Market analysis from Markets.com

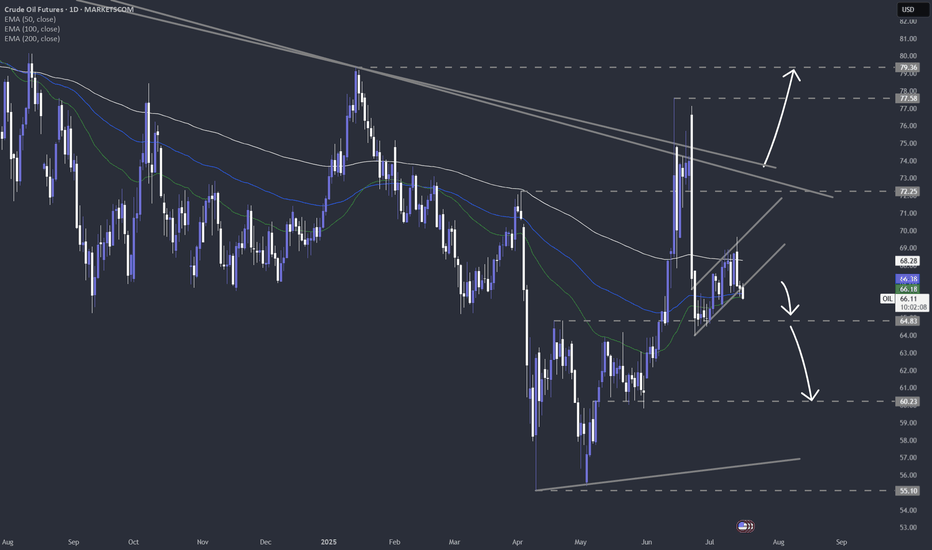

After OPEC+ meeting, where a promise was made to increase production in September, WTI continues to slide. Let's dig in. MARKETSCOM:OIL TVC:USOIL Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and...

Last Friday the US delivered not its best NFP reading. US dollar bears jumped into action. Let's dig in! MARKETSCOM:DOLLARINDEX TVC:DXY FX_IDC:EURUSD FX_IDC:USDJPY FX_IDC:USDCAD Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider...

The US dollar bulls went in hard after during and after the Fed's press conference. Can the momentum stay? Let's dig in. MARKETSCOM:DOLLARINDEX TVC:DXY Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work...

Manipulation? Smells like it, but of course, this is just the market we are currently living in. Let's dig in. MARKETSCOM:COPPER COMEX:HG1! Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether...

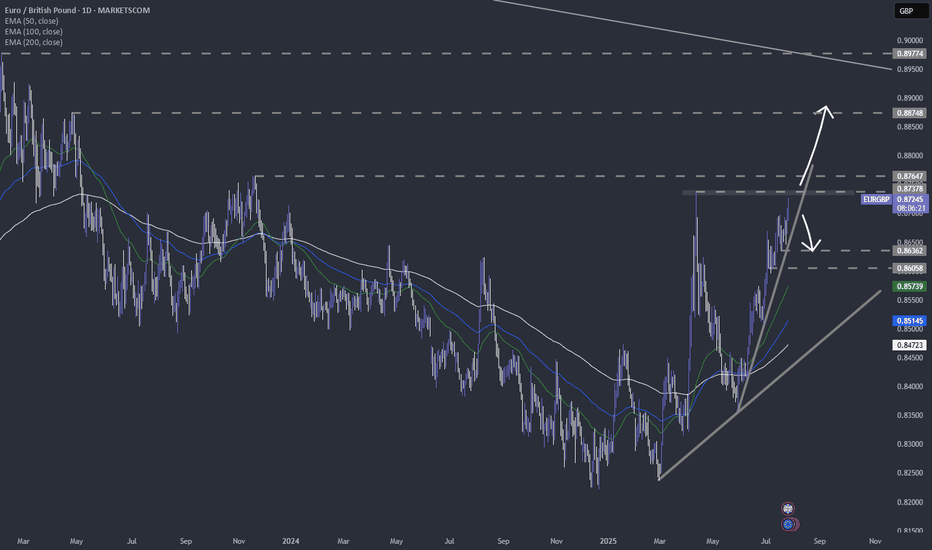

FX_IDC:EURGBP is slowly approaching a strong area of resistance, which is the current highest point of 2025. Let's dig in... MARKETSCOM:EURGBP Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether...

MARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds. Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should...

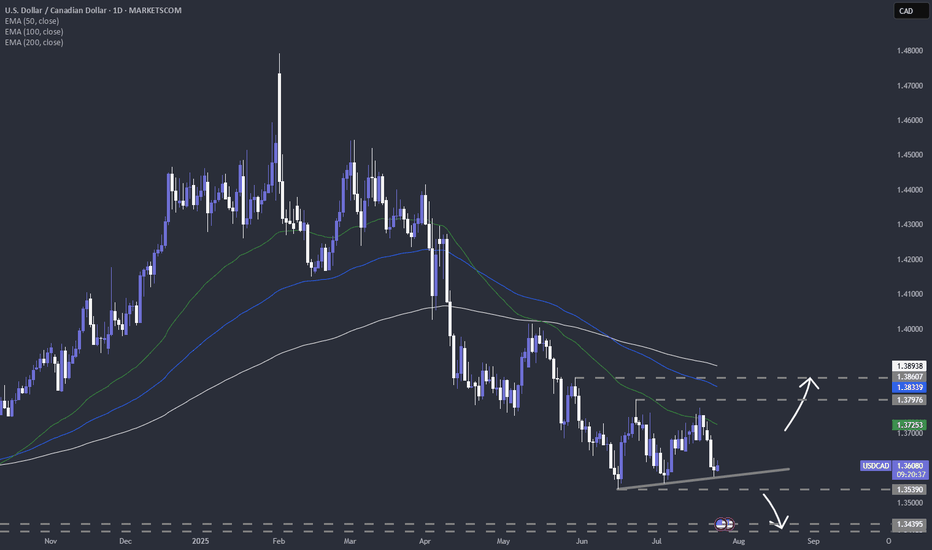

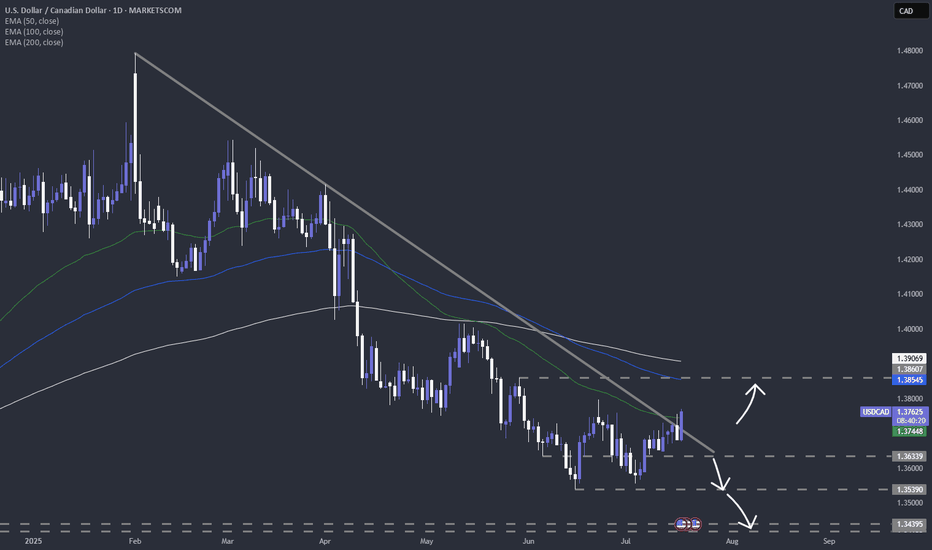

FX_IDC:USDCAD ready for a lower low? Let's see. MARKETSCOM:USDCAD Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is...

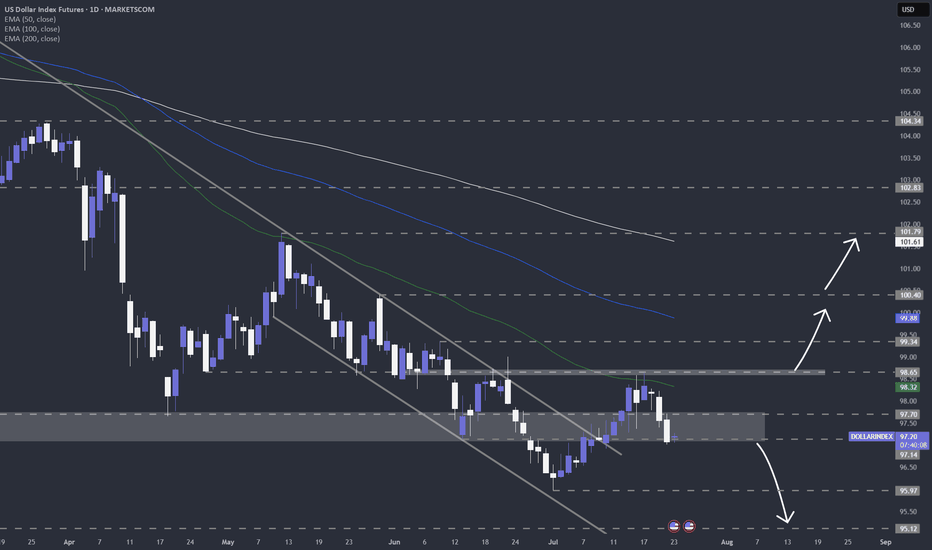

After finding resistance near my 50-day EMA on the daily chart, TVC:DXY is now showing signs of continued weakness. Let's dig in. MARKETSCOM:DOLLARINDEX Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and...

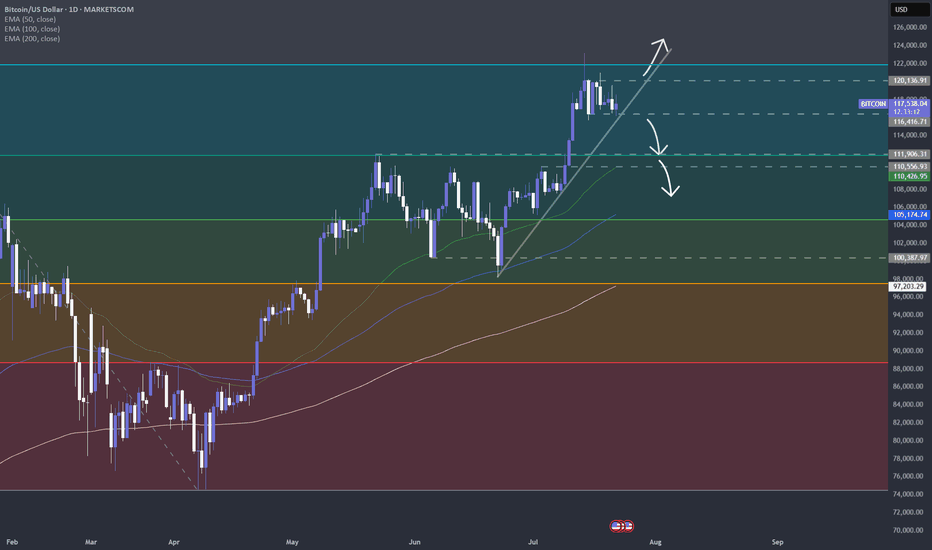

In this new world, where governments and financial institutions are getting more and more interested in cryptos, will those start losing their appeal? Let's take a look at CRYPTO:BTCUSD MARKETSCOM:BITCOIN CRYPTO:ETHUSD MARKETSCOM:RIPPLE Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when...

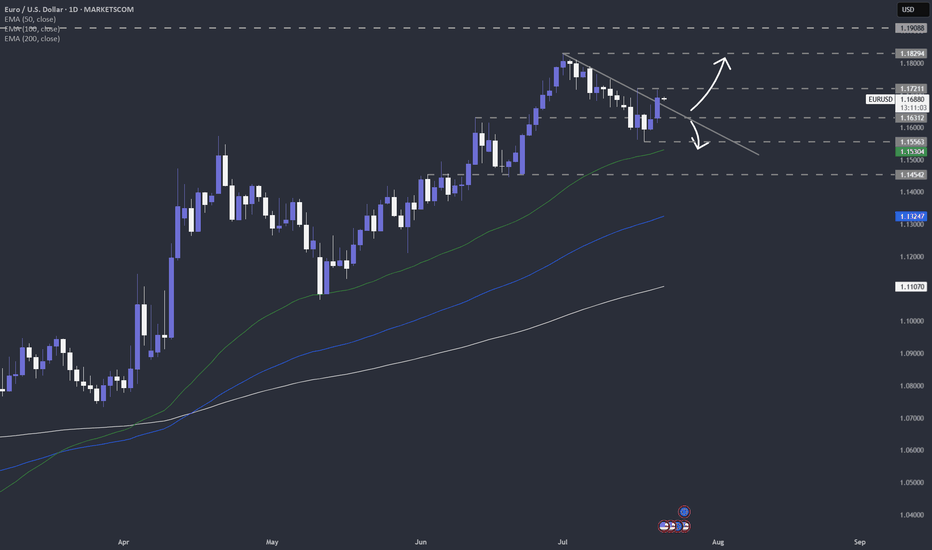

This week we are monitoring EUR and USD carefully, as we could see some interesting moves, due to some events on the economic calendar. Let's dig in. FX_IDC:EURUSD MARKETSCOM:EURUSD TVC:DXY MARKETSCOM:DOLLARINDEX Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this...

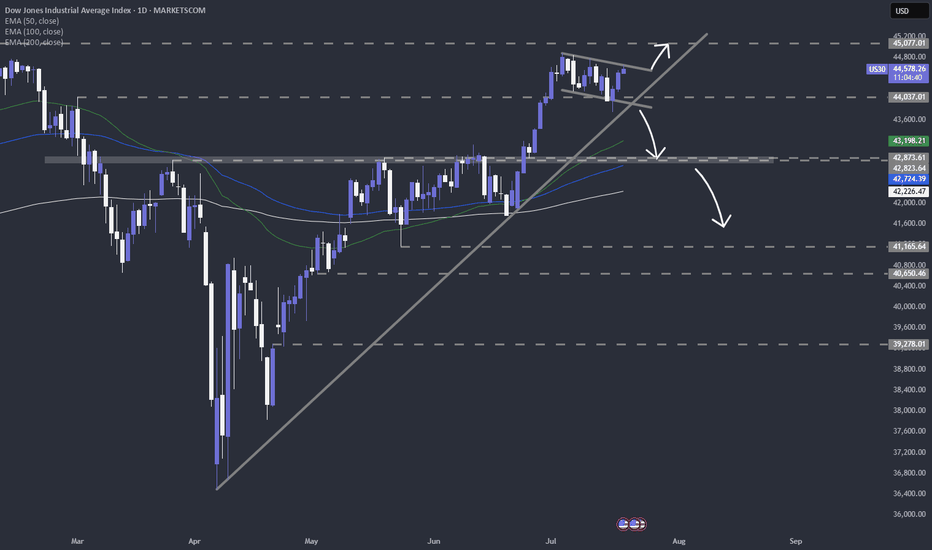

Currently, the Dow Jones Industrial Average TVC:DJI is trading within a short-term downside channel. However, could it just be part of a correction, before another possible leg of buying? Let's dig in. MARKETSCOM:US30 Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this...

Once again, FX_IDC:USDCAD is breaking its medium-term downside resistance line, drawn from the current highest point of this year. If the rate remains above it, we may see a few more bulls stepping in. Let's take a look. MARKETSCOM:USDCAD Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading...

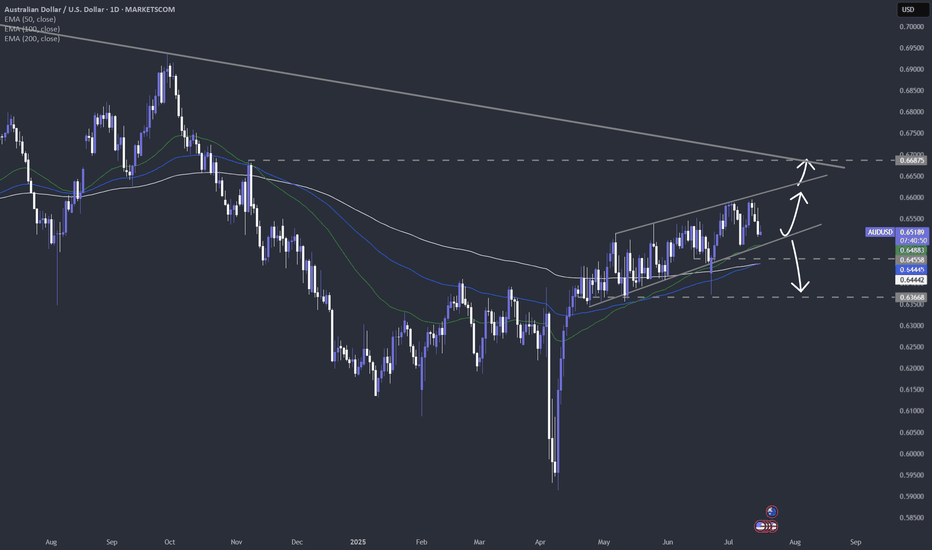

We are keeping a close eye on the Australian job numbers tonight. If you are trading AUD, then that's the data to watch. Let's dig in. FX_IDC:AUDUSD FX_IDC:AUDJPY FX_IDC:AUDNZD Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether...

The technical picture of MARKETSCOM:OIL is showing a possible bearish flag formation, which may lead WTI oil to some lower areas. Is that the case? Let's dig in. NYMEX:CL1! Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you...

TVC:GOLD is currently struggling with one of its key resistance barriers, at around 3365. We need a clear break above that area in order to aim for higher areas. However, we are not getting bearish yet. Let's dig in! MARKETSCOM:GOLD Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs...

From the very short-term perspective, the SP:SPX is currently stuck in a tight range. Waiting for a little breakout. Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high...

NASDAQ:NVDA is the most talked about and everyone is capitalizing on that. Let's take a look. NASDAQ:NVDA Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of...

US is planning to implement tariffs on copper imports at a scale of 50%. It's an interesting move, which might not make much sense. Let's dig in. MARKETSCOM:COPPER COMEX:HG1! Let us know what you think in the comments below. Thank you. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you...