Market analysis from Trade Nation

The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes. The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a...

The GBPUSD currency pair price action sentiment appears bullish, supported by the prevailing uptrend. The recent intraday price action appears to be a sideways consolidation towards the previous resistance. The key trading level is at 1.2930 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back...

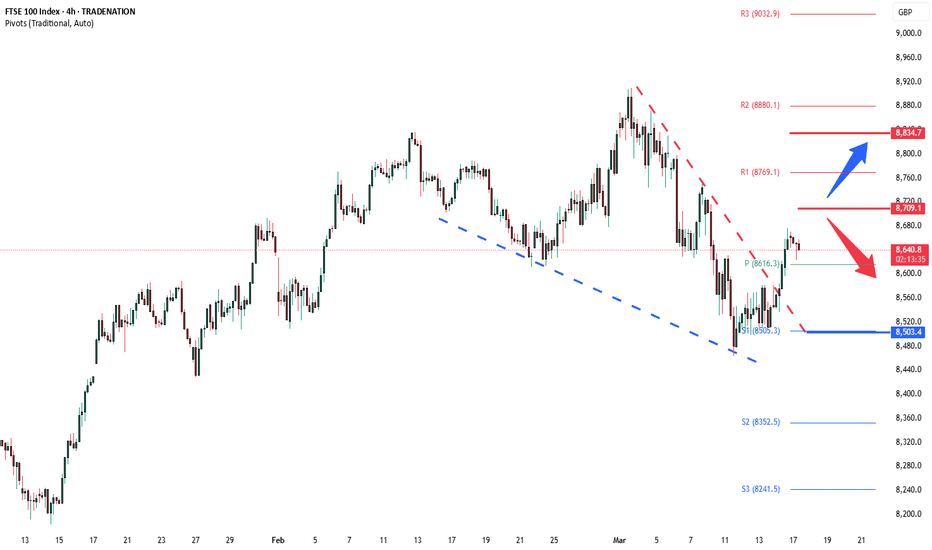

The FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8700, which corresponds to the current intraday swing high. This level is critical as it determines the next directional move of the index. From the current levels, an oversold rally could...

Economic Data due this week: Monday: US retail sales (February), China industrial production and retail sales (January to February). Tuesday: Germany economic sentiment (March). Earnings: XPeng. Wednesday: US interest rate decision, Japan interest rate decision. Thursday: UK unemployment rate (January), UK interest rate decision. Earnings: Nike, FedEx,...

The ADA/USD pair is currently exhibiting a bearish sentiment, sustained by the prevailing downtrend. The critical trading level to monitor is at 8,530, representing the current intraday swing low and the 50-day moving average (DMA) level. In the short term, an oversold rally from present levels, followed by a bearish rejection at the 8,530 resistance, could lead...

Litecoin (LTCUSD) remains in a neutral stance, as price action continues to trade within a longer-term sideways range. The key trading level at 940.00 will play a crucial role in determining the next directional move. Key Levels to Watch Resistance Levels: 1,120, 1,217, 1,320, 1,374 Support Levels: 859.00, 816.00 Bearish Scenario If LTCUSD fails to bounce back...

TRON (TRONUSD) remains in a bullish trend, supported by a longer-term uptrend. However, recent intraday price action suggests a sideways consolidation, with the rising support trendline acting as a key structural level. Key Levels to Watch Resistance Levels: 2,466, 2,614, 2,780 Support Levels: 2,034, 1,925, 1,741 Bullish Scenario A successful bounce from the...

The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,220, which represents the current intraday swing high and the falling resistance trendline level. In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,220 resistance, could lead to a downside...

Recent price action in Bitcoin (BTCUSD) suggests an oversold bounce, with resistance capping gains at the 88,000 level. The continuation of selling pressure could extend the downside move, with key support levels at 76,112, followed by 74,222 and 67,260. Alternatively, a confirmed breakout above 91,900, accompanied by a daily close higher, would invalidate the...

Copper maintains a bullish sentiment, supported by a longer-term uptrend. However, the recent price action suggests a corrective pullback toward a key support zone, which could determine the next major move. Key Levels to Watch Resistance Levels: 9850, 9970, 10086 Support Levels: 9500, 9370 (200 DMA), 9260 Bullish Scenario A successful retest and bounce from the...

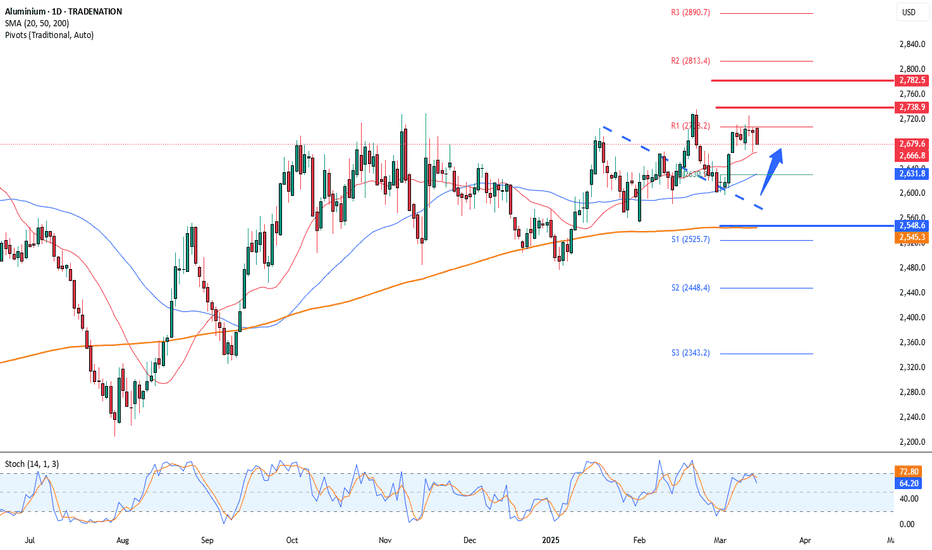

Aluminium maintains a bullish sentiment, supported by a longer-term uptrend. However, recent price action shows sideways consolidation, indicating a potential breakout or corrective move in the near term. Key Levels to Watch Resistance Levels: 2708, 2740, 2780 Support Levels: 2660, 2544 (200 DMA), 2480, 2360 Bullish Scenario A strong breakout above the 2660...

Key Trading Level: 94.70 Bearish Scenario: The overall sentiment remains bearish, aligned with the longer-term prevailing downtrend. Recent price action suggests a sideways consolidation, indicating potential continuation of the downtrend. A bearish rejection from 94.70 could reinforce selling pressure, targeting 92.33 as the first support level, with further...

The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes. The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a...

The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes. The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a...

Silver INTRADAY bullish & overbought, key trading level is at 3300. This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official...

Gold INTRADAY bullish & overbought, key trading level is at 2954 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official...

WTI Crude INTRADAY bearish & oversold capped by resistance at $68,65 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official...

FTSE100 INTRADAY bullish & oversold, the key trading level is at 8520 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official...