Market analysis from Trade Nation

Russell INTRADAY muted reaction to positive durable goods data Key Support and Resistance Levels Resistance Level 1: 2113 Resistance Level 2: 2131 Resistance Level 3: 2167 Support Level 1: 2060 Support Level 2: 2022 Support Level 3: 1987 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a...

The US Census Bureau reported that Durable Goods Orders increased 0.9% ($2.7 billion) in February, reaching $289.3 billion. This follows a revised 3.3% gain in January and beats market expectations of a 1% decline. Excluding transportation, orders rose 0.7%. Excluding defense, orders increased 0.8%. Transportation equipment led the gains, up 1.5% ($1.4 billion) to...

The Brent Crude Oil price action remains bearish, in line with the prevailing downtrend. The recent move suggests an oversold bounce, but overall sentiment remains weak unless a significant breakout occurs. Key Levels to Watch: Resistance Levels: 74.25 (critical level), 74.90, 75.90 Support Levels: 71.70, 70.70, 69.13 Bearish Scenario: A rejection from the...

The WTI Crude Oil price action remains bearish, aligning with the prevailing downtrend. The current movement suggests an oversold bounce, but the broader outlook remains weak unless a significant breakout occurs. Key Levels to Watch: Resistance Levels: 70.50 (critical level), 71.30, 72.11 Support Levels: 67.95, 67.00, 65.40 Bearish Scenario: A rejection from...

The CAC 40 Equity Index remains in a prevailing uptrend, with recent intraday price action indicating a corrective pullback toward a key support level. Key Levels to Watch: Support Levels: 7967 (critical level), 7893, 7778 Resistance Levels: 8160, 8270, 8344 Bullish Scenario: A bullish bounce from the 7967 support level, previously a resistance zone, could...

The FTSE 100 equity index is exhibiting bullish sentiment, reinforced by the prevailing uptrend. The recent intraday price action appears to be a corrective sideways consolidation, potentially forming a Bullish Flag continuation pattern, which typically precedes a continuation of the upward momentum. Key Trading Levels: Support Level: The critical support level...

Wednesday March 26 Data: US February durable goods orders, UK February CPI, RPI, January house price index, France March consumer confidence, Australia February CPI Central banks: Fed's Musalem and Kashkari speak, ECB's Villeroy and Cipollone speak, BoC summary of deliberations from the March meeting Earnings: Dollar Tree, RENK Auctions: US 2-yr FRN, US 5-yr...

Technical Analysis of LTC/USD Trend Overview: LTC/USD exhibits a neutral sentiment within a prevailing range-bound trading structure. The recent price action suggests an oversold bounce-back, forming a bearish sideways consolidation. This indicates indecision in the market, with neither bulls nor bears taking full control. Key Levels: Resistance: 960.00,...

The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,171, which represents the current intraday swing high and the falling resistance trendline level. In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,171 resistance, could lead to a downside...

Recent price action in Bitcoin (BTCUSD) suggests an oversold bounce, with resistance capping gains at the 88,000 level. The continuation of selling pressure could extend the downside move, with key support levels at 79,000, followed by 76,278 and 74,222. Alternatively, a confirmed breakout above 91,900, accompanied by a daily close higher, would invalidate the...

The Consumer Confidence Index, set to be released today at 14:00 GMT by the Conference Board, measures consumer sentiment on spending, jobs, inflation, and the economy. Since consumer spending drives the U.S. economy, a strong reading can signal bullish momentum for equities, while a weak reading may indicate bearish sentiment. Traders watch this data closely for...

The Consumer Confidence Index, set to be released today at 14:00 GMT by the Conference Board, measures consumer sentiment on spending, jobs, inflation, and the economy. Since consumer spending drives the U.S. economy, a strong reading can signal bullish momentum for equities, while a weak reading may indicate bearish sentiment. Traders watch this data closely for...

The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes. The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a...

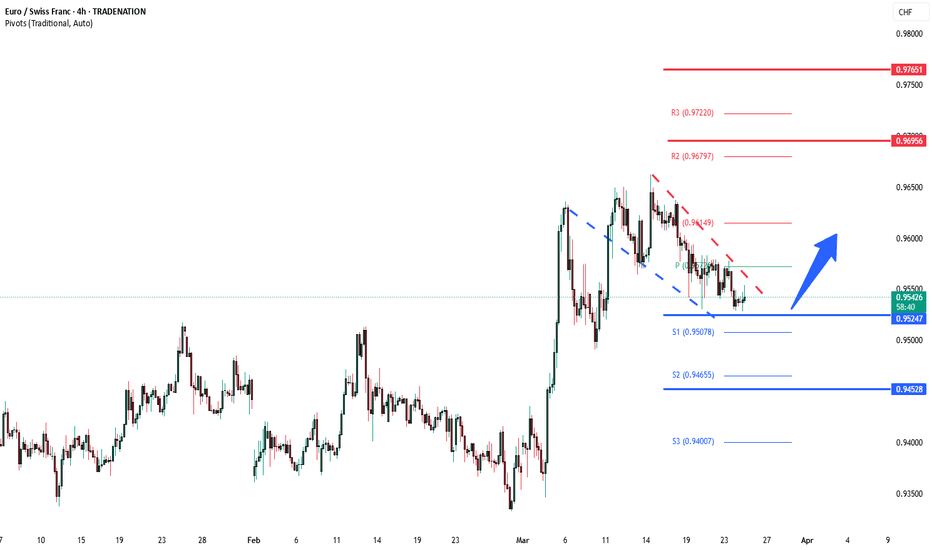

The EUR/CHF currency pair is showing a bullish sentiment, supported by the prevailing long-term uptrend. Recent intraday price action indicates a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone. Key Support and Resistance Levels: Support Zone: The critical support level to watch is 0.9530,...

Trend Overview:The EUR/USD currency pair remains in a bullish trend, supported by a prevailing uptrend. The recent intraday price action suggests a corrective pullback towards a newly formed support zone, previously a resistance level. Key Levels to Watch: Support Levels: 1.0755 – Previous resistance turned support, key level for potential bounce. 1.0700 –...

The DAX40 continues to exhibit bullish sentiment, breaking out from a period of sideways consolidation and pushing toward previous resistance and all-time highs (ATH). The prevailing uptrend supports further upside potential, with key resistance levels in focus. Key Support and Resistance Levels Resistance Level 1: 23,446 Resistance Level 2: 23,815 Resistance...

Tuesday March 25 Data: US March Conference Board consumer confidence index, Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, January FHFA house price index, February new home sales, China 1-yr MLF rate, Japan February PPI services, Germany March Ifo survey, EU27 February new car registrations Central banks:...

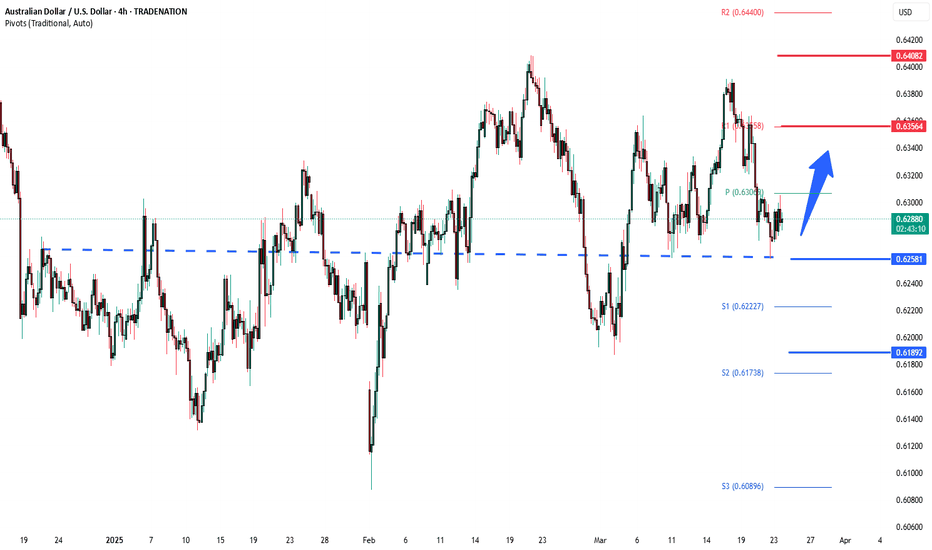

The AUDUSD currency pair is exhibiting bullish sentiment, driven by the prevailing uptrend. The recent intraday price action indicates a corrective pullback towards a previous resistance zone, which has now transformed into new support. This pattern suggests that the pair may be consolidating before resuming its upward momentum. Key Trading Levels: Support...