Market analysis from IC Markets

AUDNZD reversed off its resistance at 1.0915 (61.8% Fibonacci extension, 76.4% & 50% & 50% Fibonacci retracement) where it could potentially drop further to its support at 1.0857 (100% Fibonacci extension, horizontal swing low support). Stochastic (34, 5, 3) reversed off its resistance at 89% where a corresponding drop could occur.

CADCHF is approaching its support at 0.7532 (100% Fibonacci extension, 38.2% Fibonacci retracement, horizontal swing low support) where it could potentially bounce off from to its resistance at 0.7599 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) bounced off its support at 1.5% where a corresponding...

USDCAD bounced off its support at 1.2998 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it could potentially rise to its resistance at 1.3277 (76.4% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) bounced off near its support at 3.8% where a corresponding rise could occur. We have also...

AUDNZD bounced off its support at 1.0841 (61.8%, 100%, 100% Fibonacci extension, 50% Fibonacci retracement, horizontal overlap support) where price could rise to its resistance at 1.0922 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (89, 5, 3) bounced off its support at 4.4% where a corresponding rise could occur.

USDCHF is approaching support at 0.9858 (100% Fibonacci extension, 76.4% & 23.6% Fibonacci retracement, horizontal swing low support) where price could potentially bounce up to its resistance at 0.9970 (61.8% & 50% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is testing its support 4.37% where a corresponding bounce could occur.

EURUSD is approaching support at 1.1620 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where a bounce up to its resistance at 1.1711 (76.4 Fibonacci retracement, horizontal overlap resistance) could occur. We do have to be cautious of the intermediate resistance at 1.1663 (38.2% Fibonacci retracement, horizontal overlap...

GBPUSD is approaching support at 1.3082 (100% Fibonacci extension, 50% Fibonacci retracement, horizontal swing low support) where price could bounce up to its resistance at 1.3213 (61.8% & 76.4% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at 3.75% where a corresponding bounce could occur.

AUDUSD is approaching its support at 0.7364 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where it cound potentially bounce up to its resistance at 0.7429 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is approaching its support at 3.8% where a corresponding

USDCAD bounced off its support at 1.3037 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where it could potentially rise up to its resistance at 1.3257 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (55, 5, 3) bounced off its support at 2.9% where a corresponding rise could occur.

Weekly Gain/Loss: -0.34% Weekly Closing price: 110.97 Weekly perspective: Following a retest to the underside of the 2018 yearly opening level at 112.65 two weeks back, price recently crossed swords with a trend line resistance-turned support (taken from the high 123.57). Having seen this line hold firm as resistance on a number of occasions in the past, it’s...

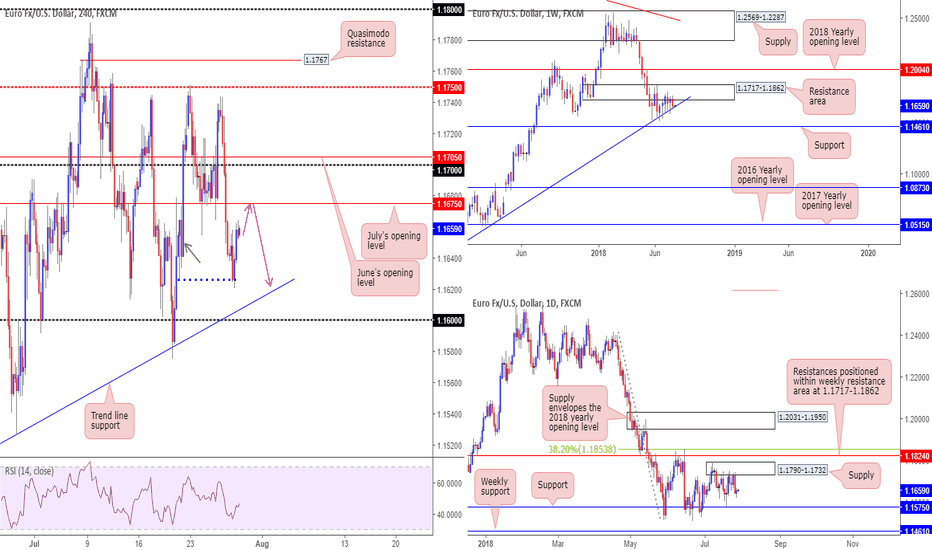

EUR/USD: Weekly Gain/Loss: -0.53% Weekly Closing price: 1.1653 Weekly perspective: As of late May, the single currency has been confined to a tight range comprised of a resistance area plotted at 1.1717-1.1862 and a trend line support (etched from the low 1.0340). Areas outside of this border to keep eyeballs on fall in at the 2018 yearly opening level drawn...

EUR/USD bulls, as you can see, lost their flavor just ahead of the H4 mid-level resistance at 1.1750 on Thursday, consequently forcing price through a number of key H4 support barriers. Despite disappointing US durable goods orders m/m, the euro fell sharply after Draghi clarified guidance regarding an interest rate hike through summer 2019 at the earliest. As a...

CADCHF is approaching its resistance at 0.7629 (100% Fibonacci extension, 50% & 78.6% Fibonacci retracement, horizontal swing high resistnace) where it could potentiall reverse down to its support at 0.7526 (100% Fibonacci extension, 50% Fibonacci retracement, horizontal swing low support). Stochastic (89, 5, 3) is approaching its resistance at 93% where a...

USDCAD is testing its support at 1.3045 (100% Fibonacci extension, 38.2%, 61.8% & 78.6% Fibonacci retracement, horizontal overlap support) where it could potentially bounce up to its resistance at 1.3193 (61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (89, 5, 3) has bounced off its support at 3.2% where a corresponding rise could occur.

AUDJPY is approaching support at 81.91 (61.8% Fibonacci extension, 61.8% Fibonacci retracement x2, horizontal overlap support) where price could bounce to its resistance at 82.85 (50% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is testing its support at 2.3% where a corresponding bounce could occur.

NZDUSD is approaching support at 0.6770 (61.8% Fibonacci extension, 61.8% & 50% Fibonacci retracement, horizotnal swing low support) where a bounce to its resistance at 0.6823 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap resistance) could occur. Stochastic (55, 5, 3) is testing its support at 3% where a corresponding bounce could occur.

USDCHF is approaching its support at 0.9902 (100% & 61.8% Fibonacci extension, 61.8% & 76.4% Fibonacci retracement, horizontal overlap support) where we price could rise to its resistance at 0.9977 (61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 2.8% where a corresponding...

EURGBP is testing its support at 0.8881 (100% Fibonacci extension, 50% & 23.6% Fibonacci retracement, horizontal overlap support) where price could rise to its resistance at 0.8955 (50% Fibonacci retracement, 61.8% Fibonacci extension, horizontal swing high resistance). Stochastic (55, 5, 3) has reversed off its support at 3.5% where a corresponding rise could occur.