Market analysis from Tickmill

Title: Gold Futures ( GC1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 1975.2 Pivot: 1912.5 Support: 1836.9 Preferred Case: Looking at the H4 chart, my overall bias for GC1! is bearish due to the current price crossing below the Ichimoku cloud , indicating a bearish market. Expecting price to possibly drop towards the support at 1836.9, where...

In this update we review the recent price action in the Gold futures contract and identify the next high probability trading opportunity and price objectives to target

In this update we review the recent price action in TLT and identify the next high probability trading opportunities and price objectives to target

In this update we review the recent price action in the Dollar Index and identify an intraday trading opportunity and price objective tot target

Title: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 214.05 Pivot: 172.60 Support: 142.05 Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to...

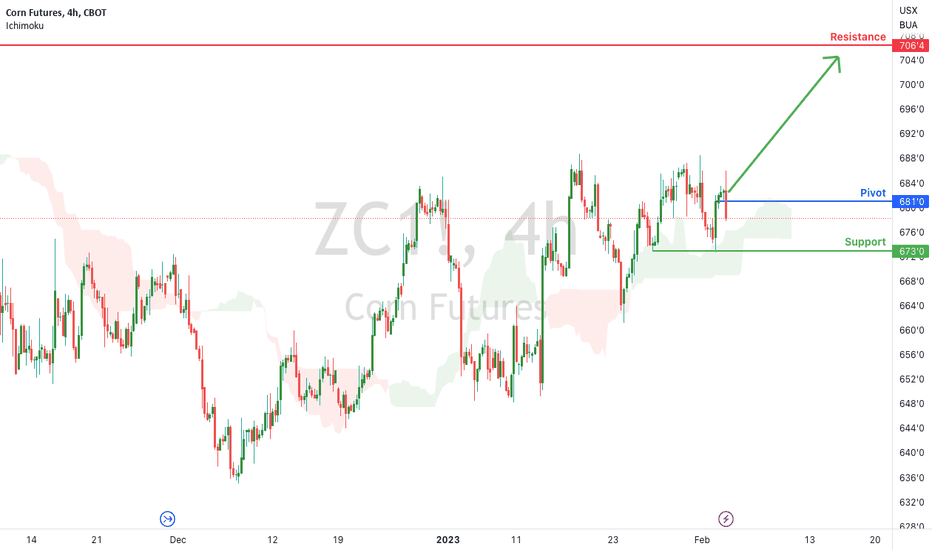

Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 706.50 Pivot: 6681.00 Support: 673.00 Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to...

Title: DOTUSD Futures ( DOTUSD03G2023 ), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 6.705 Pivot: 6.326 Support: 6.030 Preferred case: Looking at the H4 chart, my overall bias for DOTUSD03G2023 is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to retest the pivot at 6.326, where the...

In this update we review the recent price action in the emini Nasdaq futures contract and identify the next high probability trading opportunities and price objectives to target

In this update we review the recent price action in the emini SP500 futures contract and identify the next high probability trading opportunity and price objectives to target

Title: Russell Futures ( RTY1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 2033.0 Pivot: 1909.8 Support: 1832.2 Preferred case: Looking at the H4 chart, my overall bias for RTY1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to retest the pivot at 1909.8, where...

Title: Platinum Futures ( PL1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 1068.8 Pivot: 1022.0 Support: 971.4 Preferred case: Looking at the H4 chart, my overall bias for PL1! is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. Expecting price to retest the pivot at 1022.0, where the overlap...

Title: Soybean Oil Futures ( ZL1! ), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 64.60 Pivot: 61.66 Support: 59.90 Preferred case: Looking at the H4 chart, my overall bias for ZL1!is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to retest the pivot at 61.66, where the overlap...

Title: Live Cattle Futures ( LE11 ), H4 Potential for Bullish Continuation Type: Bullish Rise Resistance: 159.175 Pivot: 157.875 Support: 155.375 Preferred case: Looking at the H4 chart, my overall bias for LE1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to continue heading towards the...

Title: Copper Futures ( HG1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 4.2900 Pivot: 4.2200 Support: 4.1105 Preferred case: Looking at the H4 chart, my overall bias for HG1! is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. Expecting price to continue heading down towards the support at 4.1105,...

In this update we review the recent price action in the Crude Oil futures contract and identify the next high probability trading location and price objectives to target

In this update we review the recent price action in the Silver futures contract and identify the next high probability trading opportunity and price objectives to target

In this update we review the recent price action in the Gold futures contract and identify the next high probability trading opportunity and price objective to tatregt

Title: BCHUSD Futures ( BCHUSD ), D1 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 164.60 Pivot: 138.19 Support: 125.31 Preferred case: Looking at the D1 chart, my overall bias for BCHUSD is bullish due to the current price crossing above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price...