Market analysis from IC Markets

CADCHF is approaching its resistance at 0.7511 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance) where it could reverse down to its support at 0.7464 (76.4% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 98% where a corresponding reversal could occur.

AUDNZD is approaching its resistance at 1.0533 (61.8% Fibonacci extension, 38.2% Fibonacci retracement, horizontal overlap resistance) where it could reverse down to its support at 1.0505 (38.2% Fibonacci retracement, horizontal pullback support). Stochastic (21, 5, 3) is approaching its resistance at 93% where a corresponding could occur.

CADJPY is approaching its support at 82.20 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 82.55 (50% Fibonacci retracement, horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its ascending support line.

GBP/USD: H4 movement, after rebounding from its support area priced in at 1.3150-1.3121, endeavoured to regain 1.32 status Tuesday, though failed in dramatic fashion. The British pound, amid US trading hours, yielded ground to the US dollar, as the pair shrivelled over plan B Brexit concerns. UK lawmakers rejected the key Cooper’s amendment B, along with...

AUDUSD is approaching its support at 0.7142 (61.8% Fibonacci extension, 50% Fibonacci retracement, Horizontal swing low support) where it could potentially bounce to its resistance at 0.7179 (61.8% Fibonacci retracement). Stochastic (55, 5, 3) is approaching its support at 5.9% where a corresponding bounce could occur.

NZDUSD is approaching its support at 0.6808 (100% Fibonacci extension, 50% & 38.2% Fibonacci retracement, horizontal pullback support) where it could potentially bounce to its resistance at 0.6848 (61.8% Fibonacci retracement). Stochastic (89, 5, 3) is approaching its support at 4.9% where a corresponding bounce could occur.

EURUSD is approaching its resistance at 1.1454 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) where it may reverse down to its support at 1.1392 (38.2% Fibonacci retracement, horizontal overlap support). Stochastic (55, 5, 3) is approaching its resistance at 96% where a corresponding reversal may occur.

CADCHF is approaching its support at 0.7441 (100% Fibonacci extension, 23.6% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 0.7515 (horizontal swing high resistance). Stochastic (55, 5, 3) is approaching its support at 5.2% where a corresponding bounce could occur.

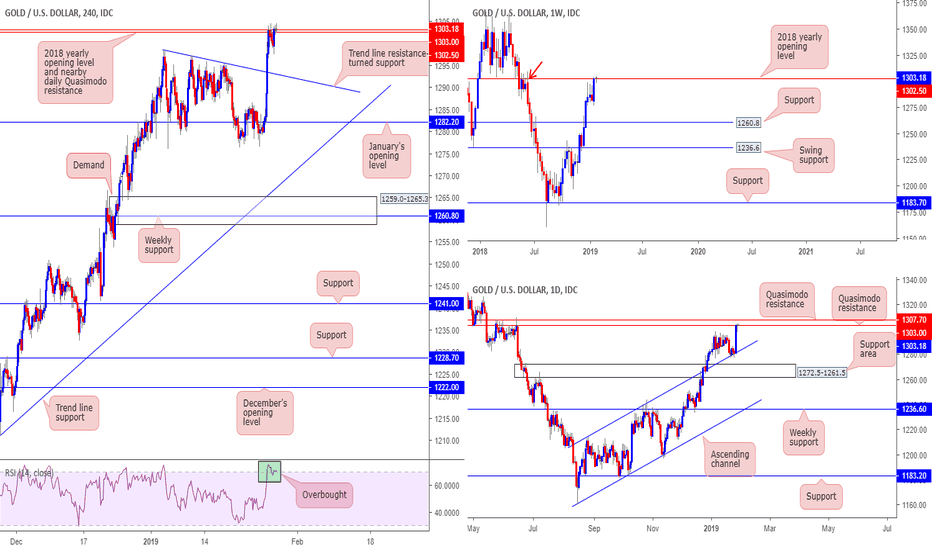

XAU/USD (GOLD): Upside momentum slowed considerably Monday, consequently concluding the session unchanged. In view of the weekly timeframe, bullion is seen crossing swords with the 2018 yearly opening level at 1302.5, which happens to merge with supply painted at 1309.3-1289.9 (red arrow). In collaboration with weekly structure, daily action is seen challenging...

USD/CHF: Down 0.16% on the day, Monday’s segment witnessed an influx of safe-haven demand for the Swiss franc based largely on global equities shedding ground. This – coupled with the US dollar index extending Friday’s losses sub 96.00 – marginally forced the H4 candles beyond a trend line resistance-turned support (extended from the high 1.0008) and came within...

AUD/USD: The Australian dollar yielded ground to its US counterpart Monday once price shook hands with its 0.72 handle. For traders who read Monday’s briefing you may recall the piece highlighted 0.72 as a number likely on the radar for many sellers this week. The ingredients behind 0.72 as a sell zone are down to the following: • Converges with a local H4...

EURNZD bounced nicely off its support at 1.6705 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 1.6873 (76.4% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is bounced off its support at 1.7% where a corresponding rise could occur.

NZDUSD is approaching its support at 0.6715 (61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal swing low support) where it could potentially bounce to its resistance at 0.6770 (61.8% Fibonacci retracement). Stochastic (55, 5, 3) is approaching its support at 2% where a corresponding bounce could occur.

AUDCHF is approaching its support at 0.7038 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal pullback support) where it could potentially bounce to its resistance at 0.7089 (38.2% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is approaching its support at 4.6% where a corresponding bounce could occur.

EURJPY bounced nicely off its support at 123.78 (76.4% Fibonacci retracement, horizontal swing low support, channel support) where it could potentially bounce to its resistance at 124.35 (50% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is bounced off its support at 2.7% where a corresponding rise could occur.

USD/CHF: Broad-based USD buying (US dollar index overthrew its 96.50 mark to the upside) bolstered the USD/CHF into US trade Thursday. This, as you can see from the H4 timeframe, hauled the candles back to the lower boundary of 1.0000/0.9977 (comprised of the 1.0000 (parity) level and December’s opening level at 0.9977), which is, once again, holding ground. It...

GBPUSD is approaching its support at 140.58 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, Horizontal pullback support) where it could potentially bounce to its resistance at 141.44 (100% Fibonacci extension, Horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its support at 5.4% where a corresponding bounce could occur.

CHFJPY is approaching its resistance at 110.37 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, Horizontal swing low support) where it could potentially drop to its support at 109.81 (100% Fibonacci extension, Horizontal swing high resistance). Stochastic (89, 5, 3) is approaching its resistance at 95% where a corresponding drop could occur.