Market analysis from TradeStation

Tobacco stock Altria has fought higher all year despite weakness in the broader market. Now it may be forming a potential continuation pattern. Notice the series of higher lows since February 24, combined with peaks around $53.85. That ascending triangle could suggest the uptrend remains in effect because buyers are active at steadily higher levels. Next, the...

Financials are the second-worst performing sector in the last week, and today we’re considering a difficult chart for mega lender Bank of America. The first pattern on the chart is the $43.50 level. It was a peak last June, then a low in December and January. With BAC stalling there recently, is the price zone becoming resistance again? Next, consider how the...

The U.S. Oil Fund ETF has been ripping since December. But now it may be showing signs of fatigue. The main pattern on today’s chart is the lower high on March 23 versus March 8. That could suggest prices are entering a longer period of consolidation – possibly with an ABC correction resolving below the March 16 low of $67.73. Next is the high-volume spinning...

Most technology stocks remain well off their highs in 2022, but not Juniper Networks. The maker of routers and switches closed at its highest level in almost 11 years last week. The breakout followed some interesting patterns that may anticipate a bigger move. First, notice the three positive news events since early December. First, Jefferies issued an upgrade....

United Airlines has taken off in the last two weeks, but some chart watchers may think it’s reached its highest altitude. The key pattern on today’s chart is the $40-42 area level. UAL jumped above this price zone in November 2020 when the vaccine news emerged, followed by a successful retest in January 2021. The airline held $40 again in December, January and...

Pfizer has bounced in March after two negative months, and now it’s having a quick pullback. The first pattern on today’s chart is the 50-day simple moving average (SMA), which PFE recently crossed above. Other times the pharmaceutical giant moved over (or under) this SMA were followed by continuation higher (or lower). For example, last September, November and...

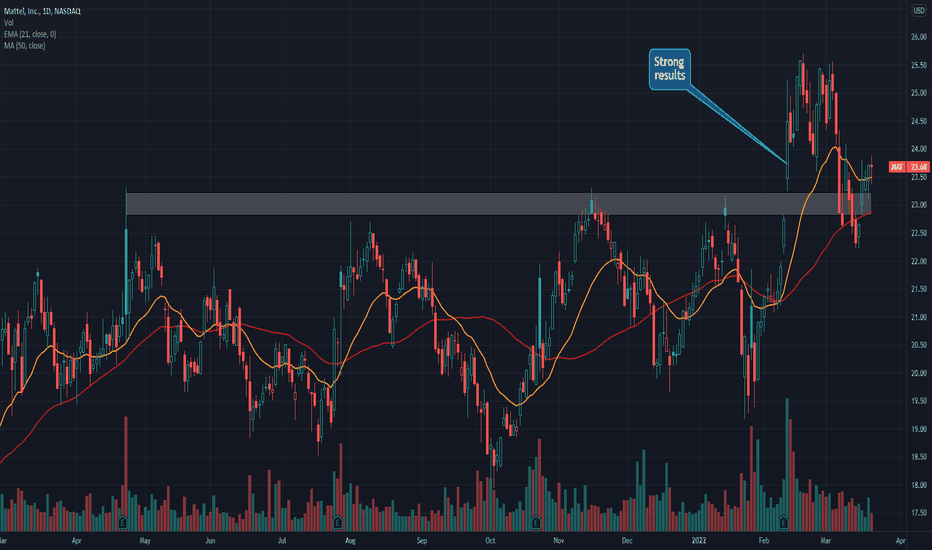

Mattel jumped to multiyear highs last month. Now, after a pullback, some traders may look for the move to continue. The first pattern on today’s chart is the area around $23 where the toymaker peaked several times last year. Notice how strong quarterly results propelled MAT above that zone on February 10. Prices pulled back this month and briefly dipped below $23...

EBay, along with many other e-commerce names, has skidded lower since the middle of last quarter. But now it’s showing signs of a reversal. The main pattern on today’s chart is the falling trendline running along the highs of November and January. Prices are now trying to push through it. Second, notice how EBAY held $50 in February and again this month. Not...

Energy stocks remain the leading sector in 2022. Today we’re considering another pullback in a major name: oil-field servicer Schlumberger. Like Exxon Mobil yesterday, SLB has retreated from a multiyear high to hold its 50-day simple moving average (SMA). SLB also made a slightly higher low this week versus earlier in the month. (Notice the trendline starting...

Exxon Mobil has pulled back following a big surge earlier this year. XOM shot above $90 last week for the first time since early 2017. It then retraced almost all the move and is now trying to hold its 50-day simple moving average (SMA). Its current price level is also near a high from June and July 2019. Can it turn old resistance into new support? Third,...

The S&P 500 has been in a steady downtrend all year. That makes it a good time to assess the state of the index before the big Fed announcement later today. Bearish and bullish forces are battling each other on this chart. First you have the sharply falling trendline that began on January 4. This 2-1/2 month slide dragged the 50-day simple moving average (SMA)...

At times of broad market weakness like the present, it can be interesting to find stocks unscathed by the selling. Dollar Tree appears to be in that camp. The discount retailer has remained above its 100-day simple moving average (SMA) during the entire downturn of 2022. This stands in sharp contrast with the S&P 500, Nasdaq-100 and Dow Jones Industrial Average,...

Walt Disney has been under pressure for the last year. But now it may have formed a bullish reversal pattern. DIS dove toward $129.30 on January 24 during the S&P 500’s initial swoon this year. It retested and held that level on Tuesday, resulting in a potential double-bottom pattern. Next, the pullback represents a retracement of the entire rally that occurred...

Most semiconductors have lagged recently as technology stocks and the broader Nasdaq-100 struggle. That makes the price action in Broadcom especially interesting. Notice how AVGO is holding its 100-day simple moving average (SMA). In contrast, the Philadelphia Semiconductor index is mired below its 200-day SMA. (See below.) Second, Bollinger Band Width has...

Bitcoin has been under pressure since early November, but now the top cryptocurrency may be showing signs of turning higher. The first pattern on this chart is the 50-day simple moving average (SMA) with our Moving Average Speed custom script . This indicator shows the SMA’s rate of change. It helped flag bullish turns in July and October of 2020, plus July and...

General Electric staggered throughout the course of 2021, and now the bulls may be jumping ship. The main pattern on today’s chart is the close under $88. The industrial stock bounced around that level in December, January and February. Has it finally lost relevance as support? Next, consider the lower high last month versus January. That kind of descending...

CME Group could be attempting a breakout as the broader market struggles. Notice how the exchange operator snuck above $231 a month ago, overcoming resistance from early November. Second, CME pulled back and held the level on February 24 (after Russia invaded Ukraine). The 50-day simple moving average (SMA) was also coming up from below. Prices followed by...

Harley-Davidson has struggled for years, but now the motorcycle maker could be getting back in gear. The main pattern on today’s chart is the bullish gap following a strong quarterly report on February 8. Consider how HOG has traded since the move: Not only did buyers quickly defend a retest lower last week. They’ve also kept prices above the 200-day simple...