📅 BANK NIFTY Trading Plan – 21-Mar-2025

📍 Reference Close: 49,993.80

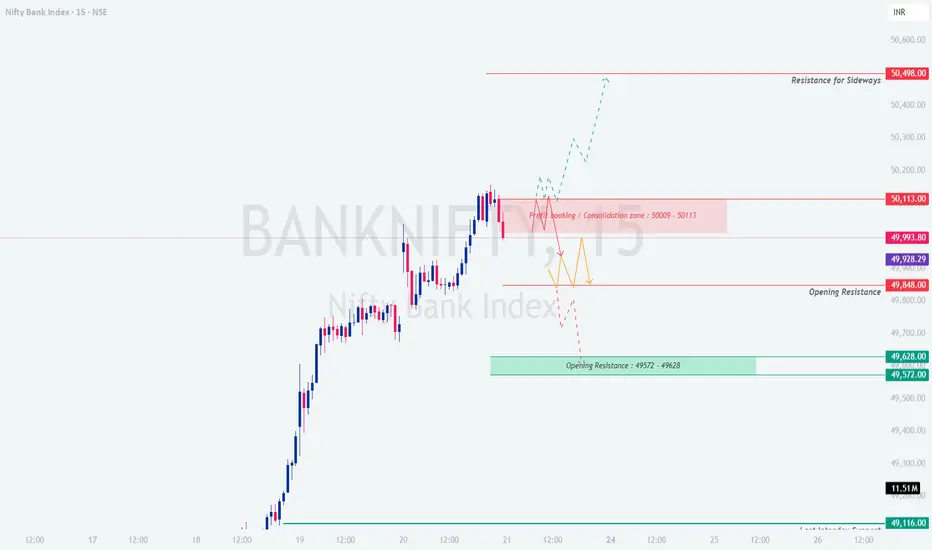

📊 Chart Context: Bank Nifty is trading just below a crucial consolidation zone after a strong uptrend. Now, price is near a likely decision point, where either profit booking or another leg of rally may unfold.

📌 Opening Scenario 1: GAP-UP Opening (200+ Points)

🟢 Expected Opening Zone: 50,200 – 50,350+

🎯 Educational Tip: Avoid chasing trades during a gap-up unless price sustains above key resistance levels with a breakout-retest confirmation.

📌 Opening Scenario 2: FLAT Opening (Within 49,950 – 50,050)

🟠 Expected Opening Zone: 49,950 – 50,050

🎯 Educational Tip: During flat opens, let the market form its direction. Don’t pre-empt moves – instead, trade the reaction to key levels.

📌 Opening Scenario 3: GAP-DOWN Opening (200+ Points)

🔻 Expected Opening Zone: 49,700 – 49,500

🎯 Educational Tip: On gap-down days, markets often trap early sellers. Always wait for price confirmation before entering the trade.

🛡 Risk Management Tips for Options Traders 💡

✅ Summary & Conclusion:

📍 Key Resistance Zones: 50,113 → 50,498

📍 Support Zones: 49,848 → 49,628 → 49,116

📍 The market is at a potential turning zone. React to price action at key levels rather than predicting.

📍 Maintain patience during first 30 minutes and wait for clean structure formation.

📍 Follow strict discipline with entries, exits, and stop losses.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This plan is created for educational and learning purposes only. Please do your own research or consult a registered financial advisor before making trading decisions. Always trade with proper risk management. 🙏

📍 Reference Close: 49,993.80

📊 Chart Context: Bank Nifty is trading just below a crucial consolidation zone after a strong uptrend. Now, price is near a likely decision point, where either profit booking or another leg of rally may unfold.

📌 Opening Scenario 1: GAP-UP Opening (200+ Points)

🟢 Expected Opening Zone: 50,200 – 50,350+

- []A gap-up above 50,113 opens the day inside or above the Profit Booking / Consolidation Zone (50,009 – 50,113).

[]If Bank Nifty opens near 50,200 – 50,350, be cautious of profit booking and wick rejections.

[]Price needs to sustain above 50,498 for a fresh breakout. If sustained, we may see an attempt to move toward 50,600+.

[]In case price struggles and forms bearish candles near 50,113 – 50,200, short trades can be initiated with stop loss above 50,498, targeting 49,848 and 49,628.

🎯 Educational Tip: Avoid chasing trades during a gap-up unless price sustains above key resistance levels with a breakout-retest confirmation.

📌 Opening Scenario 2: FLAT Opening (Within 49,950 – 50,050)

🟠 Expected Opening Zone: 49,950 – 50,050

- []Flat openings require a wait-and-watch approach during the first 15–30 mins.

[]Monitor price behavior around 50,009 – 50,113 zone. If price consolidates here without breakout, it could be a signal for sideways to negative bias.

[]Shorting opportunity arises if price fails to break 50,113 and closes below 49,993 with strong bearish candles – downside targets are 49,848 → 49,628.

[]For bullish bias, price must give a sustained move and 15-min close above 50,113 – in that case, expect a potential rally towards 50,498+.

🎯 Educational Tip: During flat opens, let the market form its direction. Don’t pre-empt moves – instead, trade the reaction to key levels.

📌 Opening Scenario 3: GAP-DOWN Opening (200+ Points)

🔻 Expected Opening Zone: 49,700 – 49,500

- []Gap-downs into or below Opening Resistance Zone (49,572 – 49,628) need to be observed for reaction.

[]If price reclaims and sustains above 49,628, it indicates strength and a chance to move toward 49,848 and possibly 49,993.

[]If rejection happens from this zone and price stays below 49,572, expect further downside toward 49,116 (Last Informed Demand Zone).

[]Avoid aggressive shorting on open – wait for retest and rejection from resistance to maintain risk-reward.

🎯 Educational Tip: On gap-down days, markets often trap early sellers. Always wait for price confirmation before entering the trade.

🛡 Risk Management Tips for Options Traders 💡

- []Do not buy deep OTM options, especially post 11:00 AM – time decay works against you.

[]Prefer spreads (like Bull Call or Bear Put) if expecting directional move with limited risk.

[]Set pre-defined stop losses and maximum loss per day (1–2% of capital).

[]Avoid revenge trading. One missed trade is better than blowing your capital.

[]Use higher time frame confirmation (like 15-min or hourly) before taking position.

[]Avoid holding weekly options overnight unless well in-the-money and hedged.

✅ Summary & Conclusion:

📍 Key Resistance Zones: 50,113 → 50,498

📍 Support Zones: 49,848 → 49,628 → 49,116

📍 The market is at a potential turning zone. React to price action at key levels rather than predicting.

📍 Maintain patience during first 30 minutes and wait for clean structure formation.

📍 Follow strict discipline with entries, exits, and stop losses.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This plan is created for educational and learning purposes only. Please do your own research or consult a registered financial advisor before making trading decisions. Always trade with proper risk management. 🙏

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.