Market analysis from OANDA

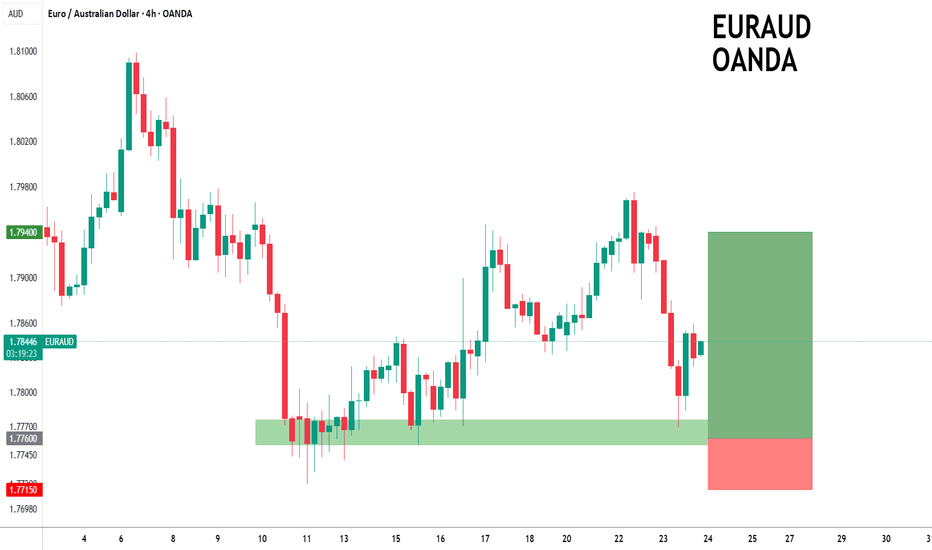

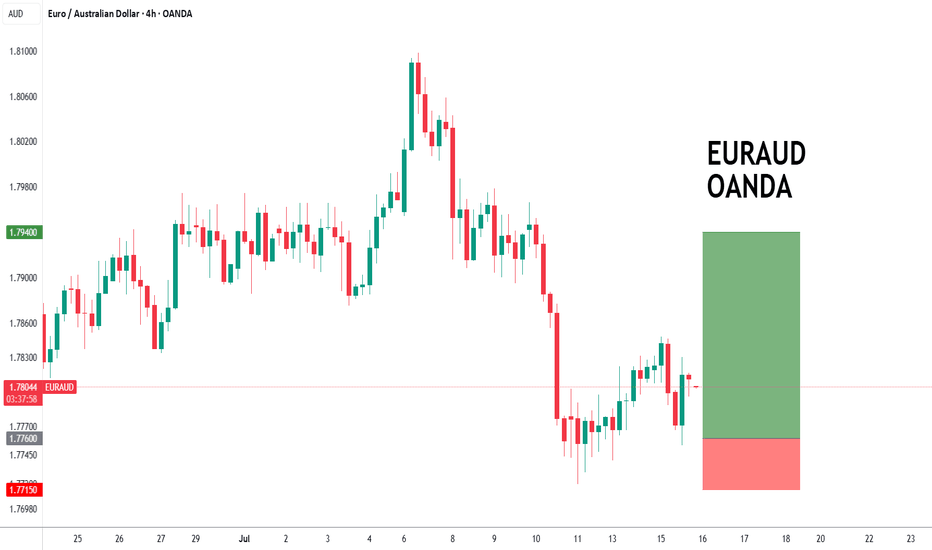

EURAUD - 24h expiry The primary trend remains bullish. We are trading at oversold extremes. Preferred trade is to buy on dips. Risk/Reward would be poor to call a buy from current levels. Bespoke support is located at 1.7760. We look to Buy at 1.7760 (stop at 1.7715) Our profit targets will be 1.7940 and 1.7960 Resistance: 1.7840 / 1.7900 /...

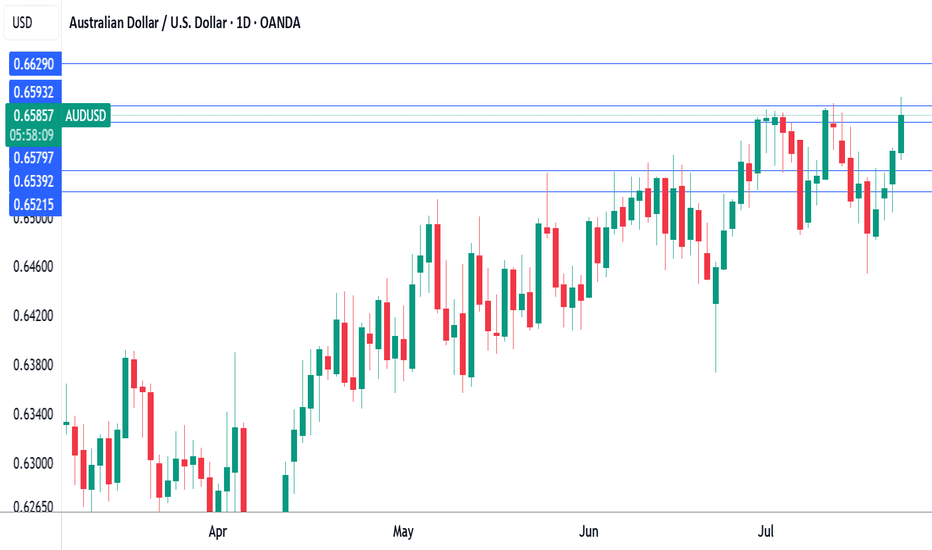

The Australian dollar has rallied for a fourth sucessive day. In the North American session, AUD/USD is trading at 0.6588, up 0.50% on the day. The red-hot Aussie has jumped 1.6% since Thursday and hit a daily high of 0.6600 earlier, its highest level since Nov. 2024. The financial markets are in a risk-on mood today, buoyed by the announcement that the US and...

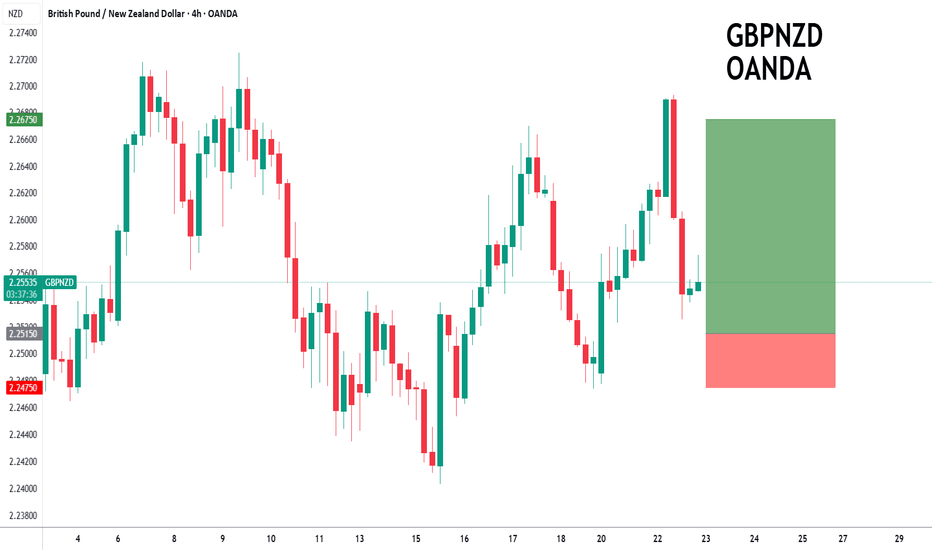

GBPNZD - 24H expiry The medium term bias remains bullish. Price action looks to be forming a bottom. Preferred trade is to buy on dips. Bespoke support is located at 2.2515. Risk/Reward would be poor to call a buy from current levels. We look to Buy at 2.2515 (stop at 2.2475) Our profit targets will be 2.2675 and 2.2710 Resistance: 2.2660 / 2.2720 /...

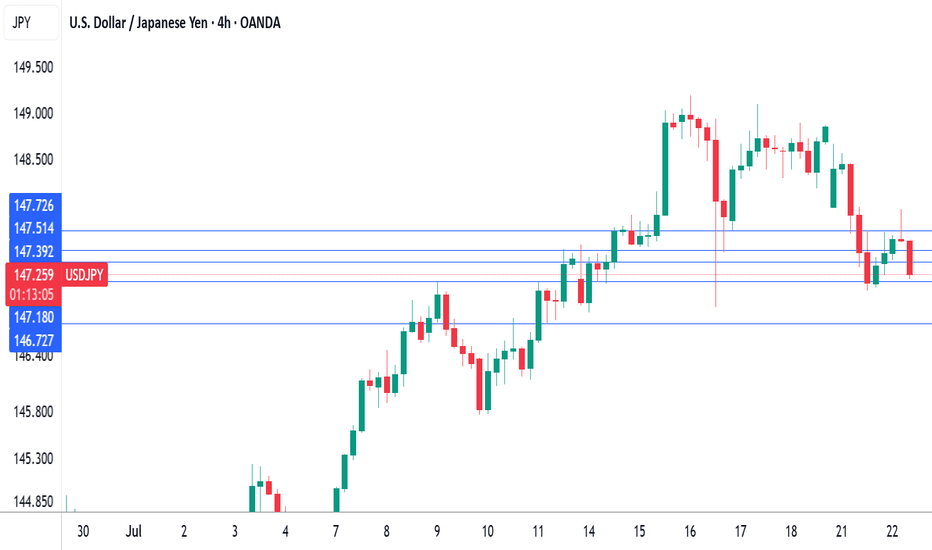

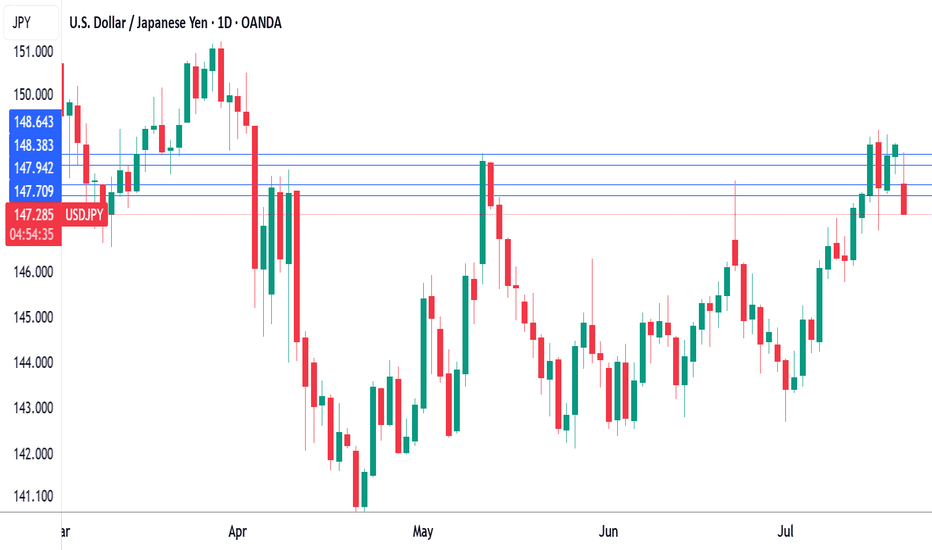

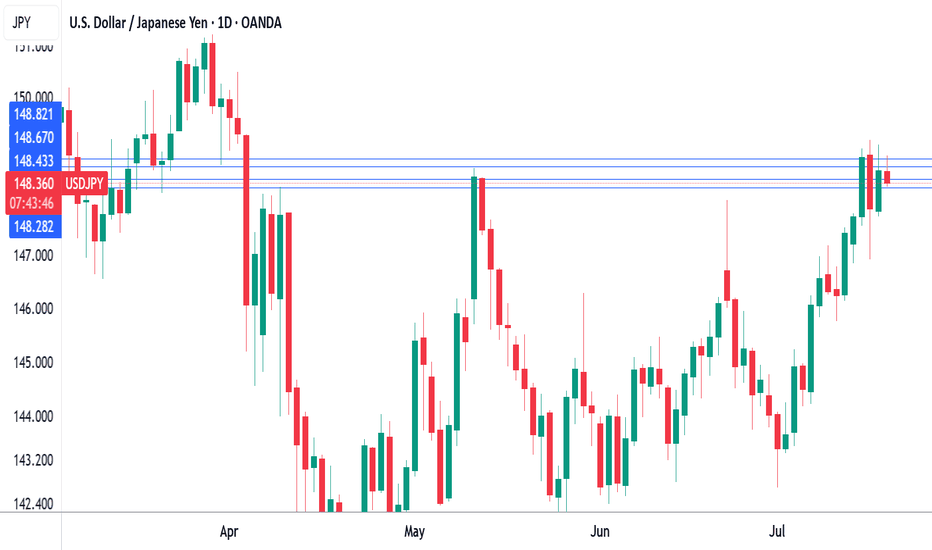

The Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.71, down 0.07% on the day. Japanese Prime Minister Ishiba's ruling coalition failed to win a majority in the election for the upper house of parliament on Sunday. The result is a humiliating blow to Ishiba, as the government lost its majority in the lower...

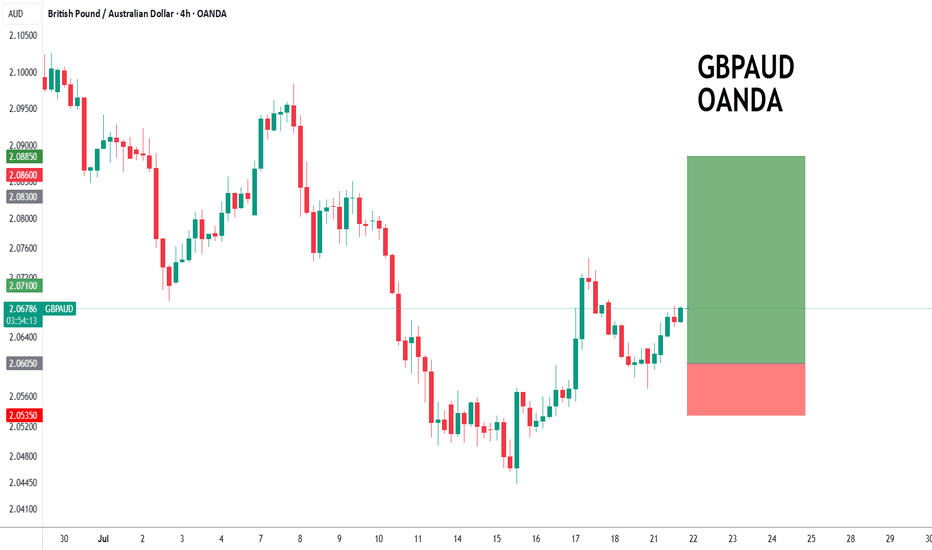

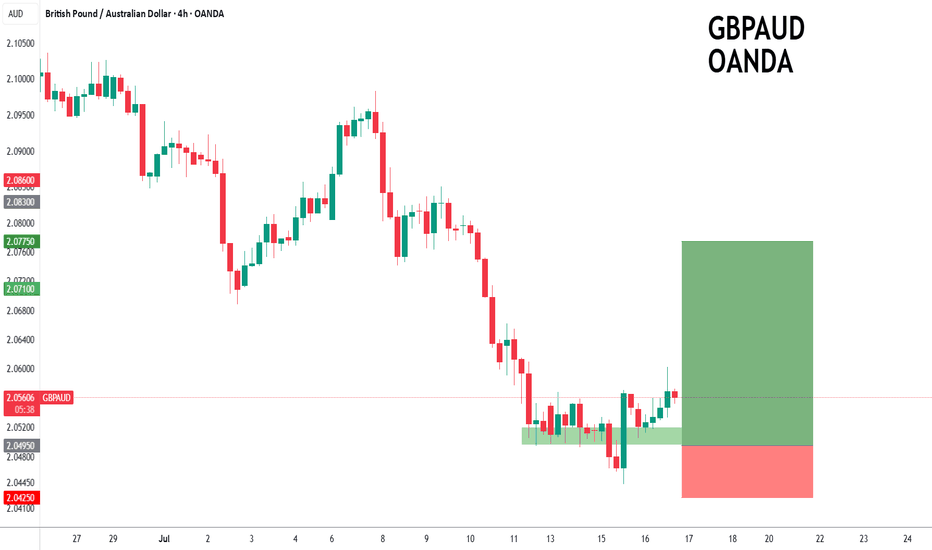

GBPAUD - 24h expiry The primary trend remains bullish. Price action looks to be forming a bottom. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.0605. We look to Buy at 2.0605 (stop at 2.0535) Our profit targets will be 2.0885 and 2.0950 Resistance: 2.0750 / 2.0800 / 2.0970 Support: 2.0600 / 2.0520...

The Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.71, down 0.73% on the day. Japanese Prime Minister Ishiba's ruling coalition failed to win a majority in the election for the upper house of parliament on Sunday. The result is a humiliating blow to Ishiba, as the government lost its majority in the lower...

The Japanese yen is showing little movement on Friday. In the North American session, USD/JPY is trading at 148.69, up 0.06% on the day. On the data calendar, Japan's inflation rate eased in June. It's a light day in the US, highlighted by UoM consumer sentiment and inflation expectations. Inflation in Japan fell in June as expected and the yen is showing little...

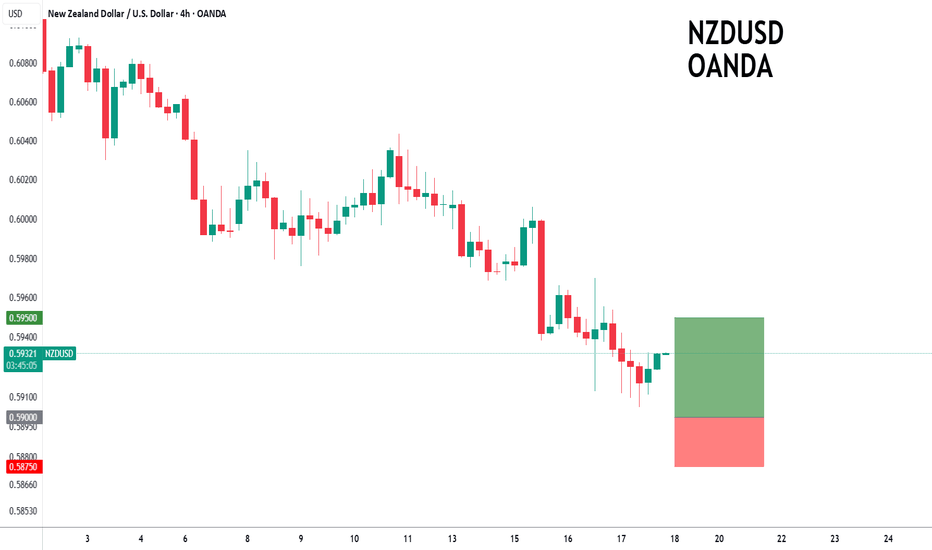

NZDUSD - 24h expiry The correction lower is assessed as being complete. We expect a reversal in this move. Risk/Reward would be poor to call a buy from current levels. A move through 0.5925 will confirm the bullish momentum. The measured move target is 0.5975. We look to Buy at 0.5900 (stop at 0.5875) Our profit targets will be 0.5950 and 0.5975...

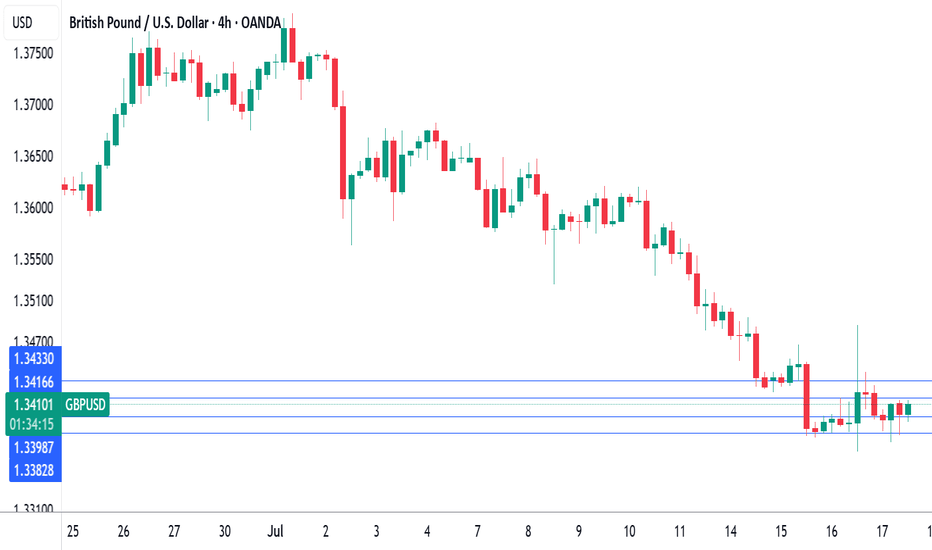

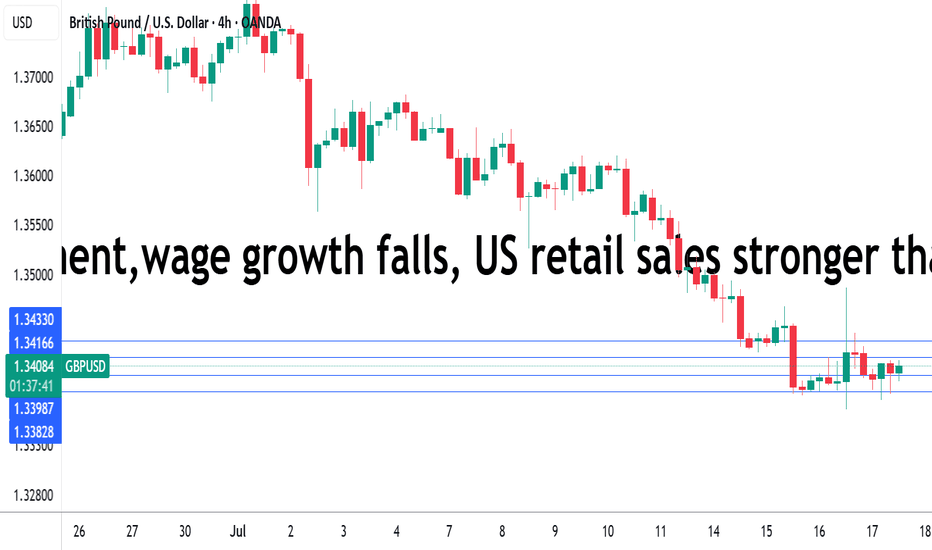

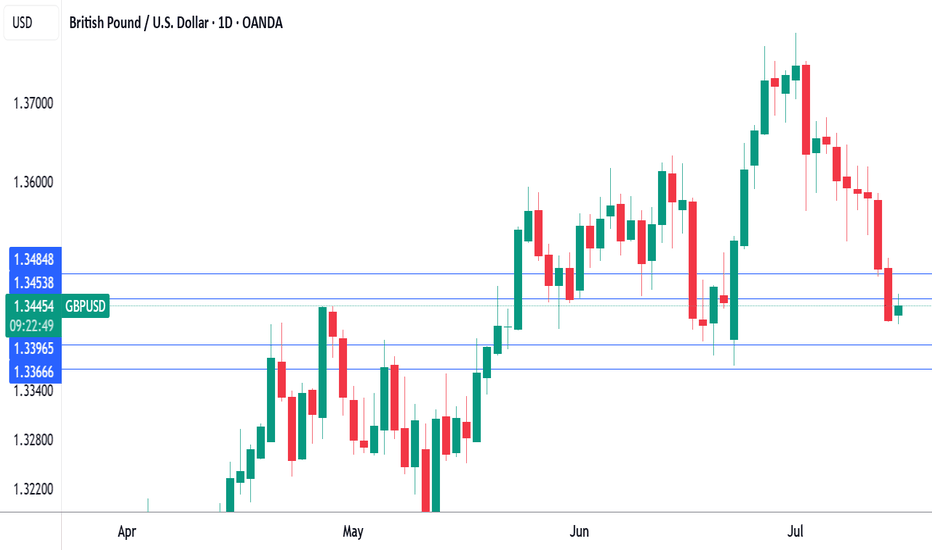

The British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day. Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly...

The British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day. Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly...

GBPAUD - 24h expiry The primary trend remains bullish. Price action looks to be forming a bottom. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.0495. We look to Buy at 2.0495 (stop at 2.0425) Our profit targets will be 2.0775 and 2.0820 Resistance: 2.0670 / 2.0750 / 2.0830 Support: 2.0490 / 2.0440...

The British pound has stabilized on Wednesday and is trading at 1.3389 in the European session, up 0.07% on the day. This follows a four-day losing streak in which GBP/USD dropped 1.5%. On Tuesday, the pound fell as low as 1.3378, its lowest level since June 23. Today's UK inflation report brought news that the Bank of England would have preferred not to hear. UK...

EURAUD - 24h expiry The primary trend remains bullish. The selloff has posted an exhaustion count on the daily chart. Preferred trade is to buy on dips. Risk/Reward would be poor to call a buy from current levels. Bespoke support is located at 1.7760. We look to Buy at 1.7760 (stop at 1.7715) Our profit targets will be 1.7940 and 1.7970 Resistance:...

The British pound has edged up higher on Tuesday. In the European session, GBP/USD is trading at 1.3453, up 0.21% on the day. Earlier, GBP/USD touched a low of 1.3416, its lowest level since June 23. All eyes will be on the UK inflation report for June, which will be released on Wednesday. Headline CPI is expected to remain unchanged at 3.4% y/y, as is core CPI...

NZDJPY - 24h expiry Trading has been mixed and volatile. Price action looks to be forming a top. We look for a temporary move higher. Preferred trade is to sell into rallies. Bespoke resistance is located at 88.45. We look to Sell at 88.45 (stop at 88.65) Our profit targets will be 87.65 and 87.50 Resistance: 88.50 / 88.65 / 88.90 Support: 87.90 / 87.60...

The Australian dollar has edged lower on Monday. In the North American session, AUD/USD is trading at 0.6555, down 0.32% on the day. The Aussie took advantage of US dollar weakness last week as it touched a high of 0.6593, its highest level since November 2024. China's economy is expected to have grown by 5.1% in the second quarter, after back-to-back quarters of...

The British pound continues to have a quiet week. In the European session, GBP/USD is trading at 1.3530, down 0.30% on the day. The UK wrapped up the week on a down note, as GDP contracted in May by 0.1% m/m. This followed a 0.3% decline in April and missed the consensus of 0.1%. The decline was driven by a 1% decline in manufacturing and a 0.6% contraction in...

GBPNZD - 24h expiry The medium term bias remains bullish. We look for a temporary move lower. Preferred trade is to buy on dips. Bespoke support is located at 2.2485. Risk/Reward is ample to buy at market. We look to Buy at 2.2485 (stop at 2.2430) Our profit targets will be 2.2705 and 2.2730 Resistance: 2.2650 / 2.2740 / 2.2790 Support: 2.2500 / 2.2450 /...