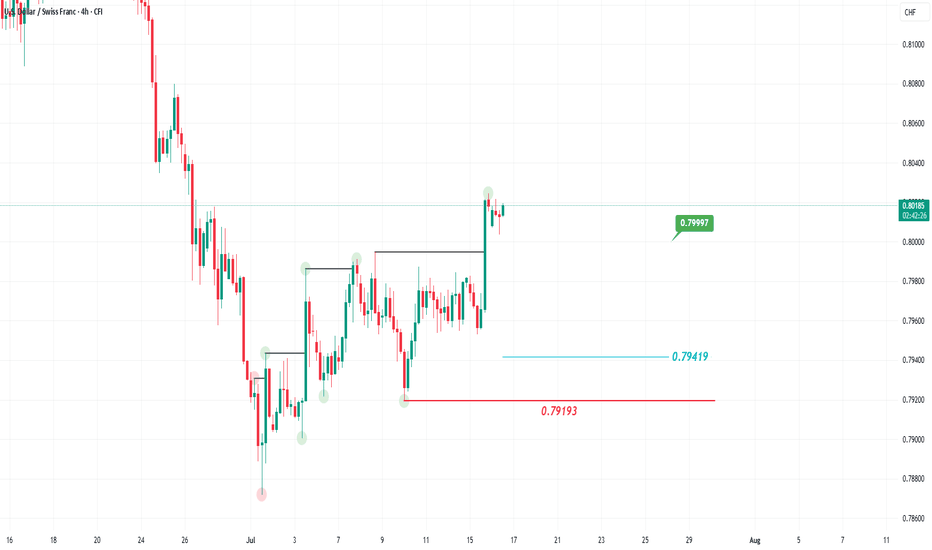

The recent rebound of the US dollar has led to a decline in the Swiss franc against it, similar to other major currencies. The US dollar is also expected to show further strength in the coming period, supported by recent positive economic data, most notably, and the annual Consumer Price Index (CPI) - which came in at 2.7%, the highest reading in the last four...

After its recent surge to reach the highest levels since September 2011, silver is showing short-to-medium-term negative signals on the 4-hour timeframe, before potentially resuming its upward trend on the daily chart. As seen in the chart above, the price dropped quickly below the 38.37 level, forming a new low and shifting the 4-hour trend from bullish to...

After the recent rebound of the US dollar following two quarters of decline, the USD/JPY pair has been on an upward trajectory, forming a series of higher highs on both the 4-hour and daily charts. However, the recent drop below the 146.515 level and the formation of a new low suggests a potential shift in trend on the 4-hour timeframe from bullish to bearish....

US President Donald Trump announced a postponement of the suspension of tariffs from July 9 to August 1, stressing that this deadline is final and will not be delayed again. This decision has left the markets cautious, particularly US indices, but the Dow Jones Index has taken a different route compared to the S&P 500 and Nasdaq, which are generally trending...