Not Financial Advice

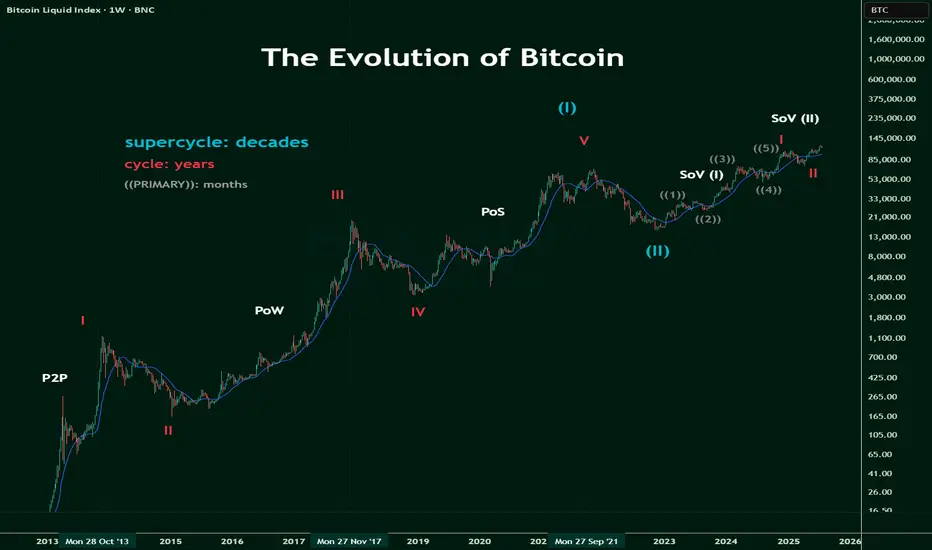

Born in 2009, bitcoin was a proof of concept out of an esoteric online forum.

It was intended as a secure, swift, P2P solution to transact on a global stage without global scrutiny nor supervision.

Sure it worked, but would it last?

Then Proof of Work, PoW, showed it's efficacy and prowess as years quickly approach a decade's worth.

It's value was recognised as the world gets stunned by BTC's rally.

BTC's rally.

But then crypto winter came.

So did Ethereum, but this was to be Bitcoin's catalyst.

Programmers soon carved DeFi niche propelling Bitcoin's value as a staked token, by 'bridging' the asset onto Ethereum, where a slew of financial products and Dapps began to fight for dominance.

The world of Proof of Stake, PoS, began to take shape, cementing itself as the perfect complementary power to Bitcoin's security.

Of course, where there is money, bad actors appear, causing BTC to tumble as rugs get pulled and users are caught in the turmoil of poor regulation.

BTC to tumble as rugs get pulled and users are caught in the turmoil of poor regulation.

But regulators caught up and has since given the industry a fresh wind for its sails.

Institutions pile in, eager to avoid mass adoption, and Bitcoin cements itself as a Store of Value (SoV).

To note that there will be multiple stages for this SoV, as the first stage was the acceptance from corporations that Bitcoin is safe: SoV (I).

Cue SoV (II) today where blue chips and central banks are circling bitcoin, tempted to bite.

And the final form, SoV (III) will be the day when bitcoin is simply, ubiquitous.

Born in 2009, bitcoin was a proof of concept out of an esoteric online forum.

It was intended as a secure, swift, P2P solution to transact on a global stage without global scrutiny nor supervision.

Sure it worked, but would it last?

Then Proof of Work, PoW, showed it's efficacy and prowess as years quickly approach a decade's worth.

It's value was recognised as the world gets stunned by

But then crypto winter came.

So did Ethereum, but this was to be Bitcoin's catalyst.

Programmers soon carved DeFi niche propelling Bitcoin's value as a staked token, by 'bridging' the asset onto Ethereum, where a slew of financial products and Dapps began to fight for dominance.

The world of Proof of Stake, PoS, began to take shape, cementing itself as the perfect complementary power to Bitcoin's security.

Of course, where there is money, bad actors appear, causing

But regulators caught up and has since given the industry a fresh wind for its sails.

Institutions pile in, eager to avoid mass adoption, and Bitcoin cements itself as a Store of Value (SoV).

To note that there will be multiple stages for this SoV, as the first stage was the acceptance from corporations that Bitcoin is safe: SoV (I).

Cue SoV (II) today where blue chips and central banks are circling bitcoin, tempted to bite.

And the final form, SoV (III) will be the day when bitcoin is simply, ubiquitous.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.