Market analysis from OANDA

The Japanese yen is lower on Friday. USD/JPY is trading at 147.66 in the North American session, up 0.38% on the day. The Bank of Japan minutes from the July 31 meeting signaled that the BoJ remains committed to further rate hikes. This reiterates comments from BOJ President Ueda that he will raise rates, provided that growth and inflation are in line with the...

NZDUSD - 24h expiry The bearish engulfing candle on the weekly chart is negative for sentiment. Daily signals are mildly bearish. 20 1day EMA is at 0.5956. Offers ample risk/reward to sell at the market. The sequence for trading is lower lows and highs. We look to Sell at 0.5959 (stop at 0.5984) Our profit targets will be 0.5885 and 0.5875 Resistance:...

The New Zealand dollar showed some strong gains earlier but couldn't consolidate. After rising as much as 0.50%, NZD/USD has retracted and is trading at 0.5939 in the North American session, up 0.17% on the day. New Zealand's inflation expectations for the next two years ticked lower in the third quarter, falling to 2.28% from 2.29% in Q2. As well, one-year...

NIK225 - 24h expiry Price action continues to trade around significant highs. The primary trend remains bullish. 20 1day EMA is at 40385. We look for a temporary move lower. Dip buying offers good risk/reward. We look to Buy at 40405 (stop at 40105) Our profit targets will be 41305 and 41455 Resistance: 40895 / 41043 / 41315 Support: 40635 / 40375 /...

The New Zealand dollar continues to have a quiet week. In the European session, NZD/USD is trading at 0.5923, up 0.37% on the day. The kiwi has been under pressure, falling 3.4% against the US dollar in July. New Zealand's employment report for Q2 was pretty much as expected, but the news wasn't good. The unemployment rate rose to 5.2% from 5.1% in Q1, below the...

NZDUSD - 24h expiry There is no clear indication that the downward move is coming to an end. Our short term bias remains negative. 50 4hour EMA is at 0.5931. We look for a temporary move higher. Risk/Reward would be poor to call a sell from current levels. We look to Sell at 0.5920 (stop at 0.5941) Our profit targets will be 0.5858 and 0.5848 Resistance:...

The Japanese yen is in negative territory on Tuesday. In the European session, USD/JPY is trading at 147.74, up 0.45% on the day. The Bank of Japan minutes from the June policy meeting were somewhat dovish, but the yen has still headed lower today. The minutes indicated that most BoJ members favored keeping interest rates unchanged, since there were downside...

GBPAUD - 24h expiry The primary trend remains bullish. Price action looks to be forming a bottom. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.0470. We look to Buy at 2.0470 (stop at 2.0420) Our profit targets will be 2.0670 and 2.0700 Resistance: 2.0600 / 2.0670 / 2.0700 Support: 2.0450 / 2.0420...

The Australian dollar has extended its gains on Monday. In the North American session, AUD/USD is trading at 0.6483 up 0.22% on the day. The US dollar made inroads last week against all the major currencies except the yen and gained 1.5% against the Australian dollar. Australia's Melbourne Institute inflation guage soared 0.9% m/m in July, up sharply from 0.1% in...

The Canadian dollar continues to lose ground against its US counterpart and is trading at two-month lows. In the European session, the Canadian dollar is trading at 1.3875, down 0.13% on the day. USD/CAD has risen for six straight days, climbing 1.9% during that time. US nonfarm payrolls for July were softer than expected at 73 thousand, compared to the forecast...

NZDJPY - 24h expiry Trading has been mixed and volatile. Price action looks to be forming a top. We look for a temporary move higher. Preferred trade is to sell into rallies. Bespoke resistance is located at 88.90. We look to Sell at 88.90 (stop at 89.10) Our profit targets will be 88.10 and 87.90 Resistance: 89.00 / 89.20 / 89.50 Support: 88.40 / 88.10...

EURAUD - 24h expiry The primary trend remains bullish. The selloff is close to an exhaustion count on the daily chart. Preferred trade is to buy on dips. Risk/Reward would be poor to call a buy from current levels. Bespoke support is located at 1.7685. We look to Buy at 1.7685 (stop at 1.7635) Our profit targets will be 1.7885 and 1.7910 Resistance:...

The Australian dollar is showing limited movement. In the European session, AUD/USD is trading at 0.6500, down 0.15% on the day. Australia's inflation rate for the second quarter came in lower than expected. Headline CPI dropped to 2.1% y/y, down from 2.4% in the prior two quarters and falling to its lowest level since Q1 2021. This was just below the market...

NZDUSD - 24h expiry Pivot support is at 0.5935. We expect a reversal in this move. Risk/Reward would be poor to call a buy from current levels. A move through 0.5975 will confirm the bullish momentum. The measured move target is 0.6000. We look to Buy at 0.5935 (stop at 0.5910) Our profit targets will be 0.5985 and 0.6000 Resistance: 0.5975 / 0.5985 /...

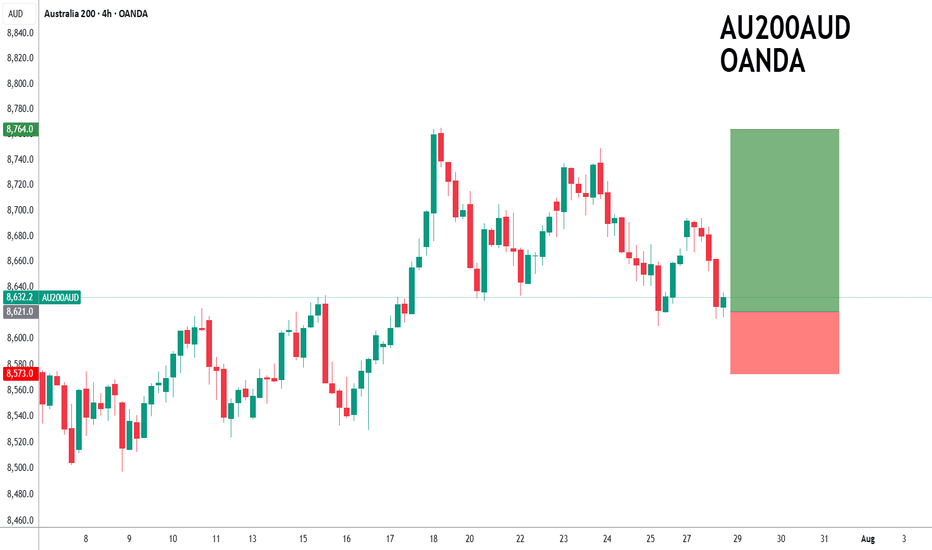

ASX200 - 24h expiry The primary trend remains bullish. Price action continues to trade around the all-time highs. 20 1day EMA is at 8619. Offers ample risk/reward to buy at the market. Our outlook is bullish. We look to Buy at 8621 (stop at 8573) Our profit targets will be 8764 and 8794 Resistance: 8670 / 8694 / 8749 Support: 8610 / 8570 / 8524 Risk...

The Australian dollar is down for a third straight trading day. In the North American session, the US dollar has posted gains against most of the major currencies, including the Aussie. The greenback received a boost after the US and the EU reached a framework trade agreement after protracted negotiations. The data calendar is bare on Monday, with no events out...

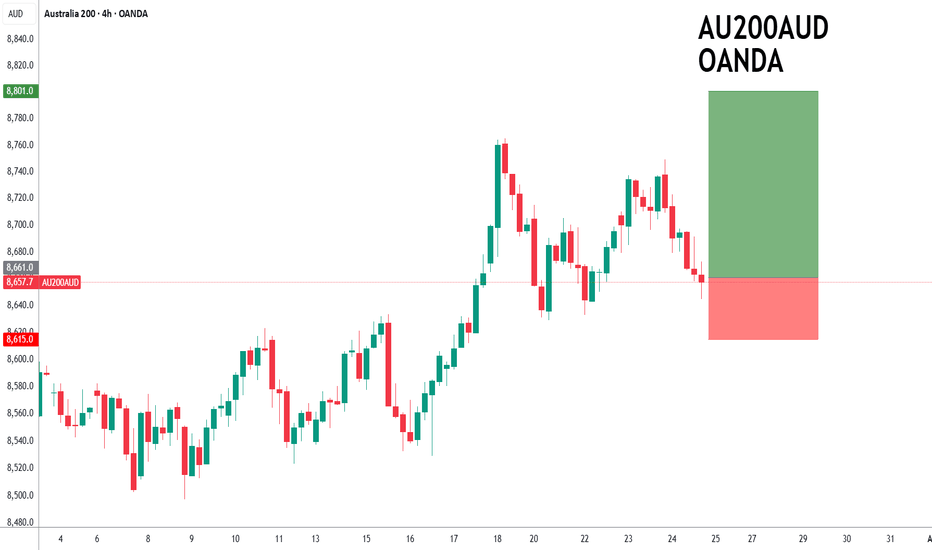

ASX200 - 24h expiry Price action resulted in a new all-time high at 8765. Price action continues to trade around the all-time highs. The bullish engulfing candle on the 4 hour chart the positive for sentiment. 50 4hour EMA is at 8658. We look for a temporary move lower. We look to Buy at 8661 (stop at 8615) Our profit targets will be 8801 and 8831...

The euro is showing limited movement on Thursday. In the North American session, EUR/USD is trading at 1.1763, down 0.03% on the day. Earlier, the euro climbed to a high of 1.1788, its highest level since July 7. The European Central Bank's decision to maintain the key deposit rate at 2.0% was significant but not a surprise. With the hold, the ECB ended a streak...