Market analysis from ThinkMarkets

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may...

XRP is under pressure as the global trade war escalates, with rising US tariffs fueling fears of inflation and recession. A break below 194.62 could trigger a major downside move, supported by a bearish technical setup. This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this...

Trade wars are escalating, and this time the United States is in conflict with nearly every major economy. In this video, I explain why this shift could have a massive impact on global markets and what it means for traders right now. I walk through the historical parallels from 95 years ago, when similar tariffs deepened the Great Depression and led to an 80...

In this video, we take a look at platinum prices following a request from a reader. Despite a brief breakout, the price hasn't risen as expected and may be morphing into a classic triangle pattern. The best strategy now is probably to wait for a triple top to form before potentially trading a breakout. We also discuss different strategies, including trading within...

GBPUSD is trading sideways in a triangle pattern as markets await potential US tariffs, which may be imposed tonight. The new tariffs will target multiple countries, making negotiations harder and most likely slowing the global economy. If tariffs are confirmed, a break below 1.2868 could trigger USD strength and GBPUSD downside. Alternatively, a break above...

AUDUSD is trading inside a triangle pattern that's been forming for 83 days. A break below 0.6215 could trigger a 188-pip drop, with a 3.82 risk-reward setup. While the RBA held rates at 4.1%, upcoming US tariffs on Liberation Day may pressure the Aussie. Fundamentals and technicals align for a potential bearish move. This content is not directed to residents of...

Platinum is setting up for a breakout above $1,010, with chart patterns pointing to a target near $1,092 and a potential 6x risk-reward ratio. While other metals have already moved, platinum could offer a strong short-term trade if the breakout triggers. This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or...

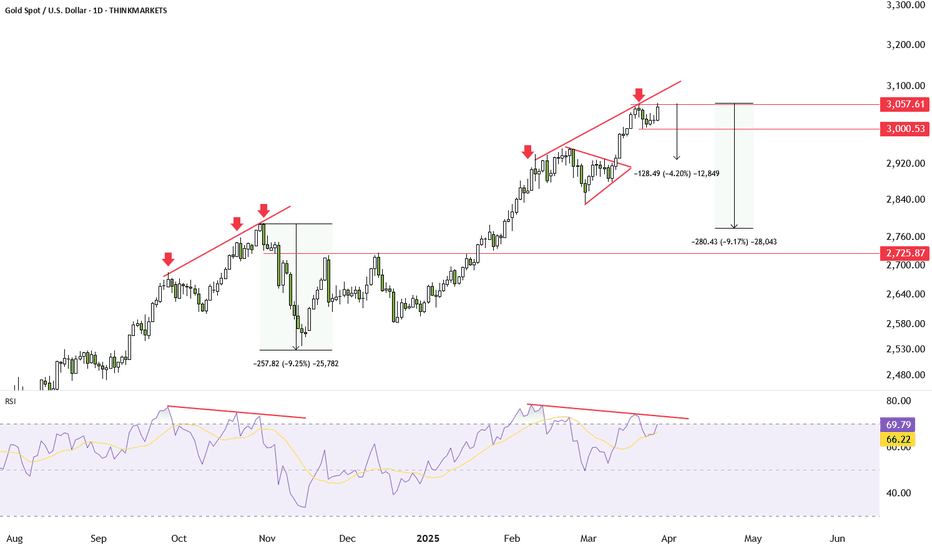

Gold remains in a bullish trend, but RSI divergence and a possible double top near all-time highs signal weakening momentum. A breach to $3,000 could send the price lower. This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market...

USDCHF is showing a 131-day head and shoulders pattern, pointing to a possible 434-pip drop if it breaks below 0.8753. Even partial moves offer solid risk-reward, with setups ranging from 3.2 to 5.1. But be cautious—there’s also a chance of a failed pattern with upside potential. Fundamentals could decide the real breakout direction. This content is not...

AUDUSD has been consolidating in a triangle pattern, suggesting a breakout is near—likely within weeks. A bullish breakout could target 0.6393, with potential for a 229-pip move. A bearish break is also possible but less clear. The setup offers strong risk-reward, with examples showing a 5.6x ratio. This content is not directed to residents of the EU or UK. Any...

A few weeks ago, sentiment was at rock bottom and traders were betting on further downside. But the 200-day moving average held, and a reversal followed. Today, the US flash services PMI bounced back above 50, boosting confidence across risk assets. Trump has also shifted focus away from trade wars, easing investor fears. Ethereum and Bitcoin remain below key...

Silver is retracing alongside gold and other assets, but is this a buying opportunity? Key support levels to watch: $32.14, aligning with silver’s sensitivity to gold, and $31.50, the lower range of the current channel. Fundamentals remain strong, with trade wars and geopolitical tensions supporting long-term bullish momentum. Where do you see silver heading...

The EUR/USD is experiencing a pullback following ECB comments and Morgan Stanley's recommendation to pause EUR long positions. Yet fundamentals suggest long-term bullish potential. What are the levels we should watch? This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this...

The Turkish Lira faced a sharp sell-off, dropping as much as 12% before recovering slightly to a 4.5% decline. The trigger? The detention of Istanbul’s mayor, Ekrem İmamoğlu, a key rival to President Erdogan. Investors have long been wary of Erdogan’s economic policies, especially with inflation soaring to 39%—previously reaching as high as 85%. With interest...

Copper formed an ascending triangle from mid-February, triggering the pattern on March 12. The price moved higher as expected but remains just shy of its target at 5.12. If there is a pullback toward 4.91, or in the worst case down to the breakout point at 4.84, traders will likely see this as a buying opportunity to align with the pattern's upward momentum. The...

The Bank of Japan is expected to keep rates unchanged tomorrow, but the most likely course of action will be rate increases, potentially reaching 1% by the end of the year from the current 0.5%. The Federal Reserve is also expected to hold rates tomorrow. However, with the US economy showing signs of softness, trade tariffs weighing on consumers, and sentiment at...

NZD/USD is nearing a key resistance level, the last line of defense for the USD bulls. A break below could trigger further USD weakness, pushing NZD/USD higher. Where do you think the market is headed? Share your thoughts in the comments! This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other...

The S&P 500 is stuck in a two day old descending triangle pattern making it a tricky setup after an aggressive sell off. A clean break below could lead to a drop towards 5549 with a further 1.6 percent decline. However there’s also the chance of a false breakdown followed by a rebound which could turn this into a fake move. This content is not directed to...