Market analysis from easyMarkets

Quick analysis on bitcoin, the main area of interest i will be monitoring are 110,500, 115k, 120K. Keeping in mind that we still have important economic data tomorrow (US Employment Data). Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's...

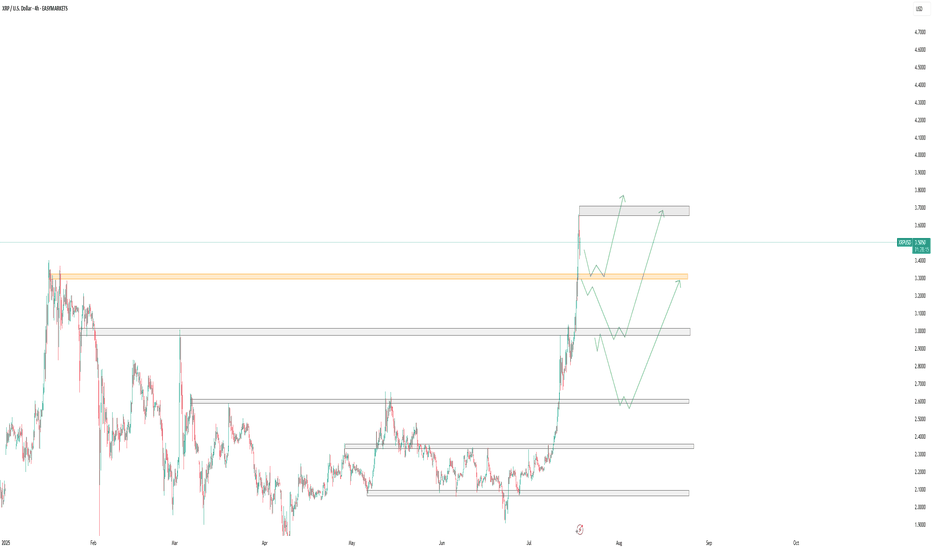

Price action on XRP has shown upward momentum after reaching the 3.7 price level. Possible scenarios include: * The 3.3 level could come into focus if the market revisits this area. Market participants may monitor it for signs of seller exhaustion or potential reversal patterns. * Should the price move lower, the 3.0 level may act as the next key area of...

In this video we are discussing the main fundamental reason behind Nasdaq bullish momentum. In addition to area if interest with possible scenarios. Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders,...

Breaking down Usd/Cad key levels and areas of interest, in addition to the possible scenarios that could take place. Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access...

Since the start of 2025, the US Dollar index DXY has faced a downside pressure driven by several key factors: * Ongoing uncertainty around the US President trade tensions with major economies. * Global Central banks reducing dollar exposure and reallocation toward other currencies and Gold. * Growing market expectations for Fed rate cuts starting Sept-25. *...

Bitcoin price in the weekend retested around 98,500$, this drop was mainly supported by the fear in the markets due to the escalations in the Middle East, & the US taking part in the War. In this short analysis video, we will be discussing the Areas of interest and possible price movement we could see. Disclaimer: easyMarkets Account on TradingView allows you...

Drawing possible scenarios we could see on Brent Oil prices. Keep in mind fundamentals supporting the move up on oil: * Geopilitical escalations between Russia and Ukraine * Opec+ production policy * US - China Trade talks and demand optimisim * Geopolitical tensions between US and Iran. Disclaimer: easyMarkets Account on TradingView allows you to combine...

Sharing the possible scenarios we could have on Usd/Jpy. Keeping in mind that the Volume is still slow since start of the week, and investors are waiting for the next set of important economic data which is starting tomorrow with the US CPI (inflation number). Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading...

Discussing the possible scenarios on Silver that just broke above the 34.5 - 35 level, reaching around the 36.2. This breakout is fundamentally supported by: * Weak U.S Economic Data * Industrial demand * Tighter Silver Supply. * Market optimism after US and China talks. It's important to watch-out for any reactive headlines, price action, and off-course the US...

Explaining the reasons for Oil gapping up during this weekly open, in addition to going over the possible scenarios we could have for the upcoming sessions. Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and...

Price action on GBP/JPY has shown upward momentum after reaching the 193 level and failing to break below it. Possible scenarios include: • A retest of the 193.6 area, where failure to close below this level could suggest continued bullish pressure. In such a case, attention may shift toward the 194.7 region as a potential level of interest. Sustained momentum...

Crude oil analysis and what are the possible scenarios we could see. Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed...