Market analysis from FP Markets

Following the pullback from lows of N$1.0903 on 20 March in the AUD/NZD cross (Australian dollar versus the New Zealand dollar) – a move that also completed a longer-term double-top pattern at N$1.1180 – buyers and sellers on the daily chart are squaring off at resistance from N$1.1002. Complementing this area is a trendline that has turned from support to...

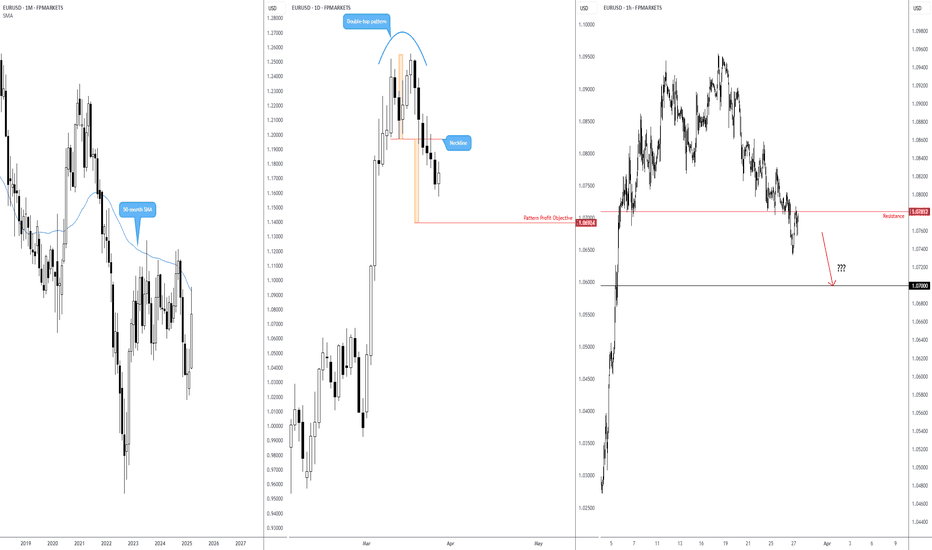

With price action on the monthly timeframe rejecting the underside of the 50-month simple moving average (SMA) at US$1.0927 and daily price recently completing a double-top pattern from the lower edge of said SMA (breaching the neckline taken from the low of US$1.0823), EUR/USD (euro versus the US dollar) bears will likely remain on the offensive until the...

Since BTC/USD (Bitcoin versus the US dollar) rebounded from the 200-day simple moving average (SMA) earlier this month at US$78,111, speculative bullish interest has been uninspiring. Further Downside As far as I can see, the major crypto pairing demonstrates scope to continue exploring south until it reaches support from US$68,926 on the monthly timeframe...

Down nearly 4.0% this month, the US Dollar Index demonstrates scope to navigate deeper waters on the monthly chart towards the 50-month simple moving average (SMA) at 101.72. A similar vibe is evident on the daily chart. Following a test of support-turned-resistance at 103.94, a possible bearish scenario could unfold if price breaches the lower edge of the current...

Versus the US dollar, spot gold (XAU/USD) rallied strongly in the early hours of the US session and is now up 1.5% on the day. Currently trading at US$2,977 and refreshing record highs, the precious metal is on the cusp of bumping heads with the widely watched US$3,000 level. Gold’s Uptrend Remains Intact Although Gold’s multi-year uptrend is not ensured to...

As shown on the weekly chart of the S&P 500, the stock market index is on track to record a fourth consecutive week underwater. However, with price action welcoming support around 5,577, a rebound higher could be on the table. This support zone includes local descending support, extended from the high of 5,669, and a channel resistance-turned-support line, taken...

Several desks forecast that the Bank of Canada (BoC) will reduce the overnight rate by another 25 basis points (bps) to 2.75% (from 3.00%) today at 1:45 pm GMT. Since June (2024), the central bank has lowered rates by 200 bps over six consecutive meetings, bringing the overnight rate closer to the mid-point of the BoC’s neutral range of 3.25% - 2.25%. The swaps...

Market participants will closely monitor February’s CPI inflation report (Consumer Price Index), scheduled to be released tomorrow at 12:30 pm GMT. The consensus anticipates that headline and core metrics will demonstrate signs of cooling. Economists anticipate that year-on-year CPI inflation has eased to 2.9% (down from 3.0% in January) and that core inflation...

February has not been kind to Tesla (ticker: TSLA), settling the month down 28% and stirring levels not seen since November 2024. I will keep the following analysis simple and concise. Despite the eye-watering drop in February, a daily support area entered the fray on Friday between US$264.82 and US$272.25, made up of the following technical...

Several themes are at play right now, which contributed to a selloff across risk assets last week. Influenced by political shenanigans (tariffs) and the Bybit exchange breach, this sent Bitcoin (BTC) 17.5% lower versus the US dollar (USD) by the close of trading on Friday. Monthly Chart: Room to Explore Deeper Waters There is not much to talk about on the...

Buyers and Sellers Squaring Off Between Monthly Support and Resistance Monthly resistance from 109.33 was a technical headwind I monitored on the US Dollar Index for a while, and so far, it has not disappointed me. The said resistance welcomed moderate selling in February, and although the combination of the 107.35 high (October 2023) and 106.52 high (April...

Nvidia (ticker: NVDA) is set to announce its Q4 FY2025 earnings results after the market closes today. The report will be for the full fiscal year and covers the period between 1 November (2024) and 31 January (2025). As the last of the Magnificent Seven stocks to report, Nvidia’s earnings results are a widely anticipated market event. Heading into the earnings...

Australian CPI inflation data (Consumer Price Index) will be released tomorrow at 12:30 am GMT. Based on estimates from Refinitiv, the year-on-year (YY) CPI print is forecast to have risen by 2.5% in January, matching December’s reading (2024). However, the current estimate range remains broad: between a high of 2.9% and a low of 2.1%. RBA: Cautionary Cut ...

If it appears as if the price of spot gold (XAU/USD) chalks up an all-time high every week, it is. In fact, the precious metal rallied northbound for eight consecutive weeks, and opposing bearish themes are few and far between. Geopolitical risks, uncertainty surrounding US President Donald Trump’s tariff plans, and limited resistance until around US$3,000 (as...

The US dollar (USD) – per the US Dollar Index – is on track to end February on the ropes following January’s monthly indecision candle at the resistance of 109.33. I believe USD bears have space to drive towards a ‘local’ descending support around 105.40ish, extended from the high of 107.35. Similarly, the daily timeframe demonstrates scope for sellers to...

From the daily timeframe, SOL/USD (Solana versus the US dollar) recently connected with support from US$163.90, aided by the H1 timeframe chalking up an inverted head and shoulders pattern. With the formation’s neckline consumed (taken from the high of 107.88), further outperformance towards the pattern’s profit objective at 179.90 could be seen.

While the UK is evading US tariffs for now, its economy continues to face a somewhat undecided future, with taxes on business set to increase in April and a lingering drag from the elevated interest rates. However, this week’s focus shifts to a rather busy slate of economic data in the UK. Regarding tier-1 metrics, I will largely focus on Tuesday’s employment...

The Reserve Bank of Australia (RBA) will meet this Tuesday and is widely anticipated to deliver its first rate cut in four years amid easing inflationary pressures. I am ‘reasonably’ convinced that the central bank will reduce the Cash Rate this week, a belief based on inflation and growth data that delivered prints south of the RBA’s recent projections (released...