Market analysis from EdgeClear

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! Happy Friday, folks! Today is the first Friday of August, and that means the highly anticipated Non-Farm Payroll (NFP) numbers came in at 7.30 am CT. US Non-Farm Payrolls (Jul) 73.0k vs. Exp. 110.0k (Prev. 147.0k, Rev. 14k); two-month net revisions: -258k (prev. +16k). Other key labor market indicators were as...

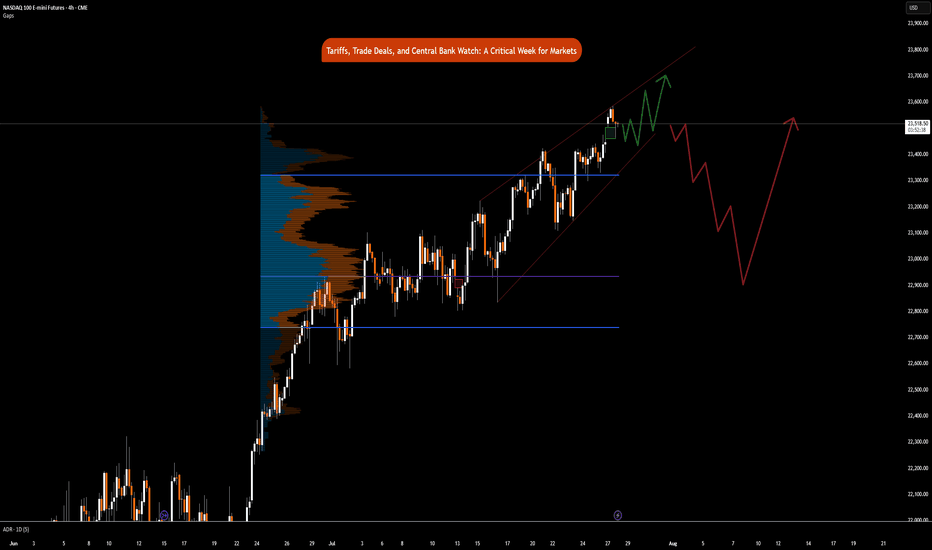

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1! This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy...

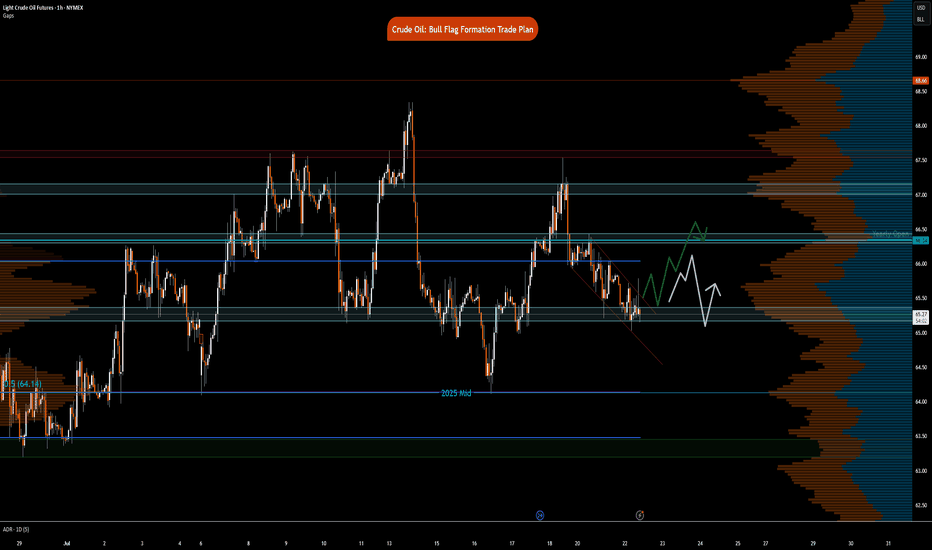

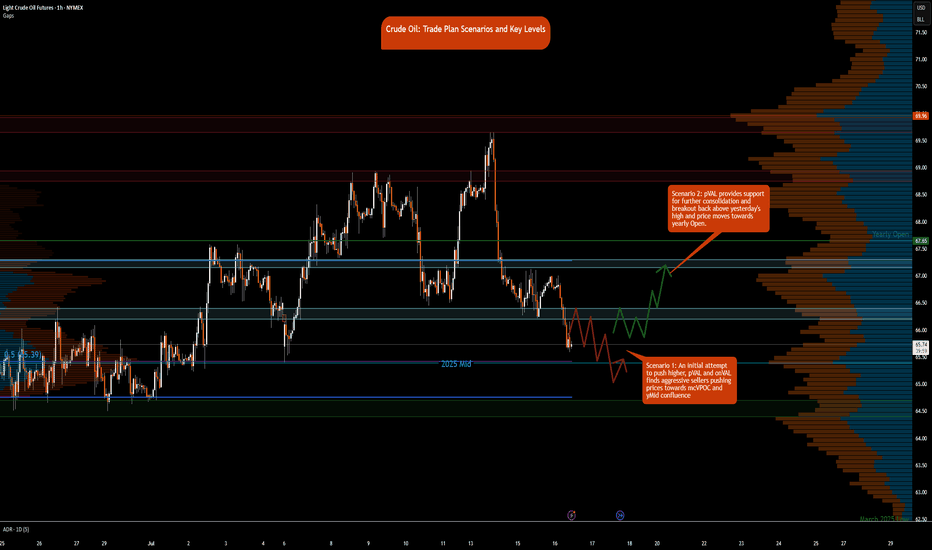

NYMEX:CL1! NYMEX:MCL1! Big Picture: Let the price action and market auction be your guide What has the market done? The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance. What is it trying to do?...

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! CME_MINI:MES1! CBOT:ZN1! Fed Policy recap: There is an interesting and unusual theme to keep an eye on this week. The Fed is in a ‘blackout period’ until the FOMC meeting- this is a customary quiet period ahead of an FOMC policy meeting. Fed Chair Powell is scheduled to give a public talk on Tuesday....

NYMEX:CL1! It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll...

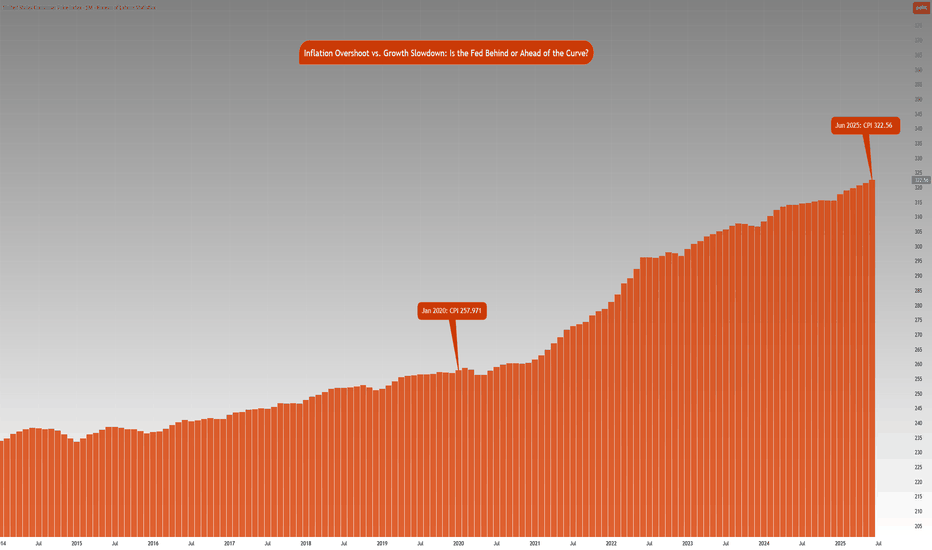

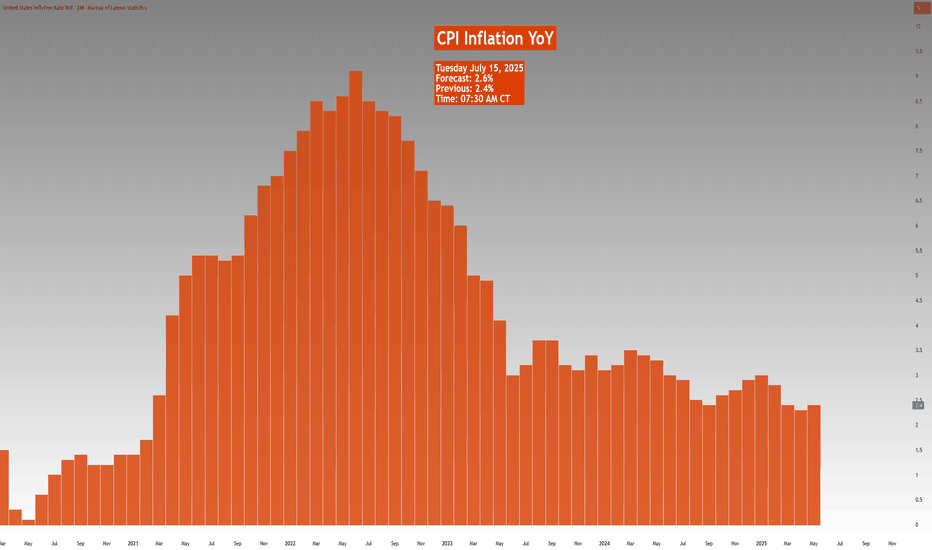

CME_MINI:ES1! CME_MINI:NQ1! COMEX:GC1! CME:BTC1! CME_MINI:RTY1! COMEX:SI1! CME_MINI:MNQ1! NYMEX:CL1! CME_MINI:M6E1! CBOT:ZN1! CME_MINI:MES1! Highlights this week include Chinese economic data points, UK CPI, US CPI, PPI, and Retail Sales. Inflation data is key, as it comes ahead of the Fed's meeting on July 30th, 2025. Market participants,...

NYMEX:CL1! NYMEX:MCL1! Bigger Picture: Traders should note that news headlines do not always drive the price action. More often, news outlets look for narrative to align with the price action. Previously, it was about the supply glut and worsening demand due to an uncertain outlook. Now the latest news flow is about Aramco OSP rising, OPEC+ adding another...

CME_MINI:NQ1! It’s a quiet week for US economic news. However, the RBA and RBNZ are scheduled to announce interest rate decisions. As has been the theme this year, markets remain highly sensitive to headline news and associated risks. US President Trump signed the One Big Beautiful Bill Act into law at the White House. Treasury Secretary Bessent is currently...

NYMEX:CL1! NYMEX:MCL1! With Nasdaq futures hitting all-time highs, our attention now turns to Crude Oil, which has seen a sharp pullback over the past week. All-time highs in equity indices present a unique challenge: There are no historical reference points—no prior price or volume data to lean against. Traders typically turn to tools like Fibonacci...

NYMEX:CL1! NYMEX:MCL1! NYMEX:BZ1! Macro: Geopolitical tensions remain high and markets are now likely to price in our scenario discussing ongoing air and missile war, given one-off intervention from the US thus far. According to Reuters, the U.S. now assesses that Iranian retaliation could occur within the next two days.What happens next is...

Market Context: NYMEX:CL1! COMEX:GC1! CBOT:ZN1! CME_MINI:ES1! CME_MINI:NQ1! CME:6E1! Implied volatility (IV) in the front weeks (1W and 2W) is elevated, and the futures curve is in steep backwardation. This indicates heightened short-term uncertainty tied to geopolitical tensions, particularly in the Middle East involving Iran and Israel. The...

CME_MINI:NQ1! Today is FOMC day; however, there is a larger geopolitical risk looming, along with the trade war and tariffs situation unfolding. Recently, we have noted inflation moving lower, although it is not yet at the FED’s 2% target. Retail sales fell sharply last month. Tariffs have not yet resulted in inflation so far, partly due to the 90-day pause,...

It is a holiday-shortened week, with the majority of markets halting early on Thursday, June 19, 2025, in observance of Juneteenth. See here for holiday trading schedule Key Themes to Monitor This Week Geopolitical Risks Any outside intervention in the ongoing Israel-Iran conflict will likely be seen as a risk-off event by market participants. Despite...

CPI day today. Scheduled to be released at 7:30 AM CT. CME:6E1! CME_MINI:ES1! CME_MINI:NQ1! CME_MINI:MNQ1! CME_MINI:MES1! COMEX:GC1! CBOT:ZN1! ES futures edged slightly higher after positive commentary from US-China trade talks. The delegations from both sides agreed on a framework to move forward with negotiations. It is important to note that...

CME_MINI:ES1! Fundamentals and Economic Calendar Data Recap: • Friday: 06/06/2025 o US Non-Farm Payrolls (May) 139k vs. Exp. 130k (Prev. 177k, Rev. 147k) o US Unemployment Rate (May) 4.2% vs. Exp. 4.2% (Prev. 4.2%) o US Average Earnings YY (May) 3.9% vs. Exp. 3.7% (Prev. 3.8%, Rev. 3.9%) • Overnight Monday: 06/09/2025 o Chinese Trade Balance...

CME_MINI:ES1! • What has the market done? ES futures are lagging compared to tech heavy index NQ futures. ES futures are still below yearly open. Yearly open has been a strong area of resistance since the rally of April 6th Lows in futures complex. • What is it trying to do? ES futures are in consolidation mode, building value higher. VPOC has shifted...

Although there is a headline fatigue and markets have been stabilizing with the worst of trade war story behind us, the fact is that uncertainty still looms. President Trump announced over the weekend that he will double down on US steel and aluminum tariffs from 25% to 50% effective June 4th. Highlight this week is US Jobs data this Friday. A key point to...

CME_MINI:NQ1! Big Picture Context: . NQ futures rallied after NVIDIA posted an earnings beat and after the Manhattan-based Court of International Trade blocked President Trump's Liberation Day tariffs. Goldman Sachs noted that the ruling on Liberation Day tariffs gives the administration 10 days to halt tariff collection, but does not affect sectoral...