Market analysis from Pepperstone

Oil extended gains and approached four-week highs, supported by an unexpected decline in U.S. crude inventories and persistent geopolitical tensions that keep international markets on edge. The price of WTI has once again surpassed $70 per barrel, its highest level in nearly a month. This bullish move is mainly driven by a 3.3 million barrel drop in U.S....

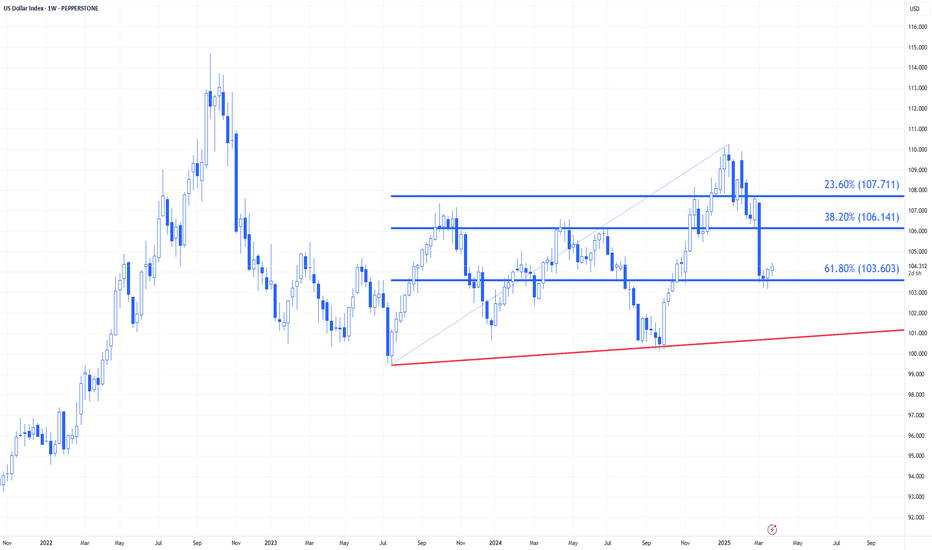

The US dollar is trading with relative stability this Wednesday, consolidating within a tight range as markets carefully analyze a series of recent economic data that suggest mixed signals about the strength of the world’s largest economy. The latest durable goods orders report for February surprised to the upside, showing an increase of 0.9%, compared to...

The US 500 rallied 0.8% last week to close at 5666 and in doing so managed to lock in its first up week since early February. The bounce also brought some joy to those dip buyers that had to endure watching the index move into correction territory (10% drop from 6144 high) the previous week when it touched a 6-month low at 5505 on March 13th. Looking forward, it...

Following hot on the heels of yesterday’s important Bank of Japan and Federal Reserve interest rate decisions, today sees the Swiss National Bank and Bank of England announcements in focus. While the outcome of the SNB meeting will still be relevant for FX markets, in today’s post we will be taking a deeper look at the potential impact of the BoE decision on the...

The U.S. dollar is regaining ground ahead of the much-anticipated second monetary policy decision of the year by the Federal Reserve, after having been under pressure during the first half of the week. The U.S. Dollar Index (DXY) is showing a 0.4% gain, positioning itself as the strongest currency among major Forex market pairs on this key trading day. Alongside...

Gold prices have once again captured investors' attention, approaching the psychologically significant $3,000 per ounce level at the start of this week. At its peak, the precious metal briefly hit $3,001, before pulling back again below the 3k mark, keeping it close to its all-time highs. The recent strength in gold comes as no surprise given the rising global...

The Chilean peso started the week with a solid appreciation of 0.95%, positioning itself as one of the best-performing currencies of the session and reinforcing a positive trajectory that has been consolidating throughout 2025, accumulating a gain of over 7% against the U.S. dollar so far. Two key factors explain this strong performance of the Chilean peso....

The Germany 40 rallied over 2% back to 23,000 on Friday as the news broke that Chancellor in waiting Friedrich Merz’s Conservatives and the Green party, whose support he needs, had reached an agreement, which could see his landmark infrastructure and defence spending package pass into law. It had already been a volatile week of trading up to that point, after...

Gold prices recorded a historic milestone during today’s trading session by briefly touching $3,000 per ounce, consolidating its role as a safe-haven asset amid a global scenario marked by intense trade tensions and expectations of relative changes in U.S. monetary policy. However, despite the psychological significance of the level reached, the yellow metal has...

The Mexican peso advanced 0.35% during the session, demonstrating remarkable resilience amid negative signals from the Mexican industrial sector and economic uncertainties in the United States. However, the near-term outlook for the currency presents considerable challenges. In Mexico, recent industrial data has raised concerns among investors. The Monthly...

After a brief and limited reprieve observed in the previous session, negative pressures have returned to the U.S. stock market, renewing investor caution. During the current session, the Nasdaq 100 is down 0.6%, while the S&P 500 loses 0.4%, demonstrating the underlying fragility of the market despite recent positive signals on the inflation front. Although both...

In the UK, we celebrate the Gun Powder plot with fireworks every November 5th, when Guy Fawkes and a group of men attempted to blow-up the houses of parliament in 1605. There is a poem, written by John Milton in 1626, that starts ‘Remember, Remember, the 5th of November’ and EURUSD traders might do well to keep this in mind, although here, we are only referring...

As an uneasy calm settles across the financial markets after yesterday’s 3.2% fall in the US 100, which brings the total slump from the all time highs of 22226 seen on February 18th to 12.5%, this can often be an ideal time to reassess the key chart levels and technical trends for the index going into the NY open later today, but more importantly so you are...

U.S. equities are facing a significantly more challenging landscape than initially anticipated with the arrival of Donald Trump's new administration in 2025. Contrary to some initial expectations, which foresaw a favorable environment for stock market growth driven by lower regulations and a more lenient tax policy, markets are experiencing strong bearish...

In a previous post on February 19th, we highlighted 2 ways to gauge the extent of a dip in the price of a particular instrument, after a phase of upside strength. This post outlined concepts related to relatively limited and shallow corrections in price, such as those where prices are moving back down to old highs, or a 10-day moving average. You can find this...

Bitcoin continues to hover around $90,000, amid a backdrop of high volatility driven by international trade uncertainties. The recent imposition of tariffs by the United States on Mexico, Canada, and China has increased market caution, with investors maintaining a defensive stance toward risk assets, including cryptocurrencies. This week, Bitcoin-focused ETFs saw...

The price of gold has once again demonstrated its strength by breaking past the $2,900 per ounce mark, reflecting a 0.6% gain in the session and a 1.8% increase for the week. This renewed upward momentum is largely tied to the unstable geopolitical environment and trade tensions, which have driven demand for safe-haven assets, solidifying gold as one of the...

The recent imposition of 25% tariffs by the United States against Mexico has generated significant pressure on the Mexican peso, which today has reached levels above 20.8 per dollar, marking yet another notable depreciation in 2025. This up to 1.5% increase at its daily high in the exchange rate reflects the uncertainty surrounding Mexico’s economic and trade...