Market analysis from CMC Markets

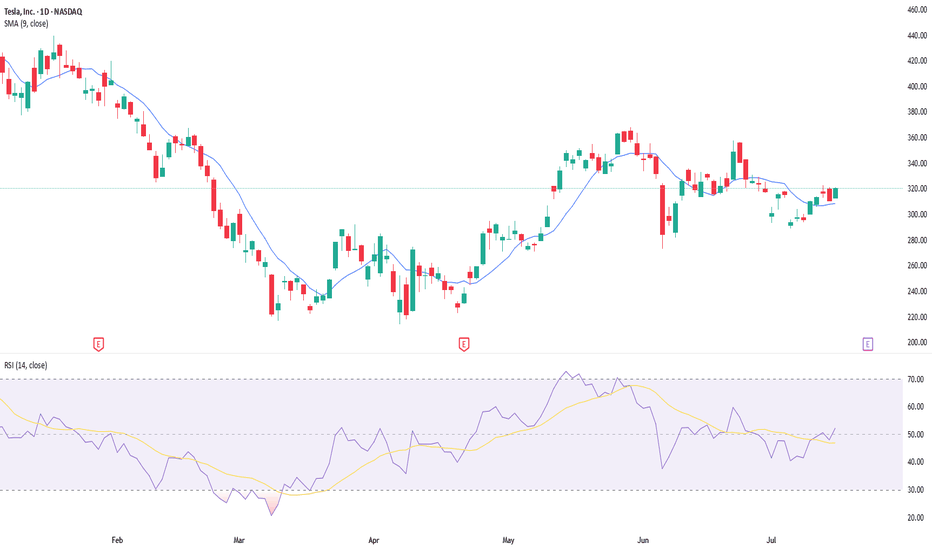

Tesla is scheduled to report its second-quarter results on Wednesday 23 July, after the New York close of trading. The company is forecast to report revenue of $22.8bn, representing a 10.5% year-on-year decline, with earnings expected to decrease 19% to $0.34 per share. Gross profit margins are also anticipated to contract by 2.3 percentage points to 16.4%, down...

Netflix (NASDAQ: NFLX) will announce its results after the close of trading in New York on Thursday, 17 July. Analysts forecast the NASDAQ-listed streaming media company to report second-quarter earnings growth of 45%, reaching $7.08 per share, while revenue is expected to increase by 15.6%, amounting to $11.1 billion. Net subscriber additions are predicted to...

Gold is showing signs of breaking down as the US dollar recovers from a steep decline. Gold and the dollar typically have an inverse relationship over the longer term. The precious metal has been trading sideways since April, but more importantly, it has been trending lower since mid-June. Gold is now approaching a critical juncture, testing an uptrend established...

The shares of META, the NASDAQ-listed owner of Facebook, recently reached overbought levels as the stock price rose above its upper Bollinger Band and its Relative Strength Index climbed above 70. This suggests that META is likely to enter a period of sideways consolidation or perhaps experience a sharp decline. However, traders should also pay close attention to...

Depending on one’s timeframe, gold has either stalled or is gradually grinding higher. This is because gold has been moving sideways since mid-April but has been trending upward within a technical trading channel since mid-May. It has been a frustrating period for gold traders, with numerous false starts moving higher and lower. However, long-term holders...

All the conditions for a reversal in the NASDAQ 100 appear to be in place, but just because these conditions are present doesn’t mean a reversal must occur. The most obvious condition is the presence of a rising wedge, which formed over the past month and broke on Friday. Whether this pattern entirely unfolds remains to be seen, but there is supporting evidence...

Gold prices have stalled once again and have struggled to make any significant advances since mid-April, remaining stuck in a range between $3,150 and $3,450. This trading range has resulted in sideways price action, with several false starts along the way. However, technical analysis suggests that this range is likely to remain in place. After breaking above a...

It looked as though the Nasdaq 100 might break out last week, following a double boost from Nvidia’s surge after its results and news that a federal court had blocked US President Donald Trump’s tariffs. However, those hopes quickly faded, and the Nasdaq promptly reversed course. Now the index finds itself in a precarious position, as it appears to be preparing...

The EURUSD is beginning to show signs of a reversal as momentum shifts and moves above its 10-day exponential moving average. The EURUSD has recently experienced a significant move since early February, rising to a high of 1.147, which resulted in it becoming overbought, touching its upper Bollinger band, and pushing the RSI above 70. Now, after a brief pullback,...

Gold is breaking down and may now have formed a double top pattern. The precious metal fell below the neckline of the double top at 3,230, which implies that gold prices have further to fall. A projection of that double top suggests that gold could fall to around $3,000. There is more at play here, suggesting that something deeper could be unfolding for gold....

The US trade war continues to generate volatility and uncertainty across asset classes. Following trade talks over the weekend between the US and China, US Treasury rates have risen, and the dollar has strengthened against its peers. This movement has pushed EUR/USD back down to around $1.11, with support near $1.109. Additionally, the pair has fallen below the...

The US dollar has weakened recently against other major currencies including the euro, pound and yen. While it may not have grabbed the headlines, there’s another currency we can add to that list: the Canadian dollar. The Canadian dollar – which was trading at around C$1.45 per US dollar at the end of January – may continue to strengthen against its southerly...

The Nasdaq 100 has staged an impressive rally over the past two weeks, climbing more than 12% since Monday 21 April to close at roughly 19,970 on Monday 5 May. However, if there were a point at which the advance might pause, it could be near current levels. The index has risen to a key area of technical resistance in the 19,900 to 20,200 range, which could prove...

Natural gas prices have fallen by nearly 30% since early March and now appear to have reached oversold conditions, suggesting a potential bounce of more than 10% back to $3.75 per million British thermal units. Natural gas has risen above its 10-day exponential moving average (EMA), indicating a possible short-term trend change. The 10-day EMA, which previously...

Gold prices have pulled back from the high reached on 22 April and, more importantly, are nearing a break from the recent period of consolidation. Gold is forming a descending triangle, which could provide clues about the direction prices will take. Typically, a descending triangle is considered a bearish continuation pattern. In this instance, gold has been...

Gold appears to be showing signs of finally cracking after an impressive run higher, with the excitement surrounding its rally potentially approaching a crescendo. The precious metal experienced a sharp intraday reversal on 22 April, a decline that continued into 23 April. Since the recent uptrend began in mid-March, gold has consistently found support at its...

USD/CAD has strengthened significantly over the past few days as markets have been shaken by President Trump’s new trade war with Canada and the rest of the world. That said, USD/CAD may be due for a pause in its recent rally and could consolidate somewhat, having reached some key technical indicators and support levels. The loonie’s relative strength index fell...

The Nasdaq 100 has continued declining, attempting to find some support after breaking below the August 2024 lows on 4 April. The next obvious support levels lie around the late 2021 and 2022 highs, which, for now at least, are offering some stability. It would not be surprising to see the index test that region during the trading session. However, a break below...