2024/11/18

Daily 4XSetUps - 1MC Is Hovering Around Yearly Lows

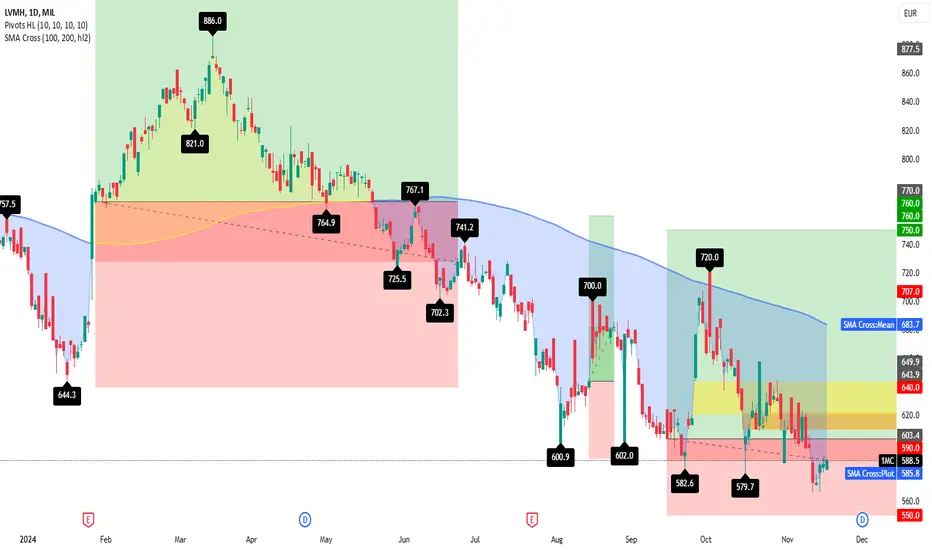

“august low, september low, october low & november low lower!

not the time for a noble corporation, like lvmh? do the lows hold?”

€ 622.5 : 2024/10/15 - yesterday's closing price action

€ 610.0 : 2024/10/16 - today's daily high price action

€ 588.5 : 2024/11/18 - last price action

€ 579.7 : 2024/10/16 - new annual low 2024 traded today

First, the bearish GAP must be recaptured! So the

“Every time you confront something painful, you are at a potentially important juncture in your life—you have the opportunity to choose healthy and painful truth or unhealthy but comfortable delusion.”

Ray Dalio

€ 588.5 : 2024/11/18 - last price action

€ 582.6 : 2024/09/23 - September 2024 Low

€ 579.7 : 2024/10/16 - October 2024 Low

€ 566.0 : 2024/11/12 - November 2024 Low

Things aren't looking good for

---------------------------------

€ 750.0 - Target Price

---------------------------------

€ 603.4 - Entry Price

€ 588.5 - last price action

--------------------------------

€ 550.0 - Stop Price

--------------------------------

With best wishes

and with good intentions!

Aaron

“daily 4XSetUps - …” is pure information material!

By trying to give you even more information about some trading capabilities to trade and/or invest in some securities. This post is not a call to action - it only provides information. You decide (not) to decide. Even if I am writing daily 4XSetUps with concrete entry prices, target prices and/or also stop prices! It is like it is - like I said; You decide to respond to the analysis I just formulated to buy, to sell, or to do nothing! More information about my approaches to investing in something specific or just trading it, or even just describing it, can be found in the daily "Another 48h - DXY ...! Analysis Post. Where I try to track the price action in

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.