Market analysis from Pepperstone

Even by recent standards, the price action seen in Gold this week so far has been extreme. For those that may not have seen it all, here we go. Gold opened at 3331 on Monday, traded to a new all time high of 3500 on Tuesday, then dropped all the way back down to 3260 on Wednesday before recovering again to current levels around 3330. A round trip of circa...

GBPUSD traded to an 8-month high on Tuesday at 1.3424, as a new wave of dollar selling swept across FX markets at the start of the week. This time driven by fresh uncertainty surrounding US economic growth and by a barrage of social media comments across the Easter Holiday period from President Trump that seemed to challenge the independence of the Federal...

As European traders return from their extended Easter break they turn on their screens to find US assets back under pressure. The US 100 index dropped 2.2% yesterday to close at 17779, which included a late rally from a mid session low at 17570. These moves are potentially reflecting a growing unease around numerous important issues, including, a lack of...

The pullback seen in EURUSD at the start of this week, which resulted in a low of 1.1264 being registered on Tuesday may have been a natural reaction to the spike from 1.0943 on Thursday 10th April, up to 1.1473 on Friday 11th April. A quick and relentless rally (low to high) of 4.8% that caught many by surprise. Now, against the backdrop of fresh dollar selling...

Last week, AUDUSD was one of the main beneficiaries of the shift from despair, over Donald Trump's seemingly relentless tariff onslaught at the start of the week, to sheer relief into the Friday close, as the US President paused the tariff start date for 90 days. This move saw AUDUSD rally an impressive 5% from opening levels on Monday at 0.5992 to close the week...

Developments earlier in the week regarding President Trump's 90 day tariff reprieve and the escalation of the trade war between the US and China have seen Gold recover from its slump, which saw it trade from a low of 2956 on Monday, to very quickly post a new all time high this morning at 3220. An impressive rally of 8.5%. It seems these two events have shifted...

After one of the most extreme trading days for the US 500 index that we have seen since the pandemic of March 2020, a slightly uneasy calm has descended across markets this morning as traders await the next tariff updates from President Trump and his team of advisors. Right now it is still unclear whether President Trump would provide an opportunity for...

Last week popular trades were sacrificed in the global risk sell off. The Germany 40 index fell 9% on the week to close at 20,344, a level last seen in early January. The rush into the relative safety of bonds and cash on Thursday/Friday in response to President Trump’s announcement of reciprocal tariffs of 20% on the EU ensured the Germany 40 index moved into...

President Trump’s confirmation of the size and scope of his reciprocal tariffs last night at a much-anticipated ‘Liberation Day’ event in the rose garden at the White House has resulted in a broad wave of negative risk off sentiment which has seen global stock markets fall, and US indices especially come under severe pressure. This trade war escalation has also...

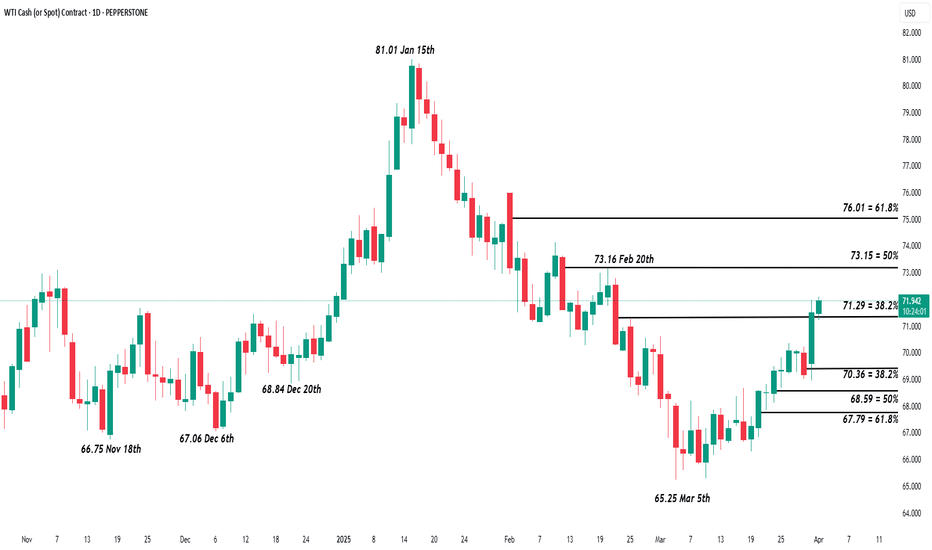

After trading between $65-70 for much of March as fears of a slowdown in the global economy would lead to reduced demand, Oil prices popped 3% yesterday to close at 71.50 and have initially nudged higher again today. The catalyst for the recent move that led to this spike, unsurprisingly, were comments from President Trump. Yes, he seems to be moving all markets...

The Chilean peso continues to face significant downward pressure against the US dollar, recording four consecutive sessions of losses. The local currency has lost the key support of the 200-day moving average, now trading near 960 pesos per dollar, reflecting a sharp decline in investor confidence toward the Chilean currency. The latest weakness in the peso is...

Risk sentiment crumbled on Friday, taking the US 100 down 3% and within touching distance of its 2025 lows at 19113 from March 11th. More importantly it brought the index to a potentially crucial first retracement support level at 19065. Further details on this in the technical section below. The weekend brought little in the way of positivity, with protests...

US equities closed the week with significant losses, reversing the gains recorded during the previous week. The S&P 500 and Nasdaq dropped more than 1%, reflecting a clear deterioration in market sentiment amid multiple adverse factors. The bearish session unfolded in an environment dominated by worrying signs of inflationary pressures, particularly the Personal...

In line with market expectations, the Bank of Mexico unanimously decided to implement another consecutive rate cut during its March 2025 monetary policy meeting. The 50-basis-point reduction brought the policy rate down to 9.00%, marking a forceful continuation of the monetary normalization cycle, one that remains behind its regional Latin American peers. The...

The Mexican peso has posted three consecutive sessions of losses against the U.S. dollar, signaling a marked erosion in investor confidence. Particularly striking is the fact that this decline has occurred even as the dollar trades in negative territory on Thursday, highlighting the inherent weakness of the peso during the session. Two key factors appear to be...

A subject within technical analysis that many find difficult to apply to their day-to-day trading is the ability to spot reversals in price. Yesterday we posted part 1 of this 2 part educational series, where we used GBPUSD as an example of how you could identify and trade a Head and Shoulders/Reversed Head and Shoulders pattern. In today’s post we discuss a...

The U.S. dollar traded weaker on Thursday, dropping 0.22% in the DXY index, despite the release of economic figures that slightly exceeded market expectations. This negative move becomes technically significant as it occurs near the 200-period moving average, a key level that was breached earlier in March, placing the greenback under greater short-term selling...

A subject within technical analysis that many traders find difficult to apply to their day-to-day trading is the ability to spot reversals in price. The misreading of price activity when a reversal is materialising can often lead to incorrect decisions, such as entering a trade too early, which can result in being stopped out of a potentially successful trade...