Market analysis from FXOpen

Apple (AAPL) Shares Jump Following Earnings Report Yesterday, after the close of the regular trading session, Apple released its earnings report, which surpassed analysts’ expectations: → Earnings per share: actual = $1.57, forecast = $1.43; → Revenue: actual = $94.04 billion, forecast = $89.35 billion. As a result, AAPL shares surged in the post-market,...

USD/CAD Rises to 2-Month High Today, the USD/CAD exchange rate briefly exceeded the 1.3870 mark – the highest level seen this summer. In less than ten days, the US dollar has strengthened by over 2% against the Canadian dollar. Why Is USD/CAD Rising? Given that both the Federal Reserve and the Bank of Canada left interest rates unchanged on Wednesday (as...

Fibonacci Arcs in Stock Trading Fibonacci arcs, derived from the renowned Fibonacci sequence, offer a compelling blend of technical analysis and market psychology for traders. By mapping potential support and resistance areas through arcs drawn on stock charts, these tools provide insights into future price movements. This article delves into the practical...

Amazon (AMZN) Shares Rise Ahead of Earnings Report Today, 31 July, Amazon is set to release its quarterly earnings after the close of the regular trading session. Available data show that Amazon (AMZN) shares are exhibiting bullish momentum, reflecting positive market expectations: → In July, AMZN shares have outperformed the S&P 500 index (US SPX 500 mini on...

Microsoft Stock (MSFT) Soars to Record High Following Strong Earnings Report As the chart illustrates, Microsoft (MSFT) shares surged sharply after the close of the regular trading session – an immediate market reaction to the company’s strong quarterly results. According to available data, MSFT's post-market price jumped to $555 per share, exceeding its...

UnitedHealth (UNH) Shares Plunge Following Earnings Report Yesterday, prior to the opening of the main trading session, UnitedHealth released its quarterly results along with forward guidance. As a result, UNH shares dropped by over 7%, signalling deep disappointment among market participants. According to media reports: → Earnings per share came in at $4.08,...

EUR/USD Hits Lowest Level Since Early July As the EUR/USD chart indicates today, the euro has fallen below the 1.1550 mark against the US dollar, reaching the lows of June 2025. As a result, July may become the first month in 2025 to record a decline in the currency pair. Why Is EUR/USD Declining? There are two key factors driving the euro’s weakness relative...

Market Analysis: USD/CHF Consolidates Gains USD/CHF is rising and might aim for a move toward the 0.8120 resistance. Important Takeaways for USD/CHF Analysis Today - USD/CHF is showing positive signs above the 0.8040 resistance zone. - There is a connecting bullish trend line forming with support at 0.7990 on the hourly chart. USD/CHF Technical Analysis ...

Market Analysis: EUR/USD Dips Further EUR/USD extended losses and traded below the 1.1600 support. Important Takeaways for EUR/USD Analysis Today - The Euro struggled to clear the 1.1800 resistance and declined against the US Dollar. - There is a key downward channel forming with resistance at 1.1575 on the hourly chart of EUR/USD. EUR/USD Technical...

How Do Traders Use the Pivot Points Indicator? Pivot points are a popular technical analysis tool for spotting areas where the price is expected to react, i.e. pause or reverse. Calculated using the previous day’s high, low, and close, they’re projected onto the current session to highlight potential support and resistance levels, especially useful for intraday...

Nasdaq 100 Index Hits New Highs Ahead of Big Tech Earnings Earlier, we noted signs of optimism in the Nasdaq 100 index as the market anticipated earnings reports from major tech firms. Now, companies such as Alphabet (GOOGL) and Tesla (TSLA) have already released their results (we previously covered their charts → here and here). Up next are the most highly...

US Dollar Index (DXY) Reaches One-Month High The US Dollar Index (DXY) has risen to its highest level since early July. According to media reports, the bullish sentiment in the market is driven by the following factors: → Optimism around US trade agreements. A new trade deal with the EU — which includes a 15% tariff on European goods — is being perceived by the...

Palantir Technologies (PLTR) Shares Surpass $160 for the First Time Shares of Palantir Technologies (PLTR), a company specialising in big data analytics software, have continued their impressive performance. Following an extraordinary rally of approximately 340% in 2024, the stock remains among the top performers in the equity market: → since the beginning of...

Europe and the US Sign Trade Agreement, EUR/USD Declines The past weekend was marked by the official signing of a trade agreement between the United States and Europe, as announced by US President Donald Trump and President of the European Commission Ursula von der Leyen following their meeting in Scotland. According to reports, the agreement is based on a 15%...

Market Analysis: Oil Prices Ease – Market Awaits Fresh Catalyst WTI crude oil is also down and remains at risk of more losses below $64.60. Important Takeaways for WTI Crude Oil Price Analysis Today - WTI crude oil price continued to decline below the $66.00 support zone. - It traded below a connecting bullish trend line with support at $65.60 on the hourly...

Market Analysis: Gold Prices Ease – Market Awaits Fresh Catalyst Gold price started a fresh decline below $3,380. Important Takeaways for Gold Price Analysis Today - Gold price climbed higher toward the $3,430 zone before there was a sharp decline against the US Dollar. - A key bearish trend line is forming with resistance near $3,350 on the hourly chart of...

The DAX Index Is Losing Its Bullish Momentum At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone. Two months have passed, and the chart now suggests that bearish signals are...

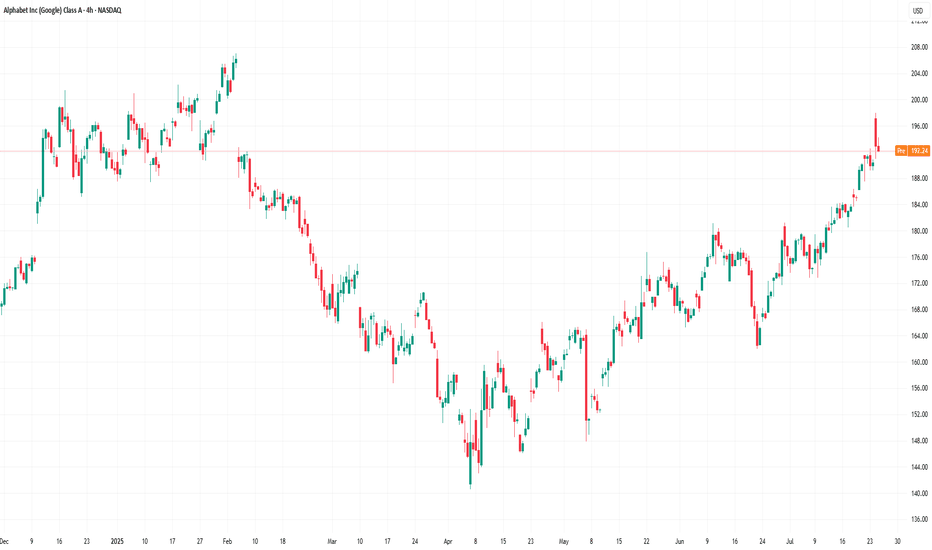

Alphabet (GOOGL) Stock Chart Analysis Following Earnings Release Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that: → an ascending channel had formed; → the psychological resistance level at $200 was of particular importance. The earnings release confirmed the market’s...