Market analysis from TradeStation

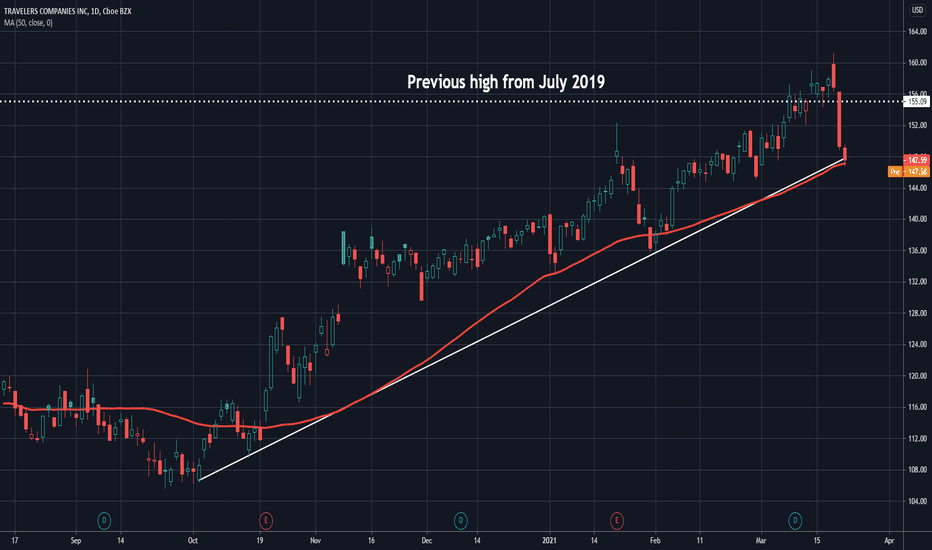

Travelers doesn’t get much attention, but maybe it should. The insurance stock trended steadily upward since October. It made a new all-time high above $160 last week when Chubb bid for Hartford. TRV quickly pulled back, creating a potential opportunity for buyers. Notice the trend line running along the lows of late October and early February. Price held that...

The Nasdaq is trying to stabilize, which could draw buyers back to semiconductors. Chip stocks like NXP Semiconductors, Broadcom and Lam Research were some of the biggest gainers in the Nasdaq-100 last week. That helped push NDX ahead of the S&P 500 for the first time in five weeks. The relative strength also came amid two positive weeks for the Philadelphia...

Visa broke out to new highs last week. Now it’s pulling back and trying to make a higher low. The first bullish signal was on February 24, when the 21-day exponential moving average (EMA) rose above the 50-day simple moving average (SMA). That’s a sign of intermediate momentum turning more bullish. Next, consider the $220 level. It was resistance at the end of...

It’s been a big week for electric vehicles and traditional automakers. Yet, Tesla has drifted aimlessly – a potential sign of momentum fading in Elon Musk’s company. First, consider the trend line that began in May. After successful bounces along that support in June and November, price has moved below it this month. Next, the current level is right around the...

Bitcoin’s been on a monster run since the fall, but the recent price action may be showing signs of fatigue. First, notice how BTC made a new high of $61,785 on March 13, combined with a lower high on MACD. This is a potential case of bearish divergence. In isolation, bearish divergence isn’t all that meaningful because uptrends often battle falling MACD. But it...

Facebook has gone nowhere since August, but now the social-media giant could be squeezing toward a breakout. The first interesting chart pattern is the descending trendline running along the November and January peaks. Prices are now challenging that line. Second, notice how the 50-day simple moving average (SMA) tried to serve as resistance in late February and...

Nike has taken a long pause, but now the sneaker giant may be trying to break out with earnings due Thursday afternoon. NKE beat estimates on December 21, eliciting a wave of bullish analyst notes. However the stock rallied before the report, and proceeded to ease lower for the next 2-1/2 months. The result has been a price channel with a slight downward slope....

Amazon.com has been dead in the water since Labor Day. Now potential signs of a downtrend may be taking shape. The first thing jumping off the chart are the series of higher lows and lower highs beginning in September. This produced a long triangle pattern that AMZN broke to the downside late last month. That decline entrenched prices below the 200-day simple...

Most of the Nasdaq took a beating lately, but not Alphabet. The parent of Google and YouTube has been standing tall since its bullish quarterly numbers on February 2. The report planted the stock above $2,000, and it’s held that bullish price gap since. Apple, Amazon, Microsoft, Facebook, Tesla, Nvidia have all slipped to their 50-day simple moving averages...

Apple rallied in December after holding $120. Now it’s back and threatening to break support at that level. The price action is part of the ongoing technical weakness in the smart-phone giant. It had a false breakout in January and a trend-line failure last month. Today we got a clue why: AAPL has cut production of its iPhone 12 mini, according to Nikkei . Once...

Recent weeks have seen breakouts in smaller social-media stocks like Twitter and Snap , which have both pulled back. Today we’re looking at TWTR. Jack Dorsey’s microblogging service didn’t only beat earnings and revenue estimates on February 9. It also showed significant traction in its direct response (DR) advertising. That sent the shares flying to new highs...

Attention is shifting toward industrials as technology and the Nasdaq struggle. Two companies in the space have potentially bullish patterns: Illinois Tool Works and Stanley Black & Decker . ITW is the larger company with a market cap of about $68 billion. It broke out to new all-time highs in August and consolidated for the next seven months. Now the bulls may...

Several bullish patterns have appeared on the Ethereum chart lately. The first one that grabs our attention today is the bullish cross on MACD. Previous times this happened, like early February and mid-December, were followed by new highs. Second, notice how ETHUSD pulled back to hold its previous breakout level around $1,420. Old resistance from January 2018...

The run-up in U.S. bond yields has squeezed the dollar higher and dragged global stocks lower. This could be creating an opportunity in Chinese stocks. The iShares Trust China Large-Cap ETF hit a 13-year high of $54.53 on February 17, followed by a sharp pullback in the last two weeks. A few interesting things appear on the chart. First, FXI has returned to an...

On bearish days like we’ve had lately, it can be useful to look for stocks lurking near highs because they often break out when calm returns. DraftKings seems to fit that bill. First, consider how the sports-betting stock formed a large bullish ascending triangle between early October and late February. Notice how it began the current month with a breakout...

Industrials have outperformed this year as investors look for the economy to rebound. Ingersoll Rand is a member of that group with some interesting chart patterns. First, notice how IR surged to a new all-time high last week. It’s now pulled back to hold its earlier peak around $47.50 and form tight pennant. Traders may watch the 8-day exponential moving average...

Software companies have lagged this year as investors focus on cyclicals like energy and financials. But one unexpected name is breaking out: Oracle. As covered previously, strong earnings lifted ORCL to new highs in December. It then pulled back to old resistance and bounced. This week, its shares are closing above their previous all-time highs. Two technical...

Nvidia has gone nowhere since the summer, but now the chart may be lining up for another push to the upside. The first pattern is the series of higher lows beginning in early January, plus a new all-time high in February. Next, the most recent low of around $528 is almost exactly the middle of its four-month range. After consolidation on either side of that...