Hello, subscribers!

It's great to see you all. Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- U.S. retail sales for November, reported by the Department of Commerce, increased by 0.7%, surpassing market expectations.

- Strong retail sales indicate that the momentum of the U.S. economy is strengthening. While a rate hold is widely expected at the December FOMC meeting, the prevailing view is that rates will also remain on hold in January.

- With the Japanese yen weakening further against the dollar, some suggest that Japanese authorities might intervene in the currency markets.

I- n the U.K., wages rose by 5.2% year-over-year from August to October, exceeding expectations and driving the pound higher.

- In Canada, the November Consumer Price Index (CPI) rose by 1.9%, falling short of the market estimate of 2.0%, which weakened the Canadian dollar.

Key Economic Indicators

+ December 18: U.K. November CPI, Eurozone November CPI, FOMC meeting results

+ December 19: Bank of Japan rate decision, Bank of England rate decision

+ December 20: U.S. November Personal Consumption Expenditures (PCE) Price Index

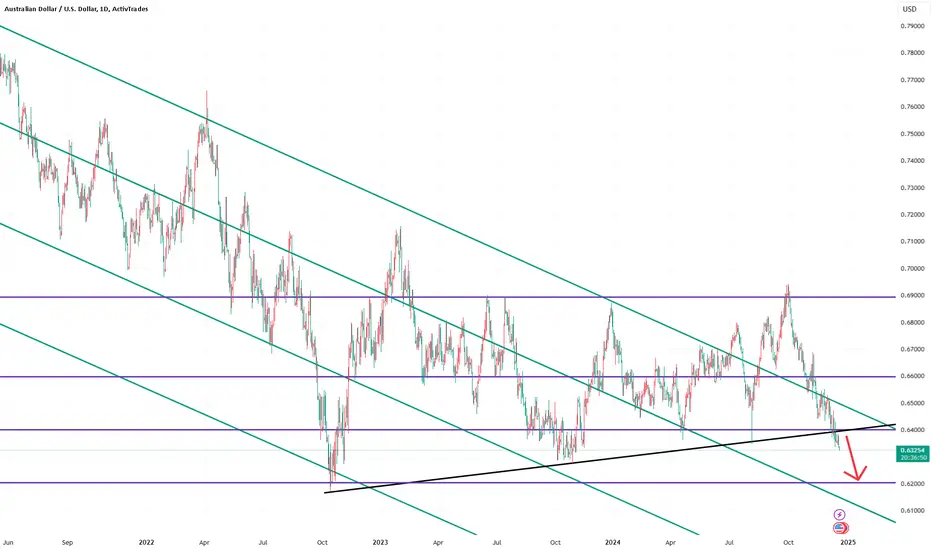

AUD/USD Chart Analysis

The AUD/USD pair has finally broken below the 0.63500 level. Based on the current chart, further declines toward the 0.62000 level seem likely. However, the direction could shift upward depending on the stance the Federal Reserve takes during this week’s FOMC meeting.

If unexpected factors lead to an upward move, I’ll quickly revise the strategy accordingly.

It's great to see you all. Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- U.S. retail sales for November, reported by the Department of Commerce, increased by 0.7%, surpassing market expectations.

- Strong retail sales indicate that the momentum of the U.S. economy is strengthening. While a rate hold is widely expected at the December FOMC meeting, the prevailing view is that rates will also remain on hold in January.

- With the Japanese yen weakening further against the dollar, some suggest that Japanese authorities might intervene in the currency markets.

I- n the U.K., wages rose by 5.2% year-over-year from August to October, exceeding expectations and driving the pound higher.

- In Canada, the November Consumer Price Index (CPI) rose by 1.9%, falling short of the market estimate of 2.0%, which weakened the Canadian dollar.

Key Economic Indicators

+ December 18: U.K. November CPI, Eurozone November CPI, FOMC meeting results

+ December 19: Bank of Japan rate decision, Bank of England rate decision

+ December 20: U.S. November Personal Consumption Expenditures (PCE) Price Index

AUD/USD Chart Analysis

The AUD/USD pair has finally broken below the 0.63500 level. Based on the current chart, further declines toward the 0.62000 level seem likely. However, the direction could shift upward depending on the stance the Federal Reserve takes during this week’s FOMC meeting.

If unexpected factors lead to an upward move, I’ll quickly revise the strategy accordingly.

네이버 카페 :

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

네이버 카페 :

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.