Market analysis from TradeStation

Pet supplier Chewy has been cooped up like a border collie in a kennel, but some technical patterns suggest it may run again soon. CHWY doubled in value since mid-September, rallying out of a bullish ascending triangle. Its animal spirits took a nap around the “nice round number” of $100 in mid-December, and the stock has consolidated there since. Bollinger...

Bitcoin broke out to new highs in December, and now Ethereum is trying to follow suit. ETHUSD flirted with new highs above $1,420 as early as January 19 but wasn’t able to close there. It probed again several times without success before ripping to another new high today. This time might be different because prices have formed a bullish ascending triangle....

Attention has recently focused on short squeezes and Big Tech earnings, but Energy remains the top-performing sector in 2021. We started the year highlighting the golden cross in the SPDR Energy ETF, which proceeded to jump to a seven-month high. Prices have pulled back since and are now trying to hold their 50-day simple moving average (SMA). The next feature...

Facebook tried to rally on strong earnings yesterday, and the bears were having none of it. The social-media giant spiked to an eight-week high early, only to close at its lowest price in over a week. In other words, it had a large bearish outside candle on heavy volume. This chart also illustrates the downward trendline on FB, which has successfully held the...

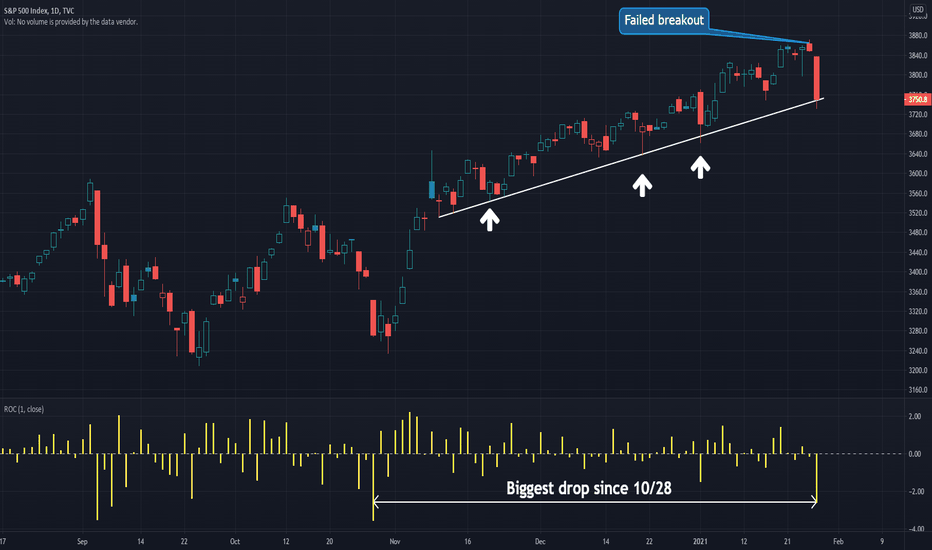

Yesterday could have been a significant day for the S&P 500. Let’s consider a few points. First, the index fell 2.6 percent, its biggest drop since October 28’s 3.5 percent selloff. It’s also now slightly negative on a year-to-date basis. Second, SPX made a new all-time high before 9:35 a.m. ET on Tuesday but ended lower. Followed by Wednesday’s slide to a...

Bitcoin has bled lower for the last three weeks, but some interesting things appeared on the chart today. First, BTCUSD made a brief stab under $30,000 before recovering. That’s not just a psychologically important “round number.” It also matches the consolidation zone at the end of 2020 and the start of this year. That was a key breakout line at the time and...

Financials were one of the best performing sectors after the Pfizer vaccine news on November 9. They’ve pulled back in the last two weeks, creating a potential opportunity in one of the biggest and most liquid names: Bank of America. BAC is trying to hold $30. Aside from its “round number” status, this level is potentially important for a few reasons. First, it...

Oracle has been one of the quieter names in tech recently, but the chart is showing signs of a potential rally. The software giant hit new highs in December following a strong quarterly report. Importantly, its newer cloud business surprised to the upside. ORCL then pulled back and has retraced the entire move. Friday and Monday, it held the same $60 level...

Housing stocks have chopped in a very tight range since October, but now they’re trying to break out. This weekly chart highlights the ascending triangle on the Philadelphia Housing Sector Index. Notice how HGX made consistently higher lows while staying under 405 – that is, until last Wednesday, January 20. Interestingly, the news that day was bearish: NAHB’s...

The U.S. dollar index has been in a steady downtrend since May. It paused after breaking a short-term trend line on January 8, but the bearish pressure continues. The main thing we wanted to highlight today is the overbought condition on stochastics. Each time it’s reached this high since March, lower prices have followed. It’s also noteworthy that the recent...

Private-equity giant Blackstone Group has squeezed into a tight range for the last month, but now it may be attempting a breakout. This chart shows the descending trend line on BX that began on December 23. BX closed above it yesterday for the first time, which could potentially draw interest. Next, the stock tried to sell off early this year. It bottomed around...

Recent months have seen a shift toward cyclical stocks like International Paper, which has some potentially bullish chart patterns. First, IP spiked to $53.39 on January 6. That was the highest level since September 2018. Such a new high can indicate a stock is under accumulation – especially when it occurs so early in a calendar year. Second, the materials...

The recent price action in Bitcoin seems to highlight the importance of two simple moving averages (SMAs): the 50-hour (SMA) and the 100-hour SMA. This chart highlights some important turns along both in the last five weeks. First, notice how the entire rally started after prices pushed above the 100-hour SMA on December 12. Next, BTCUSD held both lines after...

Ethereum’s recent price action might look like normal consolidation. But it’s actually holding some important levels from almost three years ago. First, ETHUSD slammed all the way down to $911 late Monday morning. That was close to the lows on January 22 and 23 of 2018. It was near the high on February 10, 2018. Interestingly, ETHUSD consolidated under the same...

It’s not hard to be bullish on Apple given the potential for an iPhone upgrade cycle. But now the unthinkable may be occurring on the tech giant’s chart: a bearish double-top reversal pattern. Notice how AAPL tried to push above its previous high in the early minutes of December 29, only to get rejected. That session and the next three were all the same, with...

United Airlines has gone almost nowhere for two months. But now the chart may be lining up for a rally as earnings approach. UAL exploded higher on November 9 when Pfizer’s vaccine news hit. It continued upward the following month before retreating in late December. Since then, the airline has stabilized between $42 and $44. It’s also holding support at its...

The volatility index has been falling all year, and now may be preparing for a push below the key 20 level. This chart highlights the descending triangle on VIX. It began when the market slumped in late October, with another spike on December 21. There were additional lower highs on January 4 and 12. VIX has also dropped in six of the last seven sessions and has...

The reopening trade remains in full swing as buyers target cyclical companies with low valuations. Valero Energy could be a name to watch. The oil-refinery stock has a few interesting chart patterns. First is the downward-sloping trend line in place since early 2020. VLO broke it in November and has remained above it since. Meanwhile, its 50-day simple moving...