Market analysis from IC Markets

NZDUSD is approaching its support at 0.6765 (100% & 61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 0.6834 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 3.3% where a corresponding bounce could occur.

AUDCHF bounced nicely off its support at 0.7075 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 0.7134 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is bounced off its support at 2.6% where a corresponding rise could occur.

AUDUSD is approaching its support at 0.7058 (100% & 61.8% Fibonacci extension, horizontal swing low support) where it could potentially bounce to its resistance at 0.7127 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 1.8% where a corresponding bounce could occur.

EURAUD reversed off its resistance at 1.6037 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal swing high resistance) where it is expected to drop further to its support at 1.5955 (38.2% Fibonacci retracement, horizontal pullback support). Stochastic (89, 5, 3) reversed off its resistance at 98% where a corresponding drop is expected.

AUDNZD is approaching its resistance at 1.0476 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance) where it could reverse down to its support at 1.0421 (61.8% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 94% where a corresponding reversal could occur.

CADJPY reversed off its resistance at 84.51 (100% Fibonacci extension x2, horizontal swing high resistance) where it is expected to drop further to its support at 84.10 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support). Stochastic (89, 5, 3) reversed off its resistance at 97% where a corresponding drop is expected.

GBPAUD is approaching its support at 1.8509 (61.8% Fibonacci extension, 23.6% & 38.2% Fibonacci retracement, horizontal pullback support) where it could potentially bounce to its resistance at 1.8675 (horizontal swing high resistance).

GBP/USD: Following UK PM May's concessions, which the market viewed as an indication a no-deal Brexit has diminished, cable set a fresh YTD high at 1.3350 Wednesday, firmly breaking through the 1.33 handle on the H4 timeframe. The next target on this scale has 1.34 eyed, which if 1.33 holds as support may be achieved today, according to the H4 trend and nearby...

AUDUSD is approaching its resistance at 0.7202 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) where it is expected to reverse down to its support at 0.7145 (horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 95% where a corresponding reversal is expected.

CADCHF is approaching its resistance at 0.7614 (100% Fibonacci extension, 78.6% Fibonacci retracement, horizontal swing high resistance) where it is expected to reverse down to its support at 0.7582 (61.8% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 98% where a corresponding reversal is expected.

EURUSD is approaching its resistance at 1.1409 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal pullback resistance) where it is expected to reverse down to its support at 1.1370 (23.6% Fibonacci retracement, horizontal pullback support). Stochastic (55, 5, 3) is approaching its resistance at 93% where a corresponding reversal is expected.

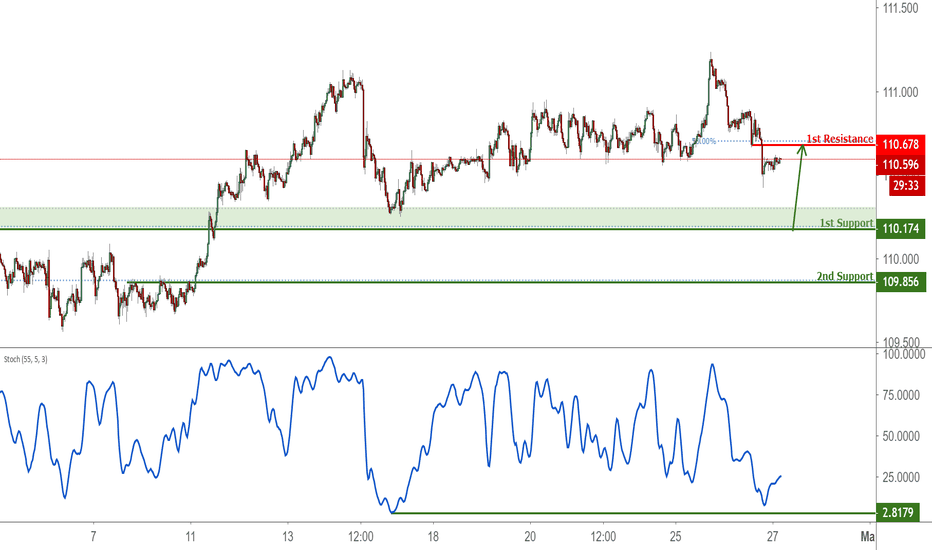

USDJPY is approaching its support at 110.174 (100% Fibonacci extension, 78.6% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 110.678 (61.8% Fibonacci extension, 38.2% Fibonacci retracement, horizontal pullback support). Stochastic (55, 5, 3) is approaching its support where a corresponding bounce could occur.

XAUUSD is approaching its support at 1319.71 (61.8% & 38.2% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 1332.76 (50% Fibonacci retracement, horizontal swing high resistance). Stochastic (55, 5, 3) is approaching its support at 2.7% where a corresponding bounce could occur.

EURUSD is approaching its resistance at 1.1372 (100% & 61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal swing high resistance) where it could reverse to its support at 1.1321 (38.2% Fibonacci retracement, horizontal swing low support). Stochastic (55, 5, 3) is also approaching resistance at 97% where a reversal could occur.

CADJPY is approaching its support at 83.63 (50% & 38.2% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 84.06 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 3.6% where a corresponding bounce could occur.

CADCHF is approaching its support at 0.7542 (61.8% & 100% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 0.7579 (50% Fibonacci retracement, horizontal overlap resistance). Stochastic (89, 5, 3) is approaching its support at 2.6% where a corresponding bounce could occur.

Dow Jones Industrial Average: Kicking things off from the top this morning, Monday observed weekly action cross swords with Quasimodo resistance at 26182, which could potentially hamper upside in this market. Further adding to the above, we can also see daily flow connecting with the underside of supply coming in at 26536-26200. It may also be of interest to...

USDCHF is approaching its support at 0.9980 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, Horizontal swing low support) where it may bounce up to its resistance at 1.0024 (32.8% Fibonacci retracement, Horizontal overlap resistance). Stochastic (34, 5, 3) is approaching its support at 3.6% where a corresponding reversal may occur.