Market analysis from Tickmill

In this update we review the price action in the E-mini SP500 futures contract and identify some high probability trade locations and price objectives to target

In this update we review the recent price action in TLT and identify the next high probability trading opportunities and price objectives to target

In this update we review the recent price action in Tesla and identify the next high probability trading opportunities and price objectives to target

Title: Sugar No. 11 Futures ( SB1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 21.18 Pivot: 18.94 Support: 19.30 Preferred case: Looking at the H4 chart, my overall bias for SB1! is bearish due to the current price crossing below the Ichimoku cloud , indicating a bearish market. If this bearish momentum continues, expect price to continue...

Title: CAC 40 Futures ( FCE1! ), D1 Potential for Bullish continuation Type: Bullish continuation Resistance: 7381.5 Pivot: 6397.5 Support: 6797.5 Preferred case: Looking at the D1 chart, my overall bias for FCE1! is bullish due to the current price crossing above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price...

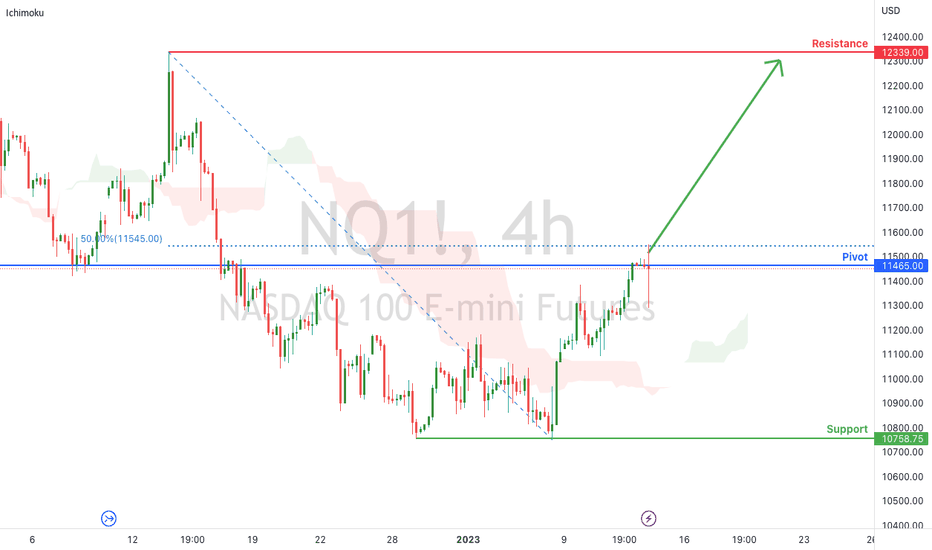

Title: Nasdaq 100 Futures ( NQ1! ), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 12339.00 Pivot: 11465.00 Support: 10758.75 Preferred case: Looking at the H4 chart, my overall bias for CL1! is bullish due to the current price crossing above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to...

Title: Cotton Futures ( CT1! ), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 87.97 Pivot: 82.36 Support: 80.37 Preferred case: Looking at the H4 chart, my overall bias for CL1! is bullish due to the current price crossing above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to continue heading...

In this update we review the recent price action in LTCUSD and identify the next high probability trading opportunity and price objectives to target

In this update we review the recent price action in ETHUSD and identify the next high probability trading opportunities and price objectives to target

In this update we review the recent price action in BTCUSD and identify high probability trade locations and price objectives to target

Title: S&P 500 E-mini Futures ( ES1! ), H4 Potential for Bullish rise Type: Bullish rise Resistance: 4034.50 Pivot: 3900.50 Support: 3804.00 Preferred case: Looking at the H4 chart, my overall bias for SPX is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to continue...

Title: BTC1! Futures ( BTC1! ), H4 Potential for Bullish rise Type: Bullish rise Resistance: 17595 Pivot: 16710 Support: 16090 Preferred case: Looking at the H4 chart, my overall bias for BTC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to continue heading...

In this update we review the recent price action in Google and identify the next high probability trading opportunities and price objectives to target

In this update we review the recent price action in Microsoft and identify the next high probability trading opportunity and price objectives to target

In this update we review the recent price action in Amazon and identify the next high probability trading opportunity and price objective to target

Title: Coffee Futures ( KC1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 174.35 Pivot: 163.80 Support: 154.30 Preferred case: Looking at the H4 chart, my overall bias for KC1! is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. If this bearish momentum continues, expect price to possibly continue...

Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 671.75 Pivot: 660.00 Support: 636.00 Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. If this bearish momentum continues, expect price to possibly continue...

Title: Silver Futures ( SI1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 24.775 Pivot: 706.50 Support: 23.140 Preferred case: Looking at the H4 chart, my overall bias for SI1! is bullish due to the current price crossing above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to...