Market analysis from Capital.com

Spotify heads into this week’s earnings update with a solid tailwind behind it, both in terms of financial performance and share price strength. After rebounding sharply from the recent Trump tariff sell-off, the shares are now trading within touching distance of their highs. Big Expectations The market is expecting another strong set of numbers from Spotify...

With US stocks bouncing on Trump’s backtracking over tariffs — just weeks after a 20% correction — it’s fair to say caution is the name of the game. Even though the headline risk has eased slightly, markets are still navigating through a fog of geopolitical noise and economic uncertainty. In moments like these, where the fundamental picture feels muddy at best,...

EUR/USD has surged higher in April, rallying more than 6% in just three weeks. But this isn’t your typical dollar weakness story — we’re now seeing signs of a deeper capital rotation into Europe, driven by political risk in the US and a breakdown in long-standing market correlations. From Dollar Dominance to European Stability After causing havoc with his...

As gold takes a breather just below its recent highs, it’s a good moment to zoom out and ask a few bigger questions. Is this a healthy consolidation before the next leg higher, or are we seeing early signs of buyer exhaustion? Let’s take a look at the key levels in play, what’s driving the broader move, and how the technical picture is shaping up. Gold Shines...

The FTSE 100, like its global peers, has been caught in the crosswinds of rising volatility over the past fortnight. Let’s break down the key levels to watch, the indicators helping to make sense of the current backdrop, and how the recent sell-off has played out beneath the surface at the sector level. Daily Timeframe: Shift in Momentum The sharp sell-off on...

Brent crude has tumbled through long-term support, hit by a one-two punch of tariff turmoil and surprise OPEC+ action. With global growth fears back in focus, oil’s technical breakdown couldn’t have come at a worse time for the bulls. Tariffs, OPEC and a Return to Growth Fears Last week was brutal for oil markets. Donald Trump’s sweeping new tariff regime –...

Global markets opened the week under pressure, with major equity indices tumbling once again as volatility swept through the Asian session. The latest wave of selling follows China’s announcement of retaliatory tariffs on the U.S., intensifying the fallout from last week’s ‘Liberation Day’ tariff shock. Investors had hoped that the worst of the uncertainty would...

The FTSE 100 daily rolling futures formed a bullish hammer candle at the lower edge of its mini-range yesterday. But before the bulls get carried away, there are a few cautionary signals to consider. FTSE 100 Follows the Price Action Playbook So Far in 2025 The FTSE 100 has been a textbook example of price action trading this year, with breakout moves, clean...

Global markets are on edge as Donald Trump’s looming tariff announcement sends shockwaves through Asian equities. Japanese stocks are leading the downturn, with the Nikkei 225 under heavy selling pressure as bearish momentum builds. Tariff Fears Rock Japanese Markets Asian markets started the week deep in the red as fears of a fresh wave of US tariffs took...

Some candlestick patterns shout their intentions, while others quietly mark a pause before the next move. The Doji falls into the latter category—it doesn’t tell you which way the market is going next, but it does highlight a moment of indecision that often precedes a meaningful move. While traders sometimes mistake it for a reversal signal, the real...

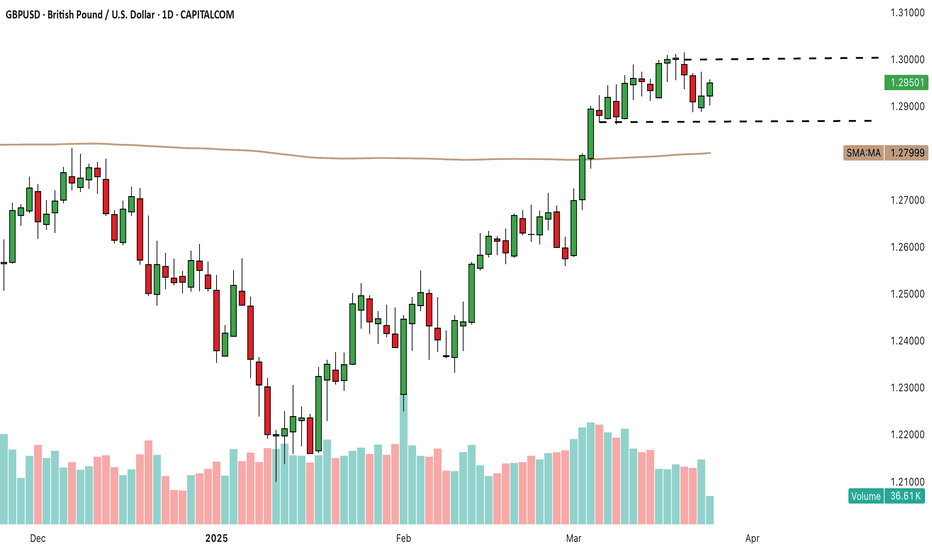

GBP/USD remains near recent highs as traders await Wednesday’s Spring Statement from Chancellor Rachel Reeves. While major tax changes are off the table, revisions to the UK’s economic outlook and fiscal plans could provide fresh direction for the pound. What to Watch in the Spring Statement The key focus will be the Office for Budget Responsibility’s...

With the S&P 500 tumbling 10% from its mid-February highs, we take a look at whether this correction is running out of steam—or just getting started. A weak bounce and a looming resistance zone suggest the index has work to do before the bulls can regain control. Tariffs, Turmoil, and the End of ‘American Exceptionalism’? For much of the past two...

Gold (XAU/USD) is starting the new week with renewed strength, building on Friday’s bounce from the key $3,000 support level. The precious metal regained momentum on Monday as heightened geopolitical tensions overshadowed the recent improvement in risk appetite. Mixed Global Sentiment The return of Israeli air and ground operations in Gaza—after a two-month...

If there’s one candle pattern that represents an immediate shift in balance between buyers and sellers it is the engulfing candle. Today we take a deep dive into some of the key nuances of this pattern and explain how context and confirmation are essential elements to making this pattern a useful tool in your trading toolkit. Understanding the Engulfing...

Alibaba’s share price has been on a tear in 2025, surging more than 70% in the first eight weeks of the year before settling into a period of consolidation. That consolidation phase has now given way to a fresh breakout, as the stock pushed through resistance in an ascending triangle pattern. Let’s take a look at the technical and fundamental catalysts that have...

Gold’s strong start to the year continued as prices surged past February’s highs, briefly touching the key $3,000 level. Let’s take a look at what’s driving golds rally and the key levels to watch this week. Trump’s trade wars send gold demand soaring Gold’s strong start to the year has been fuelled by escalating trade tensions, with Donald Trump’s tariff...

They say, “the trend is your friend”—until it bends at the end. Every strong move eventually runs out of steam, but spotting the turn and trading it effectively is no easy task. Some traders try to anticipate the reversal, positioning ahead of time, while others wait for confirmation, entering once the trend has already shifted. Both methods have their strengths...

GBP/USD has started 2025 on the front foot, reversing last year’s weakness and building momentum. Now, with the pair consolidating in a tight range near recent highs, traders are watching closely to see whether this sets the stage for another leg higher. Fundamentals: US Weakness vs. BoE Caution A key driver behind GBP/USD’s strength has been growing...