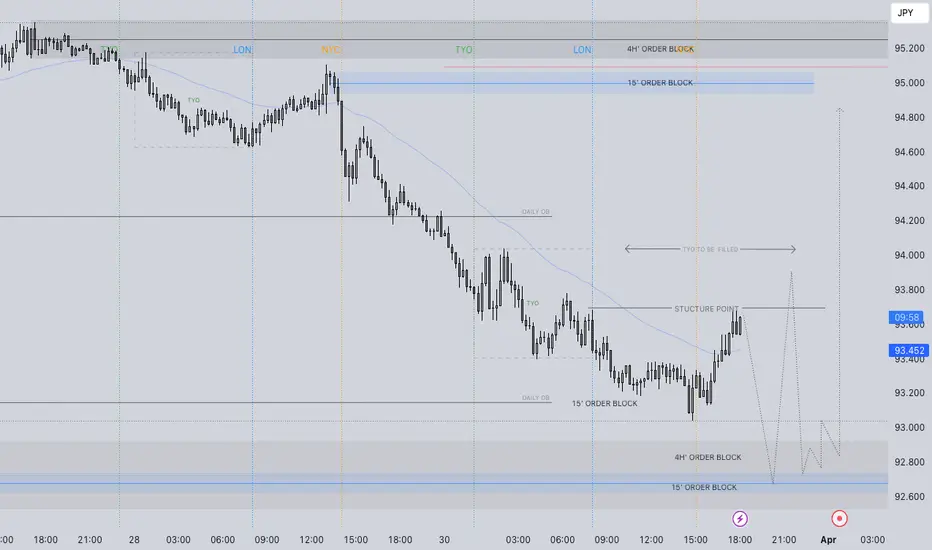

AUDJPY Monday 31st March 2025 Neu bias.

The setup that aligns with the majority of the confluences IMO would be the short position. I've time to discus this pair as price actions needs to work prior any involvement. Since current price action is closer to the long point of interest, let's discuss.

Work needs to he done. What I'd like to see is penetration of the 4h 15' OB. Ideally this would happen prior the Break of 15' structure. As per the image, it doesn't seem like that particular set up will occur first. In any case, we need to see both before risking capital. Once 4h 15' Order block is mitigated, I will then only consider the long position upon a lower time frame break of structure. To the speculator, it is a lot of waiting and waiting for particular things however what better to await price to come to you and journal the potential set up in the mean time.

post 1'/5' turn around in price - I will then have the confidence, confluence and confirmation that the position has enough buying pressure to take me to my management point.

In contrast, a trade that I'd happily wait for without taking the long to the point of interest would be the short. Why? The weekly and daily 50 exponential moving average. I would essentially be awaiting the same confluences as with the long position but in the short direction. in addition, with the 50 weekly/daily coming down to join the short party, I will accept a lower time frame break of structure as confluence to grab the short as apposed to waiting for a 15' break of structure first.

What do you think? Let's see how the markets play out.

FRGNT

The setup that aligns with the majority of the confluences IMO would be the short position. I've time to discus this pair as price actions needs to work prior any involvement. Since current price action is closer to the long point of interest, let's discuss.

Work needs to he done. What I'd like to see is penetration of the 4h 15' OB. Ideally this would happen prior the Break of 15' structure. As per the image, it doesn't seem like that particular set up will occur first. In any case, we need to see both before risking capital. Once 4h 15' Order block is mitigated, I will then only consider the long position upon a lower time frame break of structure. To the speculator, it is a lot of waiting and waiting for particular things however what better to await price to come to you and journal the potential set up in the mean time.

post 1'/5' turn around in price - I will then have the confidence, confluence and confirmation that the position has enough buying pressure to take me to my management point.

In contrast, a trade that I'd happily wait for without taking the long to the point of interest would be the short. Why? The weekly and daily 50 exponential moving average. I would essentially be awaiting the same confluences as with the long position but in the short direction. in addition, with the 50 weekly/daily coming down to join the short party, I will accept a lower time frame break of structure as confluence to grab the short as apposed to waiting for a 15' break of structure first.

What do you think? Let's see how the markets play out.

FRGNT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.