Market analysis from Trade Nation

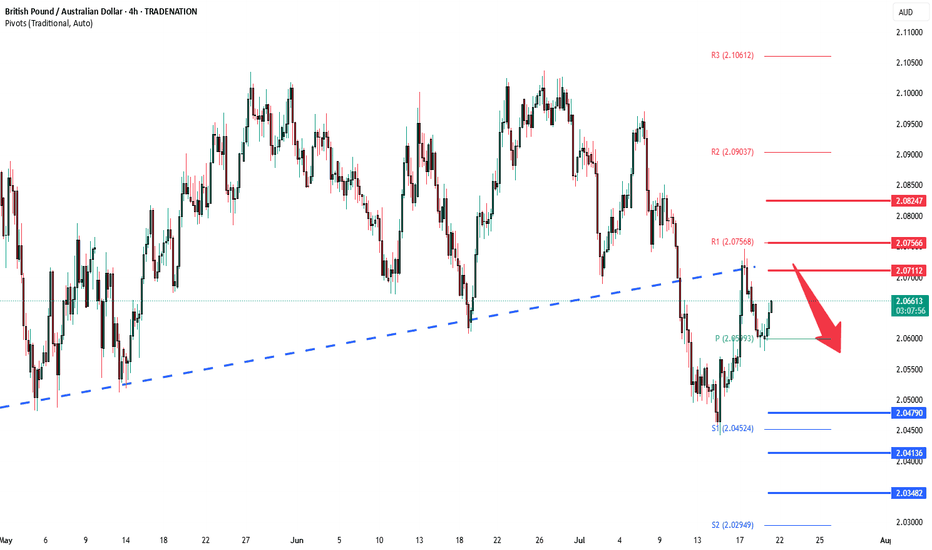

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0660, a prior consolidation zone. This level will be critical in determining the next directional move. A...

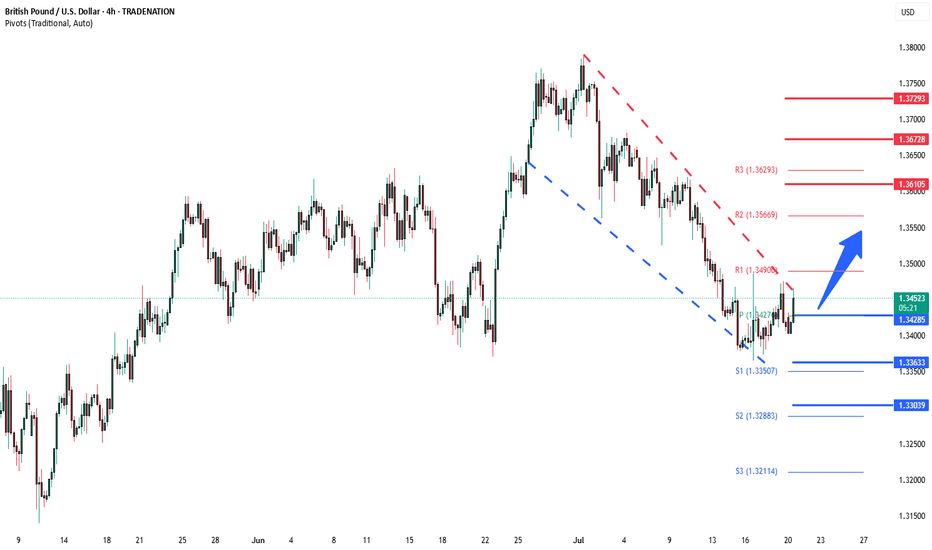

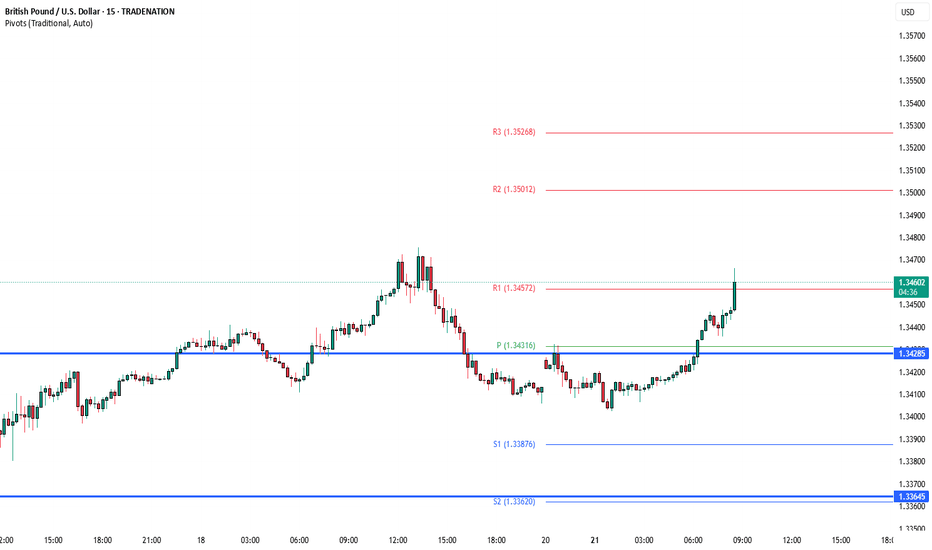

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at: 1.3600 – initial...

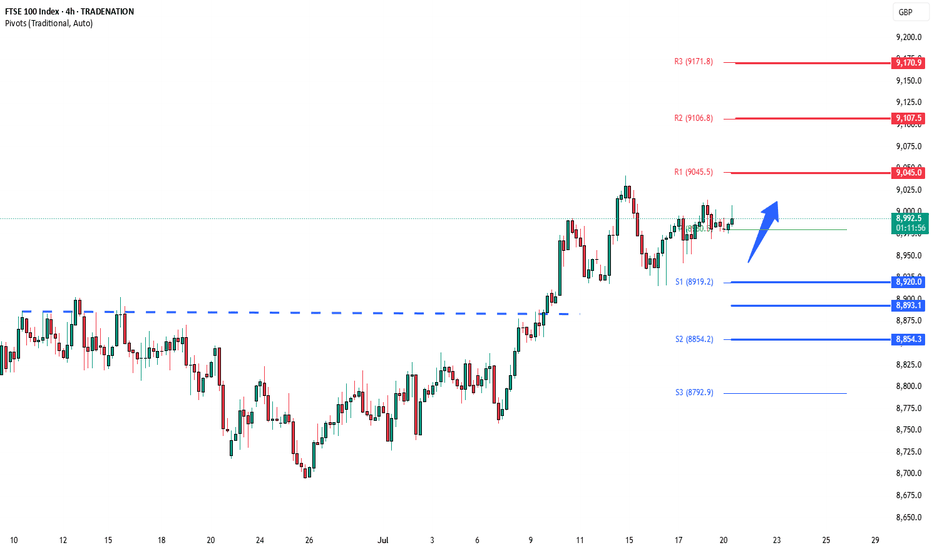

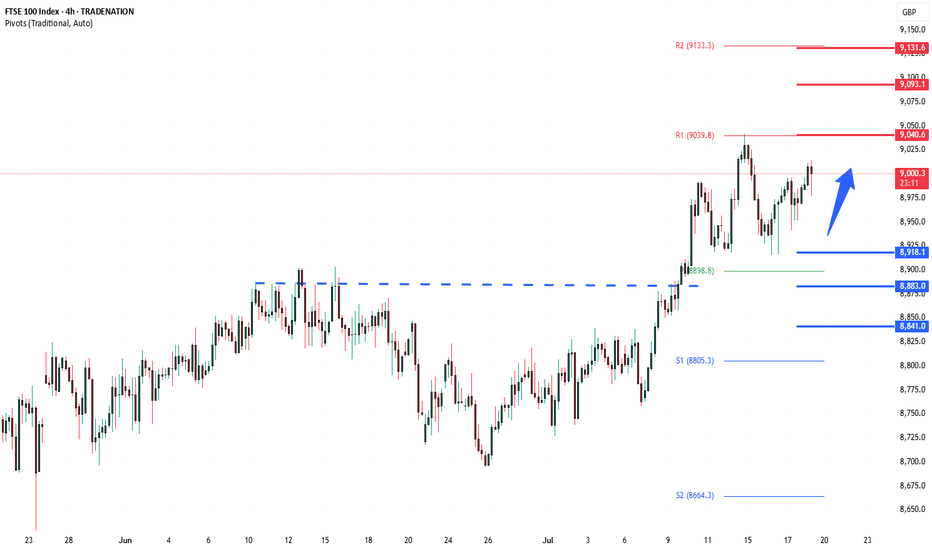

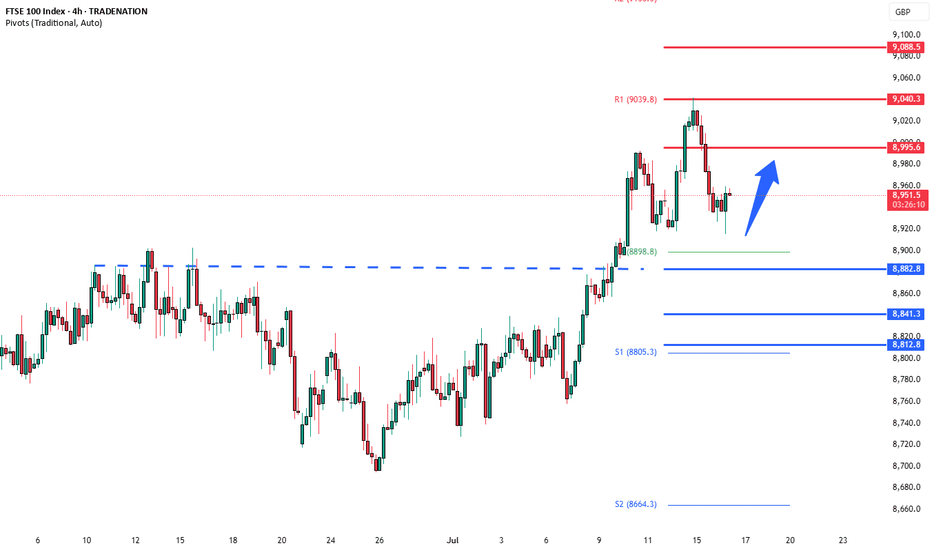

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8020 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8920 would confirm ongoing upside momentum, with potential targets at: 9045 – initial...

Economic Data & Central Bank Updates US Leading Economic Index (June) Fell by 0.1%, pointing to ongoing weakness in manufacturing, jobs, and housing. Markets may view this as a soft growth signal, potentially influencing rate cut expectations. China Loan Prime Rates (LPR) No change: 1-year at 3.0%, 5-year at 3.5%. This steady stance follows slightly better Q2...

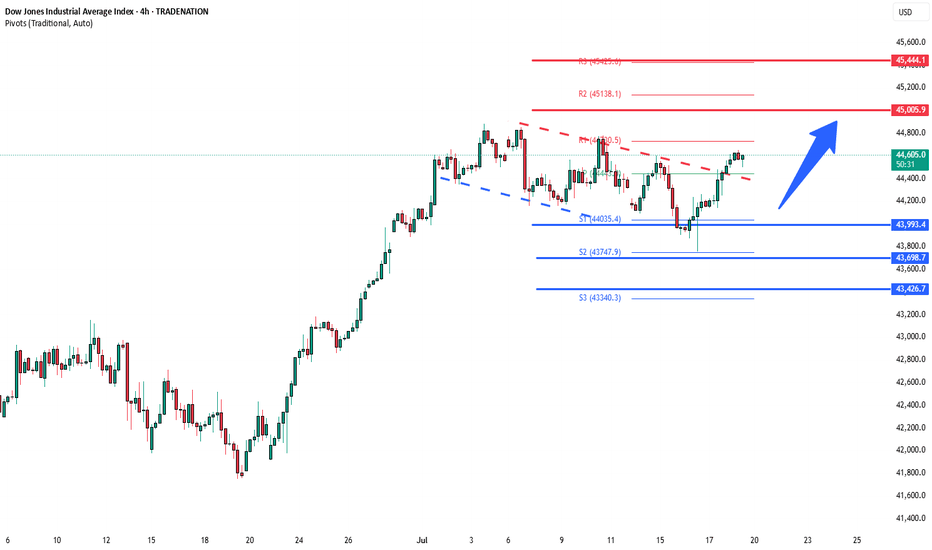

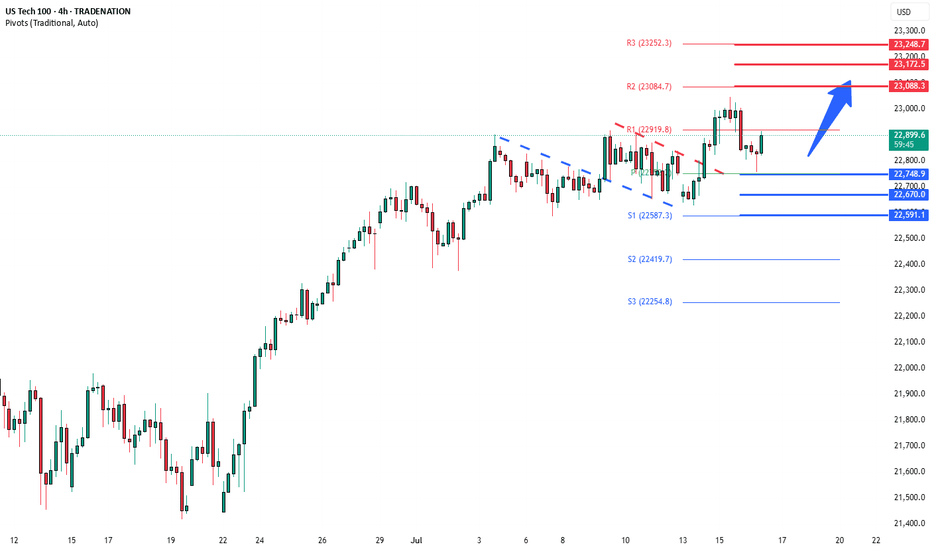

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45440 Resistance Level 3: 46000 Support Level 1: 43990 Support Level 2: 43700 Support Level 3: 43420 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Fed Signals Rate Cut Ahead US Federal Reserve Governor Christopher Waller called for a quarter-point interest rate cut this month, citing cooling inflation and minimal upside price risks. His dovish stance diverges from the broader FOMC consensus, which still views the labor market as resilient. UK-Germany Defense Pact UK PM Keir Starmer signaled potential...

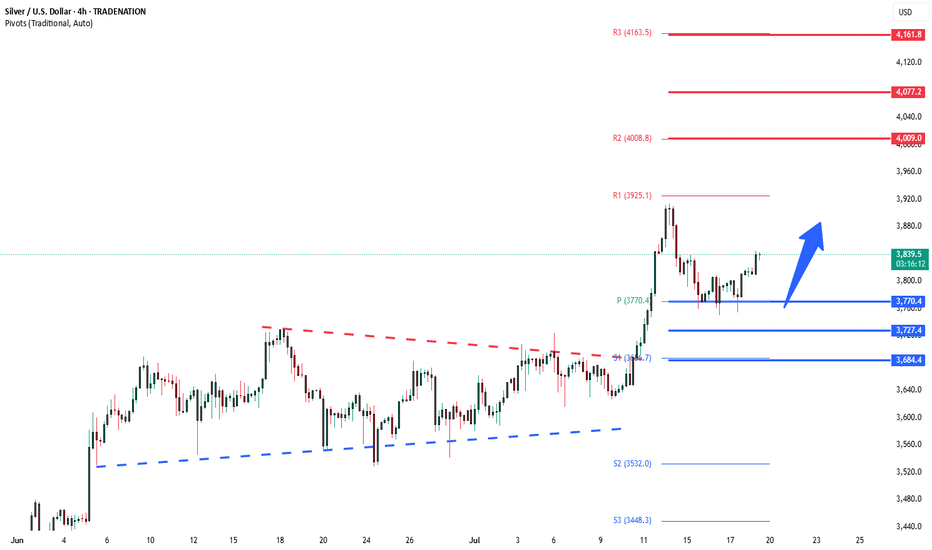

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3770 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3770 would confirm ongoing upside momentum, with potential targets at: 4000 – initial...

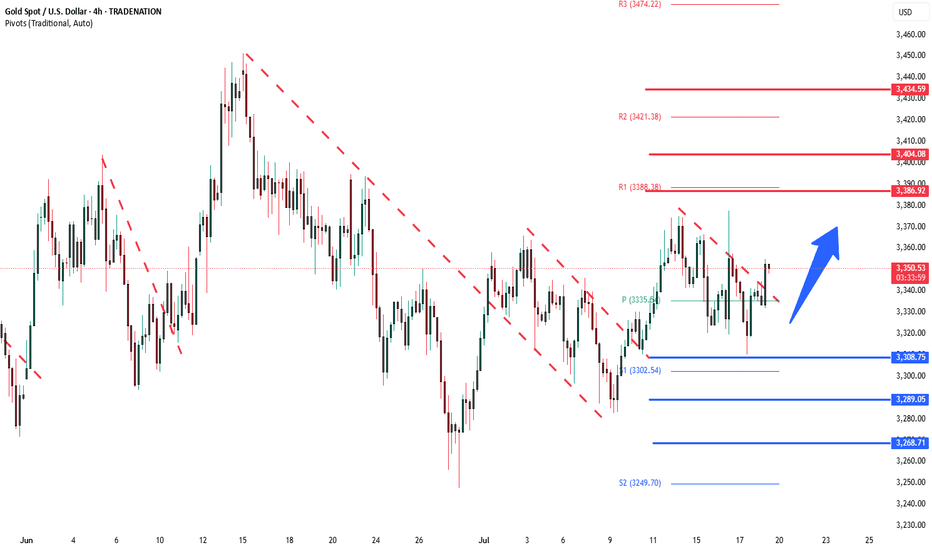

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

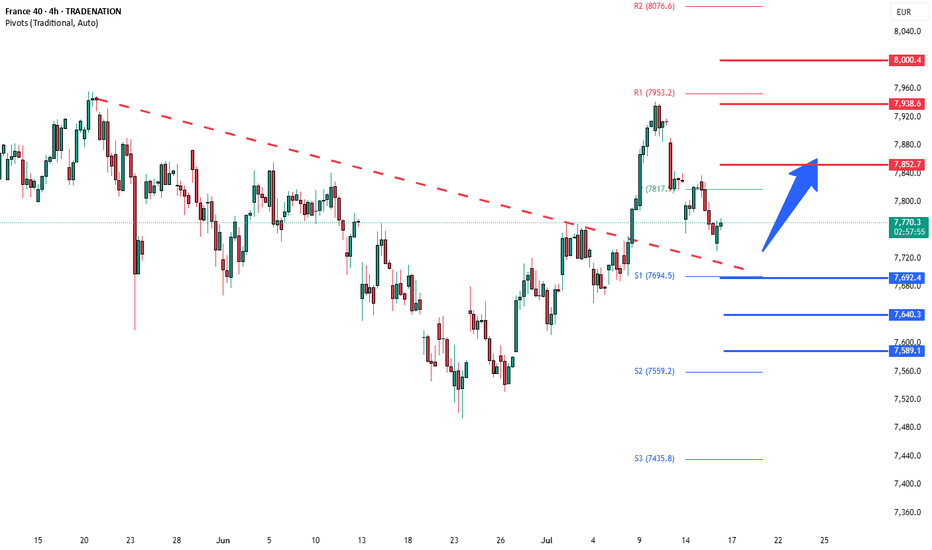

The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout. The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bullish bounce back from the 7770 level could target the upside...

The FTSE100 pair price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a sideways consolidation breakout. The key trading level is at 8920 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back from the 8920 level could target...

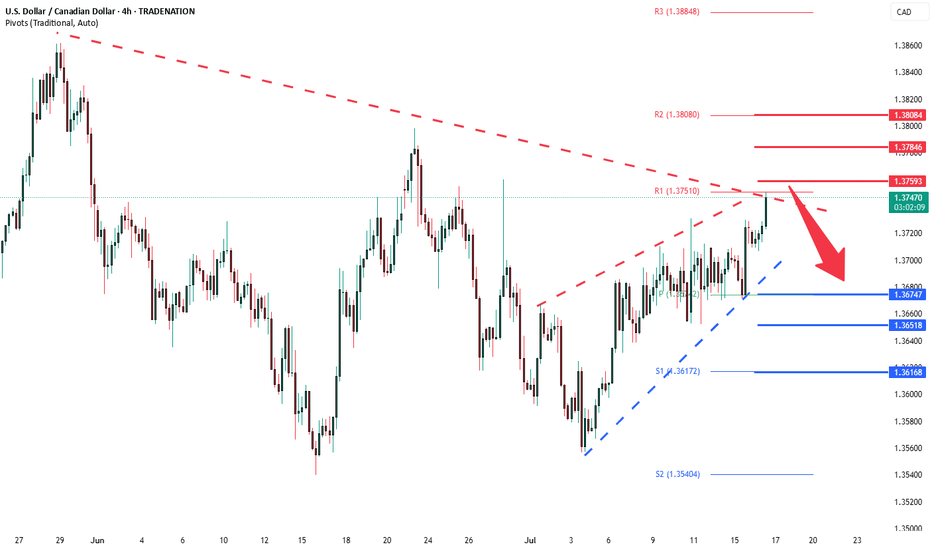

The USDCAD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous resistance zone, suggesting a temporary sideways consolidation within the downtrend. Key resistance is located at 1.3760, a prior consolidation zone. This level will be critical in determining the next directional...

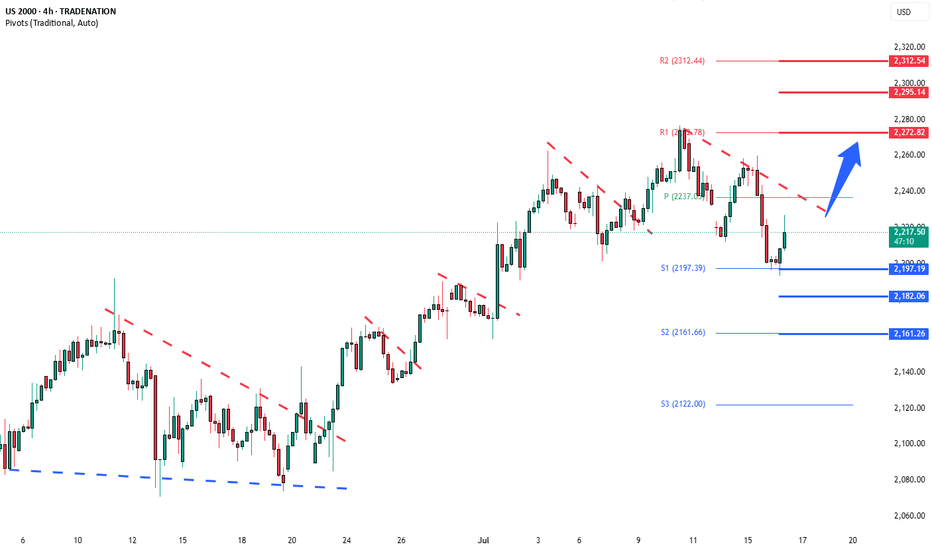

Key Support and Resistance Levels Resistance Level 1: 2270 Resistance Level 2: 2295 Resistance Level 3: 2313 Support Level 1: 2197 Support Level 2: 2180 Support Level 3: 2160 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

Tariff Expansion Threat: Donald Trump signaled upcoming tariffs on pharmaceuticals and semiconductors, two sectors heavily represented in the NASDAQ 100. These measures could: Raise consumer costs. Disrupt tech and healthcare supply chains. Add margin pressure on multinational firms. Corporate Impact: Rio Tinto revealed $300M in losses from US aluminum tariffs on...

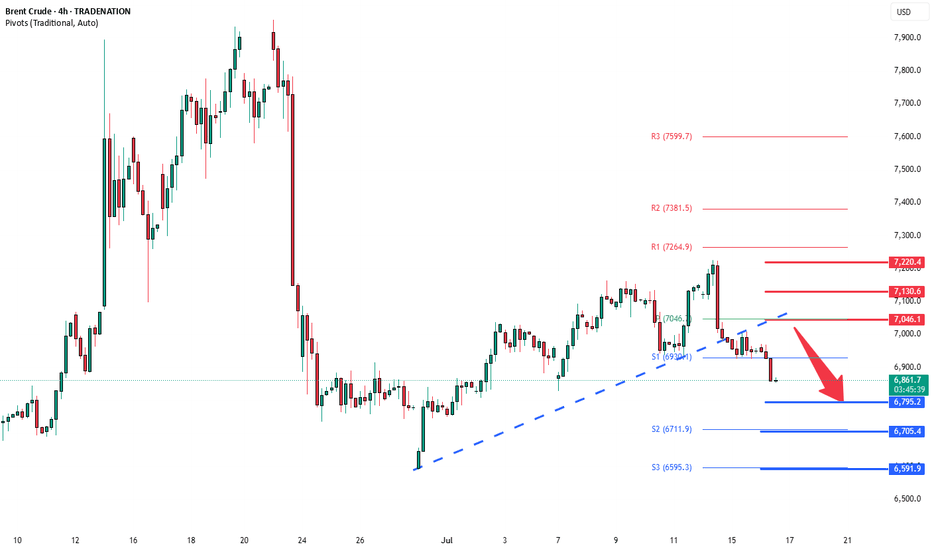

Key Support and Resistance Levels Resistance Level 1: 7050 Resistance Level 2: 7130 Resistance Level 3: 7220 Support Level 1: 6800 Support Level 2: 6700 Support Level 3: 6590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

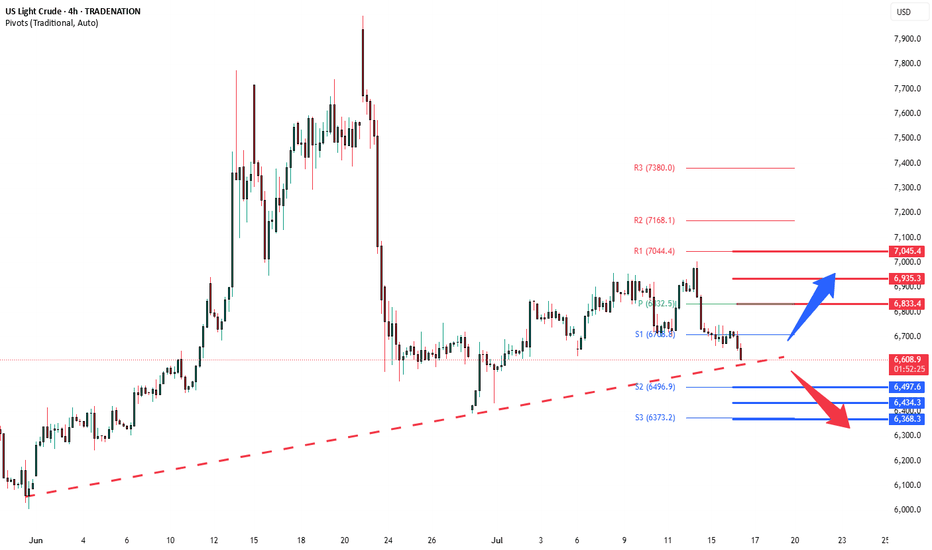

Trade Tensions & Inflation Impact on WTI Crude Tariff Announcement: The US has imposed reciprocal tariffs on 22 nations, including major trade partners such as the EU, Japan, Canada, Mexico, and South Korea, after a failed trade agreement during the 90-day negotiation window. EU Response: The EU is preparing retaliatory tariffs unless a deal is reached before the...

The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 7690 would confirm ongoing upside momentum, with potential targets at: 7850 – initial...

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...

United States June PPI: Not released yet — important for inflation outlook. Industrial Production (June): –0.2% month-on-month (weaker than expected). Capacity Utilisation: Fell to 77.4% from 77.7%. NY Fed Services Business Activity (July): Awaiting release. United Kingdom CPI (June): +3.6% year-on-year — higher than May’s 3.4%. Driven by food and air...