Happy Tuesday, friends! Fancy yourself a trader do you? In today’s episode, let’s face some hard facts and distinguish between a true trader (the 1%) and the gambler (the 99%). Grab a box of tissues, because this one might sting.

Ah, the trader. What a glorious lifestyle. From the luxury of an Adirondack chair on a cozy beach, sipping Mai Tai’s, scalping the one-minute chart, and reeling in a few grand a day. Is this what you initially pictured when you started trading?

Unfortunately, the sad reality is that this is mostly a pipe dream. It’s a lie that’s sold over and over again that appeals to our innate desire to live ‘the good life.’ But, as humans, we gobble this fantasy up and throw our hard-earned capital into the markets - often to disastrous effect.

While it’s not impossible to live this dream, the reality is that most of us focus on the end goal, the Mai Tai and the pretty senoritas, and not the process that achieves the end goal. Backtesting? Boooooring! Strategy creation? Pssh, why do that when all I have to do is find the right memecoin, bet big, and retire?

For every successful story you hear of a meme coin trade gone right, a few thousand traders could show you a -99% loss. Memecoin trading is the new lottery. You do know the odds of hitting the lottery, don’t you?

All right, as if that wasn’t enough fluff, let’s cut to the chase. If you don’t know the statistical odds of your ability to win or lose a trade, you’re not a trader; you’re a gambler. “But I follow price action, bro…” No, stop that; you’re a gambler. I’ve met a handful of price action traders with statistics, and kudos to them. But 99/100 “price action traders” are just gamblers. Confirmation bias, seeing what they want to see, and survivor bias - that’s the cocktail of “smart money concepts.” Hey, if you can backtest it, more power to you. But most of you can’t and won’t.

Building a strategy isn’t sexy, but it’s the difference between sitting down in front of the charts every day and knowing (roughly) how you will do, and sitting down in front of the charts just praying that today will be your lucky day.

Don’t rely on luck; become good. That takes hard work, just like anything else. It also takes a lot of trial and error. Start small and increase capital as your success increases. Slow and steady is the Path to Profit. Fast and loose is the road back to Burger King.

Make today the day you commit to building a long-term strategy. Make today the day you swear off gambling because your lucky day is likely not coming.

Stay frosty, friends.

Crypto Market Update

Stablecoin Dominance

Currently sitting at 5.79%, yesterday saw a strong attempt to break out above 6%, a level I have continually warned is the danger zone for the market, particularly altcoins. However, we did see a strong buy back from the market moving into yesterday’s daily close. This metric is overbought, but any strong close above 6% is a major warning sign.

Stablecoin + Bitcoin Dominance

Currently at 64.75%. This metric is also overbought, and showcasing the same technical position we were in right before Christmas, which led to a two week mark up period for the altcoin markets. Unfortunately, we’re not showing any weakness yet, so speculating on a reversal in altcoins is a high risk move at this point. Watch for a clearer sign of rejection and weakness first.

Altcoin Price Performance Relative to Bitcoin

Altcoins, besides the majors, are still getting obliterated. Underperforming Bitcoin by -24.74% currently. While we are oversold, no signs of strength yet. Perhaps in the next few days we might see a reversal in trend, but all eyes on the upcoming FOMC.

Bitcoin

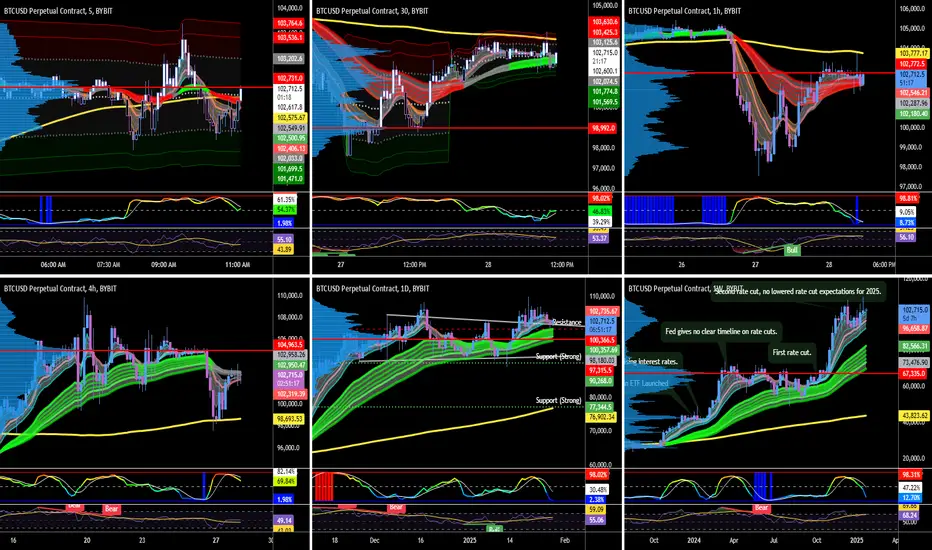

Trends

5M: Bearish

30M: Bullish

1H: Bearish

4H: Neutral

Daily: Bullish

Weekly: Bullish

After a strong sell off in reaction to the DeepSeek news, Bitcoin did put in a strong buy back at Daily Support. So far, we have not closed below our Daily Trend, nor the Weekly 10 MA. Tentatively optimistic, but I’m quite concerned about a deeper retracement unless we get a rate cut tomorrow.

Key Levels

POC: $104,955

VWAP: $102,609

Value Area Low: $101,569 - $102,079

Value Area High: $103,139 - $103,649

Next Liquidity Zone Above: $104,474 - $105,800

Next Liquidity Zone Below: $98,773 - $99,723

Bitcoin is trading in a relatively tight range today, after yesterday’s big move down. Currently fighting resistance at ~$103,500 with support at $101,566.

Strategy:

Honestly, expecting further downside pressure. Re-evaluate bias on a close above $103,500 - likely a lot of chop and volatility leading into tomorrow’s FOMC. Stay safe.

Ah, the trader. What a glorious lifestyle. From the luxury of an Adirondack chair on a cozy beach, sipping Mai Tai’s, scalping the one-minute chart, and reeling in a few grand a day. Is this what you initially pictured when you started trading?

Unfortunately, the sad reality is that this is mostly a pipe dream. It’s a lie that’s sold over and over again that appeals to our innate desire to live ‘the good life.’ But, as humans, we gobble this fantasy up and throw our hard-earned capital into the markets - often to disastrous effect.

While it’s not impossible to live this dream, the reality is that most of us focus on the end goal, the Mai Tai and the pretty senoritas, and not the process that achieves the end goal. Backtesting? Boooooring! Strategy creation? Pssh, why do that when all I have to do is find the right memecoin, bet big, and retire?

For every successful story you hear of a meme coin trade gone right, a few thousand traders could show you a -99% loss. Memecoin trading is the new lottery. You do know the odds of hitting the lottery, don’t you?

All right, as if that wasn’t enough fluff, let’s cut to the chase. If you don’t know the statistical odds of your ability to win or lose a trade, you’re not a trader; you’re a gambler. “But I follow price action, bro…” No, stop that; you’re a gambler. I’ve met a handful of price action traders with statistics, and kudos to them. But 99/100 “price action traders” are just gamblers. Confirmation bias, seeing what they want to see, and survivor bias - that’s the cocktail of “smart money concepts.” Hey, if you can backtest it, more power to you. But most of you can’t and won’t.

Building a strategy isn’t sexy, but it’s the difference between sitting down in front of the charts every day and knowing (roughly) how you will do, and sitting down in front of the charts just praying that today will be your lucky day.

Don’t rely on luck; become good. That takes hard work, just like anything else. It also takes a lot of trial and error. Start small and increase capital as your success increases. Slow and steady is the Path to Profit. Fast and loose is the road back to Burger King.

Make today the day you commit to building a long-term strategy. Make today the day you swear off gambling because your lucky day is likely not coming.

Stay frosty, friends.

Crypto Market Update

Stablecoin Dominance

Currently sitting at 5.79%, yesterday saw a strong attempt to break out above 6%, a level I have continually warned is the danger zone for the market, particularly altcoins. However, we did see a strong buy back from the market moving into yesterday’s daily close. This metric is overbought, but any strong close above 6% is a major warning sign.

Stablecoin + Bitcoin Dominance

Currently at 64.75%. This metric is also overbought, and showcasing the same technical position we were in right before Christmas, which led to a two week mark up period for the altcoin markets. Unfortunately, we’re not showing any weakness yet, so speculating on a reversal in altcoins is a high risk move at this point. Watch for a clearer sign of rejection and weakness first.

Altcoin Price Performance Relative to Bitcoin

Altcoins, besides the majors, are still getting obliterated. Underperforming Bitcoin by -24.74% currently. While we are oversold, no signs of strength yet. Perhaps in the next few days we might see a reversal in trend, but all eyes on the upcoming FOMC.

Bitcoin

Trends

5M: Bearish

30M: Bullish

1H: Bearish

4H: Neutral

Daily: Bullish

Weekly: Bullish

After a strong sell off in reaction to the DeepSeek news, Bitcoin did put in a strong buy back at Daily Support. So far, we have not closed below our Daily Trend, nor the Weekly 10 MA. Tentatively optimistic, but I’m quite concerned about a deeper retracement unless we get a rate cut tomorrow.

Key Levels

POC: $104,955

VWAP: $102,609

Value Area Low: $101,569 - $102,079

Value Area High: $103,139 - $103,649

Next Liquidity Zone Above: $104,474 - $105,800

Next Liquidity Zone Below: $98,773 - $99,723

Bitcoin is trading in a relatively tight range today, after yesterday’s big move down. Currently fighting resistance at ~$103,500 with support at $101,566.

Strategy:

Honestly, expecting further downside pressure. Re-evaluate bias on a close above $103,500 - likely a lot of chop and volatility leading into tomorrow’s FOMC. Stay safe.

Subscribe to the Crypto Alpha Report to receive my insights in your inbox daily. Data-driven research to keep you armed and dangerous.

academy.crackingcryptocurrency.com/newsletters/crypto-alpha-report/subscribe

academy.crackingcryptocurrency.com/newsletters/crypto-alpha-report/subscribe

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Subscribe to the Crypto Alpha Report to receive my insights in your inbox daily. Data-driven research to keep you armed and dangerous.

academy.crackingcryptocurrency.com/newsletters/crypto-alpha-report/subscribe

academy.crackingcryptocurrency.com/newsletters/crypto-alpha-report/subscribe

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.