Market analysis from IC Markets

EURUSD is approaching support at 1.1620 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where a bounce up to its resistance at 1.1711 (76.4 Fibonacci retracement, horizontal overlap resistance) could occur. We do have to be cautious of the intermediate resistance at 1.1663 (38.2% Fibonacci retracement, horizontal overlap...

GBPUSD is approaching support at 1.3082 (100% Fibonacci extension, 50% Fibonacci retracement, horizontal swing low support) where price could bounce up to its resistance at 1.3213 (61.8% & 76.4% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at 3.75% where a corresponding bounce could occur.

AUDUSD is approaching its support at 0.7364 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it cound potentially bounce up to its resistance at 0.7429 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at 3.8% where a corresponding

USDCAD bounced off its support at 1.3037 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where it could potentially rise up to its resistance at 1.3257 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (55, 5, 3) bounced off its support at 2.9% where a corresponding rise could occur.

Weekly Gain/Loss: -0.34% Weekly Closing price: 110.97 Weekly perspective: Following a retest to the underside of the 2018 yearly opening level at 112.65 two weeks back, price recently crossed swords with a trend line resistance-turned support (taken from the high 123.57). Having seen this line hold firm as resistance on a number of occasions in the past, it’s...

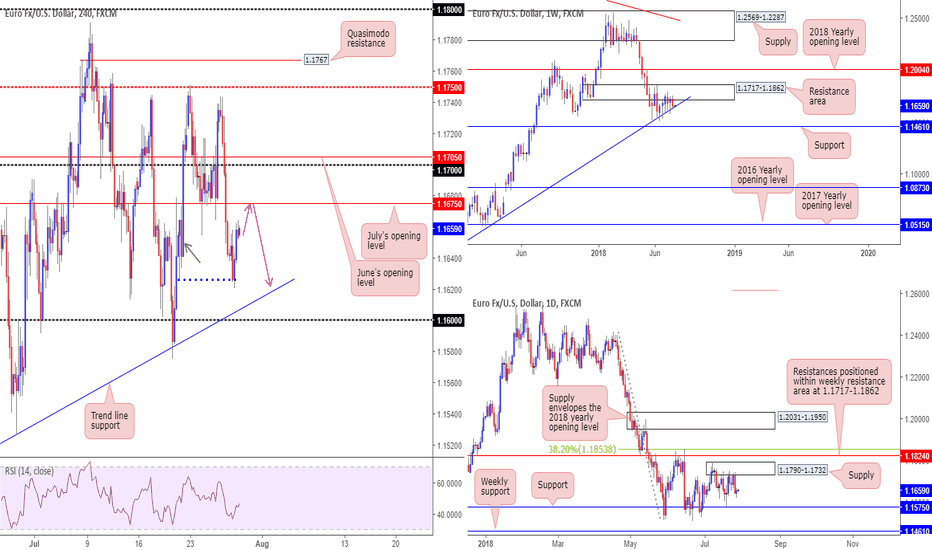

EUR/USD: Weekly Gain/Loss: -0.53% Weekly Closing price: 1.1653 Weekly perspective: As of late May, the single currency has been confined to a tight range comprised of a resistance area plotted at 1.1717-1.1862 and a trend line support (etched from the low 1.0340). Areas outside of this border to keep eyeballs on fall in at the 2018 yearly opening level drawn...

EUR/USD bulls, as you can see, lost their flavor just ahead of the H4 mid-level resistance at 1.1750 on Thursday, consequently forcing price through a number of key H4 support barriers. Despite disappointing US durable goods orders m/m, the euro fell sharply after Draghi clarified guidance regarding an interest rate hike through summer 2019 at the earliest. As a...

CADCHF is approaching its resistance at 0.7629 (100% Fibonacci extension, 50% & 78.6% Fibonacci retracement, horizontal swing high resistnace) where it could potentiall reverse down to its support at 0.7526 (100% Fibonacci extension, 50% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 93% where a...

USDCAD is testing its support at 1.3045 (100% Fibonacci extension, 38.2%, 61.8% & 78.6% Fibonacci retracement, horizontal overlap support) where it could potentially bounce up to its resistance at 1.3193 (61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (89, 5, 3) has bounced off its support at 3.2% where a corresponding rise could occur.

AUDJPY is approaching support at 81.91 (61.8% Fibonacci extension, 61.8% Fibonacci retracement x2, horizontal overlap support) where price could bounce to its resistance at 82.85 (50% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is testing its support at 2.3% where a corresponding bounce could occur.

NZDUSD is approaching support at 0.6770 (61.8% Fibonacci extension, 61.8% & 50% Fibonacci retracement, horizotnal swing low support) where a bounce to its resistance at 0.6823 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) could occur. Stochastic (55, 5, 3) is testing its support at 3% where a corresponding bounce could occur.

USDCHF is approaching its support at 0.9902 (100% & 61.8% Fibonacci extension, 61.8% & 76.4% Fibonacci retracement, horizontal overlap support) where we price could rise to its resistance at 0.9977 (61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 2.8% where a corresponding...

EURGBP is testing its support at 0.8881 (100% Fibonacci extension, 50% & 23.6% Fibonacci retracement, horizontal overlap support) where price could rise to its resistance at 0.8955 (50% Fibonacci retracement, 61.8% Fibonacci extension, horizontal swing high resistance). Stochastic (55, 5, 3) has reversed off its support at 3.5% where a corresponding rise could occur.

EURUSD is approaching its resistance at 1.1743 (61.8% Fibonacci extension, 76.4% Fiboancci retracement, horizontal swing high resistance) where price could reverse off and move towards its support at 1.1661 (50% Fibonacci retracement, horizontal overlap support). Stochastic (55, 5, 3) is approaching resistance at 96% where a reversal might occur.

USD/CAD, as you can see, came under pressure on Wednesday, influenced by the recent Trump/Juncker meeting and robust oil prices. Following an extension off the previous day’s high 1.3191, H4 price destroyed support at 1.3116 as well as the 1.31 handle, and is now attempting a break of July’s opening level positioned at 1.3045. The other key thing to note on the H4...

Early hours on Wednesday witnessed a sharp drop take shape in the Aussie market following a miss on Australian CPI figures, bringing the currency to lows of 0.7392. The market, however, made a swift U-turn here after H4 price failed to sustain losses sub 0.74. Shortly after, US President Trump and EU’s Juncker published a joint statement stating the two sides have...

Price is approaching our first support at 1.3064 (horizontal overlap support, 61.8% Fibonacci extension, 38.2% Fibonacci retracement) and might potentially rise up to our major resistance at 1.3266 (horizontal overlap resistance, 100% Fibonacci extension, 61.8% Fibonacci retracement). Stochastic (55,5,3) is also approaching support and we might see a...

Price is approaching our first resistance at 0.6379 (horizontal swing high resistance, 61.8% Fibonacci extension, short term descending resistance line) might potentially drop to our major support at 0.6767 (horizontal swing low support, 50% Fibonacci retracement). Stochastic (55,5,3) is also approaching resistance and we might see a corresponding drop in price...