Market analysis from Swissquote

The United States Federal Reserve (FED) unveiled this week a new monetary policy decision, maintaining the status quo on interest rates—hence no change in the federal funds rate since December 2024. This did not prevent the S&P 500 from hitting new all-time highs, driven by GAFAM financial results and even the top ten companies by market capitalization, which now...

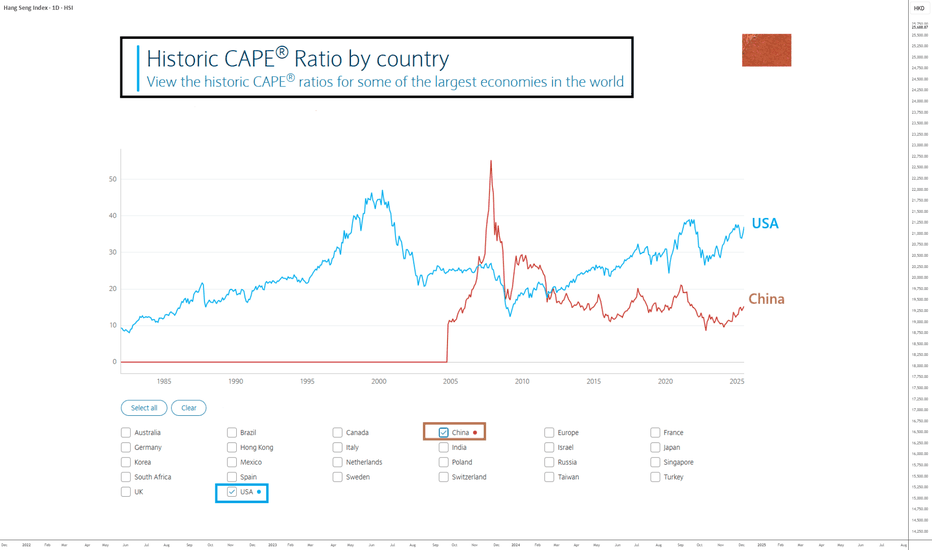

1) The S&P 500 valuation has reached its late 2021 record In the second quarter of 2025, the valuation of the U.S. market, represented by the S&P 500, returned to its record levels of late 2021. The S&P 500 has been reaching new all-time highs consistently since early July. In contrast, European and Chinese markets appear undervalued. In Europe, indices such as...

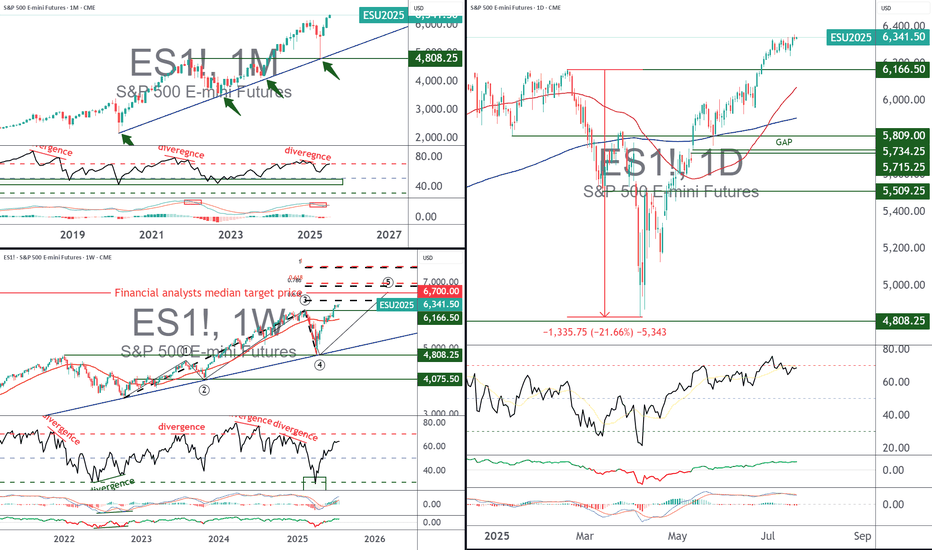

Two weeks ago, I shared a technical analysis of the S&P 500 across all timeframes. This analysis outlines price targets for the end of 2025 based on technical and fundamental criteria. You can revisit this analysis by clicking the first chart below. WARNING: A major bullish target I previously mentioned is close to being reached—6,475 points on the S&P 500...

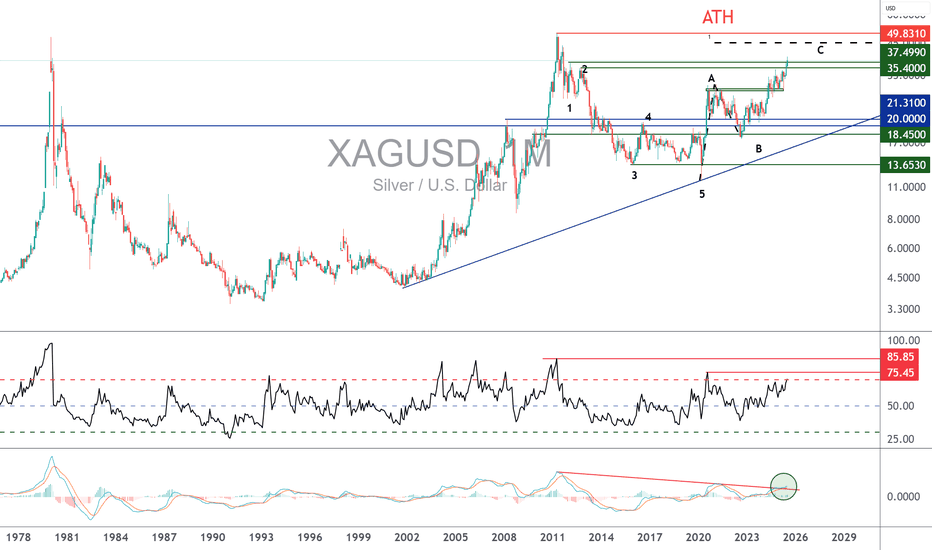

In the world of precious metals, gold has already broken its all-time high in recent months, supported by solid fundamentals. Another precious metal is now catching up: silver. Unlike platinum and palladium, silver today combines all the necessary ingredients to revisit its historic peak. Its bullish potential stems from a unique blend of market volume,...

The underlying uptrend in the BNB/USD token is a major barometer of the overall health of the crypto market, and more broadly, of investor interest in altcoins. In the previous cycle, back in January 2021, the bullish breakout of the all-time high (ATH) on BNB/USD was a leading indicator of the altcoin season. In our current cycle, BNB/USD is on the verge of...

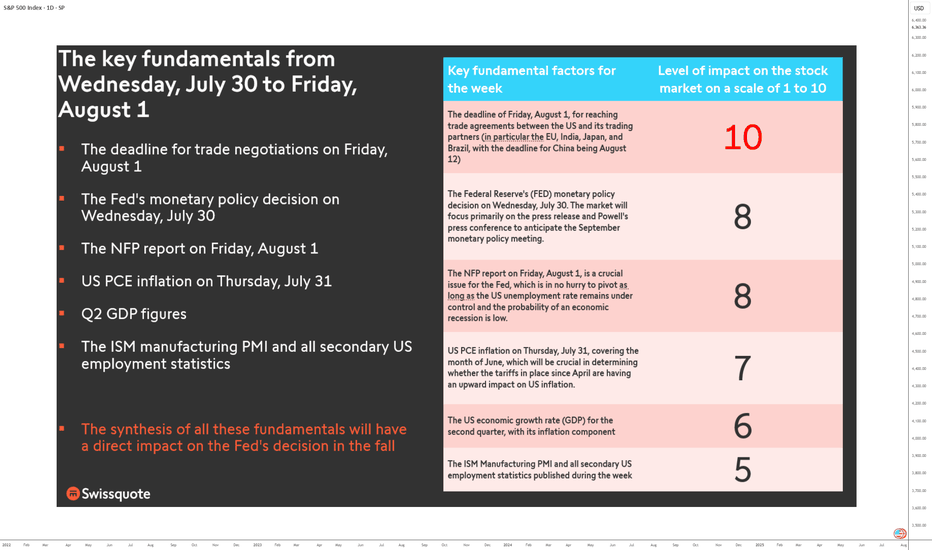

This is a high-stakes, high-pressure week for markets as the final days of July approach. Between Wednesday, July 30, and Friday, August 1, all the market-moving fundamentals are concentrated in a three-day window. It’s a stress test for the U.S. equity market: either it extends its bullish trend, or it enters a much-needed consolidation phase. Three days. No...

As the U.S. stock market trades at all-time highs and has returned to its valuation levels of late 2021 (before the 2022 bear market), it may be wise to look at the Chinese stock market as a way to diversify your portfolio. Regarding the analysis and potential of the S&P 500 Index, I encourage you to read my latest forward-looking study by clicking on the image...

Bitcoin has set a new all-time high this July, continuing the upward cycle tied to the spring 2024 halving. The decline in bitcoin dominance since early July has sparked a minor altcoin season. On this topic, I invite you to revisit my latest crypto analyses in the Swissquote market analysis archive. You can also subscribe to our account to receive alerts every...

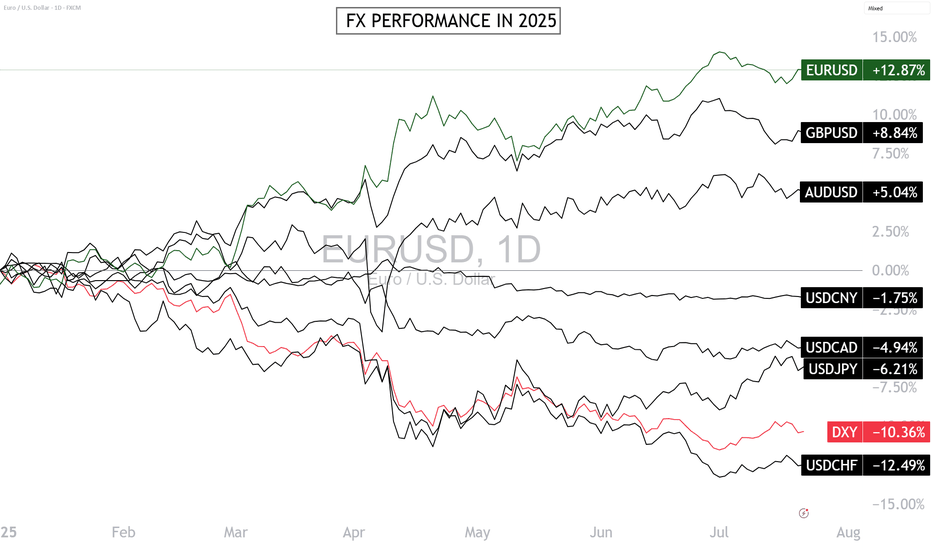

The Euro-Dollar is the best-performing major FX pair in 2025, and a short-term consolidation phase has begun below $1.18. This strength of the euro-dollar is surprising given the divergence in monetary policies. Can the euro-dollar go higher this year? How can this strength be explained fundamentally? In this week of ECB monetary policy decision (Thursday, July...

With the S&P 500 index (the S&P 500 future contract is used as a reference in this analysis) having surpassed its all-time record of 6,165 points at the end of June, and still against a backdrop of trade diplomacy, what technical and fundamental price target can we aim for over the next 12 months? 6,500 points? 6,700 points? 7,000 points? To answer this question,...

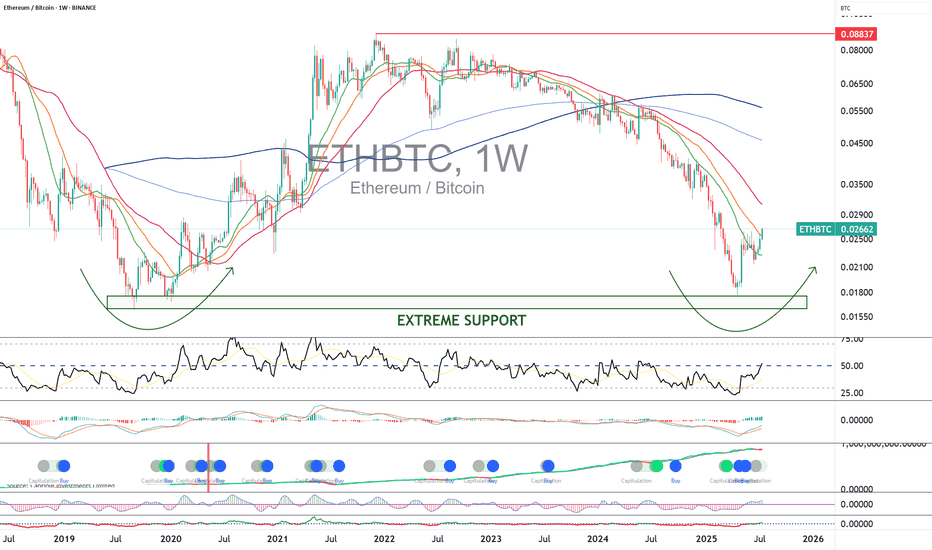

This is the big question for investors whose crypto portfolios are composed of 0% bitcoin and 100% altcoins. This split has been the wrong strategy so far this cycle, as bitcoin's dominance has steadily increased since the start of the bull cycle that began at US$15,000 in autumn 2022. But since the beginning of July, and despite bitcoin's new all-time high, its...

The bitcoin price set a new all-time high earlier this week at 123,000 US dollars, confirming that the bullish cycle linked to the spring 2024 halving is far from over. This current bullish cycle is set to end in autumn 2025, if the market continues to repeat past cycles - bitcoin's famous 4-year cycle. You can reread our bitcoin analysis on this subject by...

For several months now, the US dollar (DXY) has been under pressure against the major currencies, falling by over 11% since the start of the year. However, technical and fundamental signals suggest that a low point could be reached this summer. In this scenario, it is essential to measure the possible consequences on the markets and anticipate the best strategies...

In the columns of TradingView, we have regularly offered you technical and fundamental monitoring of the fundamental uptrend in the bitcoin price. The latter has been supported by its positive correlation with the equity market (new all-time high for the S&P 500 and new all-time high for the MSCI World index for the global equity market), its negative correlation...

The unexpected announcement of a dramatic increase in US copper tariffs triggered a bullish impulse in the copper price, which reached a new all-time high. The question is whether this bullish technical signal is reliable, or whether it could be a false signal and therefore a bullish trap. So let's review the technical analysis message on the price of copper...

While the US dollar is the weakest major currency on the foreign exchange (FX) market this year 2025, and the question of its low point arises, two other currencies seem important to me to put under close watch for this month of July: the Pound Sterling (GBP) and the Hong Kong dollar (HKD). To begin with, you can reread our latest analysis below (by clicking on...

Since the start of 2025, the US dollar has established itself as the weakest major currency on the Forex market, falling by over 11% against a basket of major currencies. If we extend the reference period to include Donald Trump's return to the presidency, the slide even reaches 12%. This spectacular decline is no accident, but the fruit of a strategy deliberately...

1) The US labor market remains resilient according to the latest NFP report, which is good news for the macro-economic situation The US labor market demonstrated its resilience last week, making a rate cut by the FED on Wednesday July 30 unlikely: the unemployment rate fell to 4.1% of the labor force, after several months of stability around 4.2%. This drop in...