Hello, subscribers!

Great to see you all. Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- November CPI: Expected to rise 0.2% MoM, with the core CPI forecasted to increase 0.3% MoM. - The market remains cautious about the potential for results exceeding expectations.

Reserve Bank of Australia (RBA): Although the RBA kept rates unchanged, Governor Michele Bullock stated during a press conference that the board has gained "some confidence" in the decline of inflation.

- Upcoming Events: Following the U.S. November CPI release, the Bank of Canada (BoC) is scheduled to announce its interest rate decision. The BoC is expected to lower rates by 50bps at this meeting.

Key Economic Indicators

- December 11: U.S. November CPI, Bank of Canada interest rate decision

- December 12: European Central Bank (ECB) interest rate decision, U.S. November PPI

- December 13: U.K. October GDP

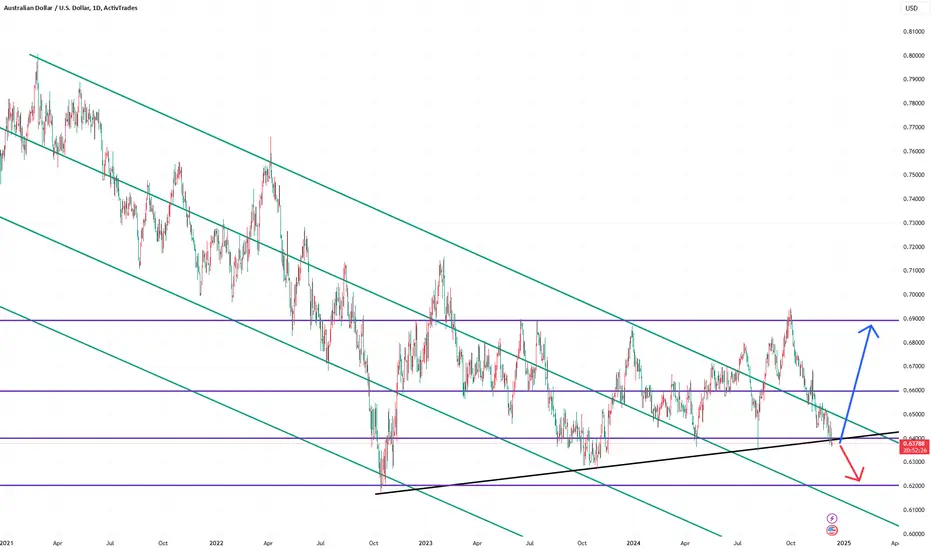

AUD/USD Chart Analysis

The upward trendline supporting AUD/USD’s bullish movement appears to be on the verge of breaking. While a rebound is still possible, the likelihood of a decline has significantly increased.

- Bearish Scenario: If the price breaks below 0.63500, a further drop toward 0.62000 could be expected.

- Bullish Scenario: If the pair rebounds from its current level, we could target 0.69000 as the potential high.

If the market moves contrary to these expectations, I’ll quickly adjust the strategy accordingly.

Great to see you all. Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- November CPI: Expected to rise 0.2% MoM, with the core CPI forecasted to increase 0.3% MoM. - The market remains cautious about the potential for results exceeding expectations.

Reserve Bank of Australia (RBA): Although the RBA kept rates unchanged, Governor Michele Bullock stated during a press conference that the board has gained "some confidence" in the decline of inflation.

- Upcoming Events: Following the U.S. November CPI release, the Bank of Canada (BoC) is scheduled to announce its interest rate decision. The BoC is expected to lower rates by 50bps at this meeting.

Key Economic Indicators

- December 11: U.S. November CPI, Bank of Canada interest rate decision

- December 12: European Central Bank (ECB) interest rate decision, U.S. November PPI

- December 13: U.K. October GDP

AUD/USD Chart Analysis

The upward trendline supporting AUD/USD’s bullish movement appears to be on the verge of breaking. While a rebound is still possible, the likelihood of a decline has significantly increased.

- Bearish Scenario: If the price breaks below 0.63500, a further drop toward 0.62000 could be expected.

- Bullish Scenario: If the pair rebounds from its current level, we could target 0.69000 as the potential high.

If the market moves contrary to these expectations, I’ll quickly adjust the strategy accordingly.

네이버 카페 :

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

네이버 카페 :

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

cafe.naver.com/autumnis

오픈 카톡방 :

pf.kakao.com/_txlKqxj/chat

텔레그램 :

t.me/shawntimemanager

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.