Market analysis from Trade Nation

The FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8715, which corresponds to the current intraday swing high. This level is critical as it determines the next directional move of the index. From the current levels, an oversold rally could...

Wednesday March 19 Data: US January total net TIC flows, Japan January capacity utilisation, Eurozone Q4 labour costs, New Zealand Q4 GDP Central banks: Fed’s decision, BoJ’s decision, ECB’s Villeroy, Centeno, Guindos and Elderson speak Earnings: Vonovia, Tencent, Ping An Insurance, General Mills This communication is for informational purposes only and should...

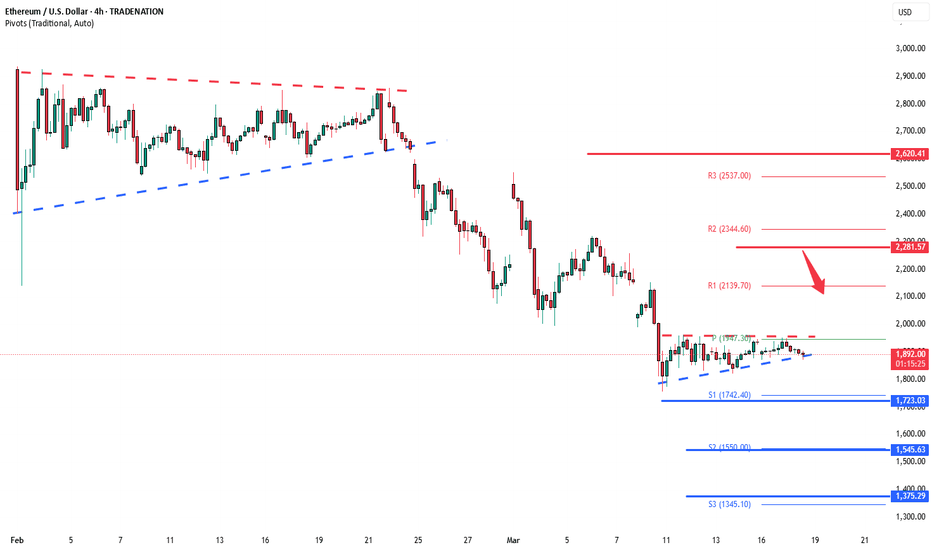

The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,220, which represents the current intraday swing high and the falling resistance trendline level. In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,220 resistance, could lead to a downside...

Litecoin (LTCUSD) remains in a neutral stance, as price action continues to trade within a longer-term sideways range. The key trading level at 940.00 will play a crucial role in determining the next directional move. Key Levels to Watch Resistance Levels: 1,120, 1,217, 1,320, 1,374 Support Levels: 859.00, 816.00 Bearish Scenario If LTCUSD fails to bounce back...

Recent price action in Bitcoin (BTCUSD) suggests an oversold bounce, with resistance capping gains at the 88,000 level. The continuation of selling pressure could extend the downside move, with key support levels at 76,112, followed by 74,222 and 67,260. Alternatively, a confirmed breakout above 91,900, accompanied by a daily close higher, would invalidate the...

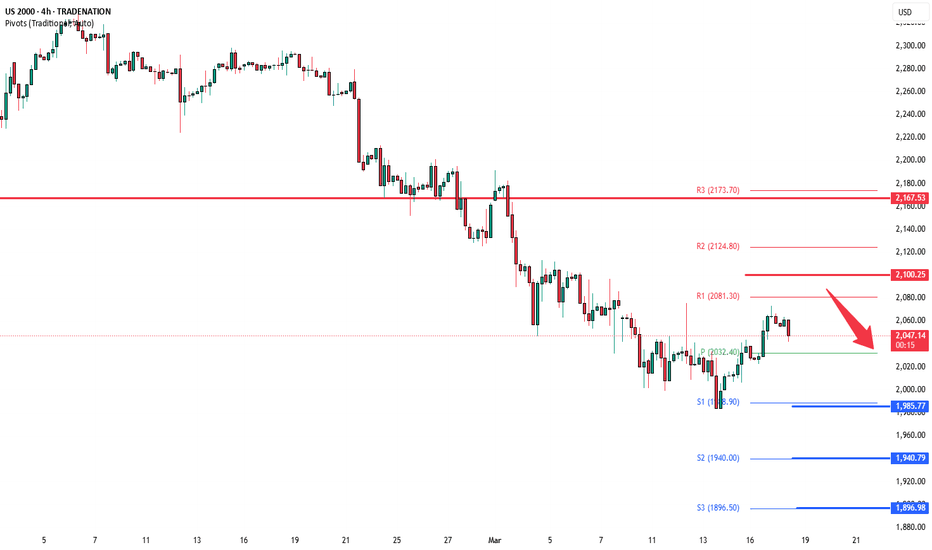

Key Support and Resistance Levels Resistance Level 1: 2081 Resistance Level 2: 2100 Resistance Level 3: 2124 Support Level 1: 1982 Support Level 2: 1940 Support Level 3: 1896 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

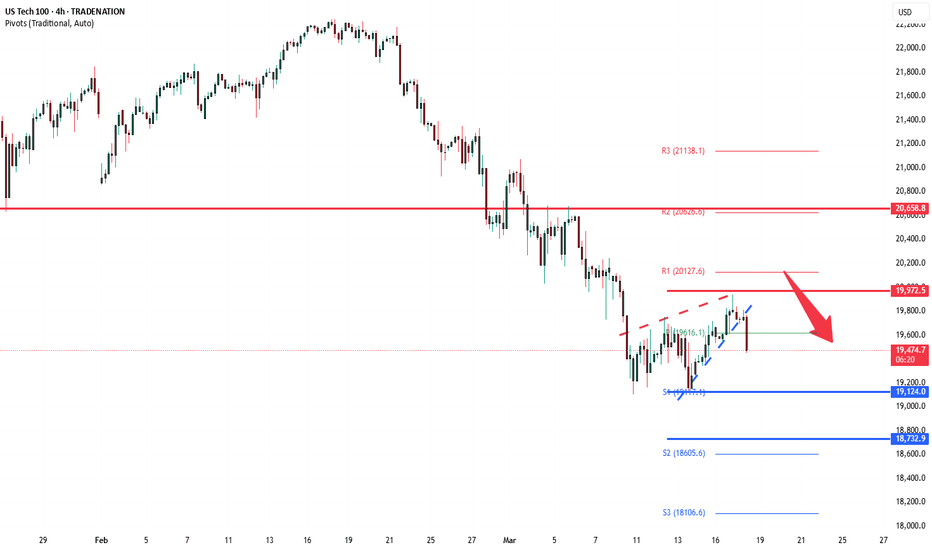

Key Support and Resistance Levels Resistance Level 1: 19972 Resistance Level 2: 20127 Resistance Level 3: 20658 Support Level 1: 19124 Support Level 2: 18732 Support Level 3: 18100 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

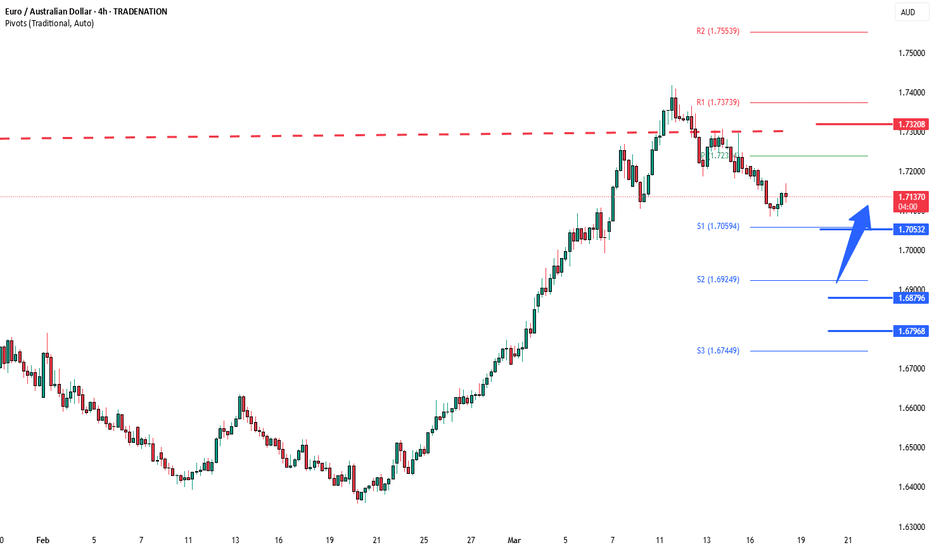

The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes. The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a...

The EUR/CHF currency pair is showing a bullish sentiment, supported by the prevailing long-term uptrend. Recent intraday price action indicates a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone. Key Support and Resistance Levels: Support Zone: The critical support level to watch is 0.9530,...

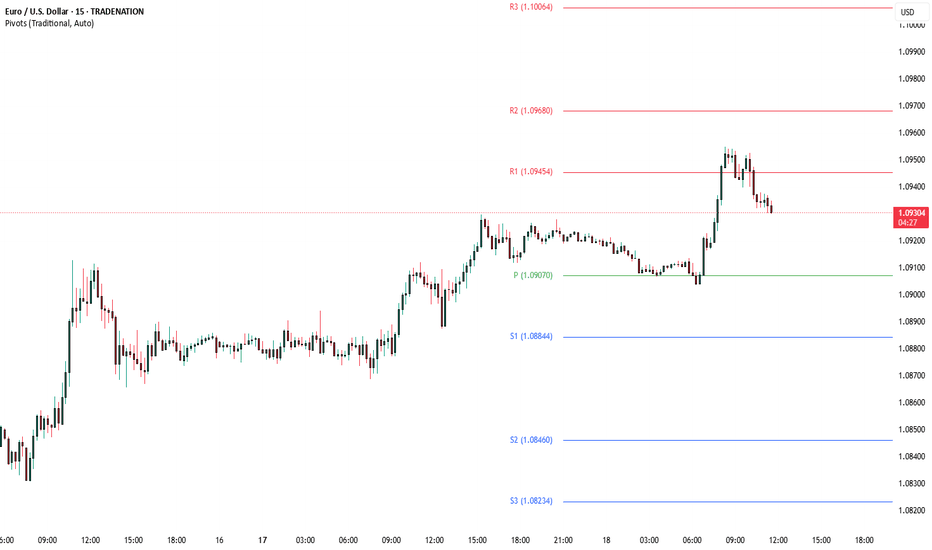

The EUR/USD pair exhibits bullish sentiment, underpinned by an ongoing uptrend. Recent intraday price action indicates a breakout from a sideways consolidation phase, aiming for previous resistance levels. Key Trading Level: 1.0877: This critical level marks the previous consolidation range and acts as a pivotal point for the bullish outlook. Bullish...

The DAX40 index is showing positive momentum this morning, driven by optimism around a debt-financed spending plan targeting defense and infrastructure. The bill is on track for parliamentary approval, with strong backing from both conservative and Social Democrat lawmakers. Meanwhile, the European Union is advancing discussions on seizing frozen Russian assets to...

Tuesday March 18 Data: US February industrial production, capacity utilisation, building permits, housing starts, import and export price index, March New York Fed services business activity, Japan January core machine orders, Tertiary industry index, February trade balance, Germany March Zew survey, Italy January trade balance, Eurozone March Zew survey, January...

Key Trading Level: 94.70 Bearish Scenario: The overall sentiment remains bearish, aligned with the longer-term prevailing downtrend. Recent price action suggests a sideways consolidation, indicating potential continuation of the downtrend. A bearish rejection from 94.70 could reinforce selling pressure, targeting 92.33 as the first support level, with further...

The NZD/USD currency pair shows bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a breakout above a period of sideways consolidation, moving toward the previous resistance level. Key Levels to Watch: Key Support: 0.5730 (previous consolidation range) Immediate Resistance: 0.5806 Higher Resistance Levels: 0.5840,...

The USD/CHF price action exhibits bearish sentiment, supported by the prevailing downtrend. The current intraday swing high at 0.8860 serves as a critical trading level, as the pair shows potential for an oversold rally before facing bearish rejection. Key Levels to Watch: Key Resistance: 0.8860 (current intraday swing high) Immediate Support: 0.8760 Lower...

Key Support and Resistance Levels Resistance Level 1: 5715 Resistance Level 2: 5770 Resistance Level 3: 5920 Support Level 1: 5500 Support Level 2: 5390 Support Level 3: 5255 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

The Gold price action exhibits bullish sentiment, supported by the prevailing uptrend. The recent intraday price action indicates a phase of sideways consolidation near the previous resistance level. Key Levels to Watch: Key Support: 2960 (previous consolidation range) Immediate Resistance: 3000 Higher Resistance Levels: 3034, 3081 Downside Support Levels: 2909,...

Bullish Scenario: The EURGBP pair maintains a bullish intraday sentiment, supported by the longer-term uptrend. The key level to watch is 0.8420, which acts as a critical resistance zone. If the price rallies above 0.8420, the uptrend could resume, targeting 0.8440, with further resistance levels at 0.8460 and 0.8500 over the longer timeframe. Bearish Scenario: A...