Market analysis from TradeStation

Housing stocks like Home Depot pulled back hard in May as the real estate market slowed. However, the bears may be throwing in the towel. The main pattern of interest on this chart is support materializing around $310. This was near the low on May 19, the same session that HD bounced at its 50-day simple moving average (SMA). It’s also near a price gap on April...

Apple has been a frustrating stock for most of the year, but now it may be squeezing toward another rally. The first pattern on today’s chart is its super-tight Bollinger bandwidth, which yesterday was the narrowest since December 2019. That could suggest price is overdue for a move. But which way will it go? MACD just turned positive (the second pattern), which...

It hasn’t always been a smooth ride, but Twitter has chopped higher since the fourth quarter. Now it may be poised for continuation to the upside. The bulls started logging on to the social-media stock in February as enhancements like direct-response (DR) advertising and mobile application promotion (MAP) drove engagement. The earnings have been mixed, especially...

The economy is reopening. People are going back to work. It’s great news for a lot of stocks, but Netflix isn’t one of them. Today the streaming-video giant’s 50-day simple moving average (SMA) closed at $513.97, or $0.53 below its 200-day SMA. That “death cross” may signal that longer-term momentum has swung more decisively toward the bearish camp. Another...

Ethereum took a beating along with other cryptos in late May, but now the bears may be losing their influence. This chart shows the 18-day exponential moving average (EMA), along with our custom script Moving Average Speed . The two studies show how ETHUSD can trend higher when it’s above the 18-day EMA. It also struggles once lower prices drag the average...

QQQ vs IWM? In some ways, it’s the big debate of 2021. Will traders stick with megacap growth stocks, or ride fast-moving small caps as the economy reopens? Or will they simply rotate between the two, guided by events and price action? Right now could be a time when a flip is taking effect again. This chart shows relative strength of the Russell 2000 Small Cap...

Yesterday was an interesting session for Snowflake, which reported decent quarterly results on Wednesday night. The data-mining disruptor initially fell on the news as analysts fretted over its high valuations. But then buyers came out of the woodwork and plowed prices to their highest close in almost three months. The result was a large bullish outside candle and...

After months of weakness, Tesla may be charged for another move to the upside. Some interesting patterns have recently appeared on the electric-car maker’s chart. First is the false breakdown below $550 on May 19. This was followed by a rebound back above the 200-day simple moving average (SMA). Interestingly, it was TSLA’s first test of the 200-day SMA since...

Wireless-tower stocks have been in long-term uptrends as mobile devices and usage proliferate. American Tower is the largest of the three, followed by Crown Castle International and SBA Communications . AMT has moved sideways for the last year. It hit an all-time high shortly before the coronavirus crash, quickly rebounded and then drifted sideways. Prices...

The first quarter’s dramatic surge in bond yields had a big impact on the market, shifting money from growth stocks to value plays. However there are growing signs of this trend reversing. The chart of 10-year Treasury yields shows how a channel has formed since late March. If it continues in its current trajectory, yields could go back toward 1.40%. Overall...

After two months of downside, Boeing may be ready to take off. Notice the downward-sloping trendline in the aerospace giant. BA ended last week above it and is continuing higher today. Second, the 8-day exponential moving average (EMA) is on the verge of crossing above the 21-day EMA. This is common signal for intermediate-term momentum turning more bullish....

Most high-profile tech IPOs from the past year have struggled – but not Roblox. The maker of virtual-reality software ended last week at a new all-time high. Its chart also pulled off some interesting feats. First, it broke the descending trendline running along the highs of April 13 and May 19. Second, it had a powerful “kicker” pattern on May 11 after its...

Square is one of the hardest-charging growth stocks in recent years. Like many growth names, the fintech has paused since vaccine news triggered a shift toward value stocks in November. But now the risk / reward may be swinging back toward the bulls. First consider the area around $200 where SQ is trying to bounce. It was also a low in late January, early March...

Chip stocks have lagged along with the broader technology sector. But just when you think they’re dead, they have a session like yesterday. Notice how the Philadelphia Semiconductor Index opened 2.2 percent below its close the previous session. Also notice how quickly it bounced and ended the session up a full 2 percent. The low was lower than Tuesday’s and the...

The U.S. Dollar has been stabilizing all year, but now the bears may be returning to their old hunting ground. Several features have appeared on the greenback’s chart, and none of them are bullish. First, consider the rising trendline running from the low of January 6 through April 29. Notice how DXY broke under it on May 7 and then failed to return above it the...

Silver began a monster rally about a year ago. Now the technicals could be lining up similarly. First, consider how XAGUSD dumped after hitting resistance at its 50-day simple moving average (SMA) in late March. Prices quickly stabilized and then entered a period of sideways consolidation. They soon pushed above the 50-day SMA and started moving higher again....

3D Systems was a popular trading vehicle 7-10 years ago. It then slipped into a long decline -- before jolting back to life in January. Now it’s pulled back and consolidated after that dramatic surge. A few chart patterns in particular stand out. First, DDD is bouncing near its 200-day simple moving average (SMA). That’s a potential sign of the longer-term...

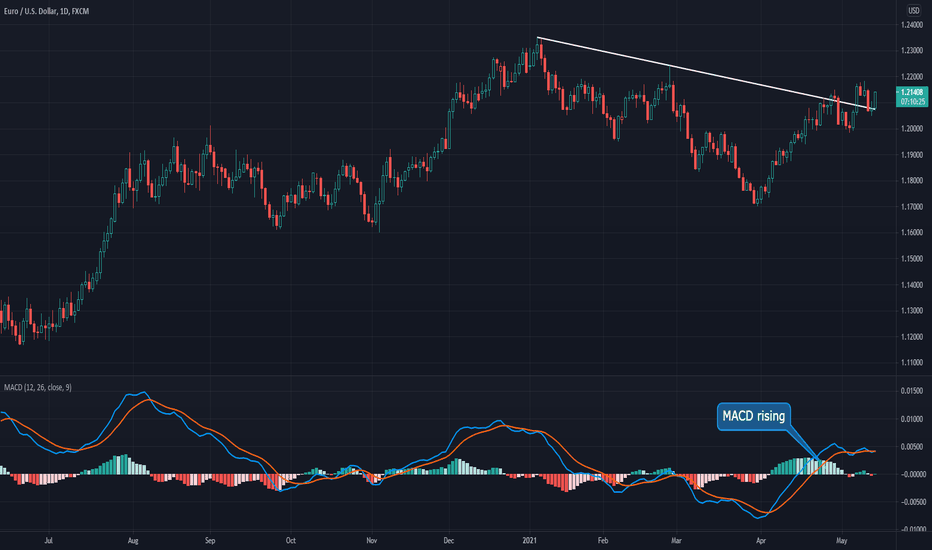

The euro has paused this year after a big surge in 2020, but now it may be getting ready for another move. Notice the downward-sloping trendline along EURUSD’s highs in early January and late February. The currency pair broke above that resistance last week and is now trying to turn it into support. MACD has also been trending higher for the past month. ...