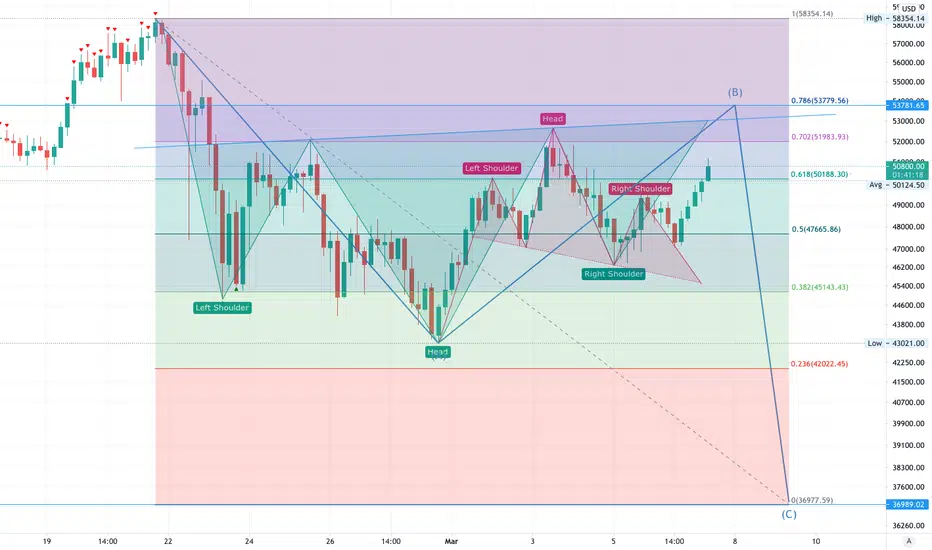

I could be totally wrong on this, but I would be cautious about trading the inverse head and shoulders on the BTC chart. If my previous analysis is correct, the neckline is too close to what I think is the 0.786 level of the entire retracement we're currently in. In my view, $54-55k will hold.

Interestingly, we saw a smaller head and shoulders within the larger inverse head and shoulders form and ultimately fail. Which tells me all the more that BTC wants to get to the 0.786 level, before turning strongly to the downside, in an A-B-C correction that will bottom at $37k.

I know this seems outlandish from where we are currently. Check out the linked analysis.

I would prepare for a reversal around $54-55k.

Interestingly, we saw a smaller head and shoulders within the larger inverse head and shoulders form and ultimately fail. Which tells me all the more that BTC wants to get to the 0.786 level, before turning strongly to the downside, in an A-B-C correction that will bottom at $37k.

I know this seems outlandish from where we are currently. Check out the linked analysis.

I would prepare for a reversal around $54-55k.

Note

It's also not going to be plain sailing right up to 54. We're in the 0.618 zone, and nearing the 0.702 zone. These are areas of ever stronger resistance. It may take more than one attempt to reach the neckline.Note

10 Mar 2021 08:08:31: I've been detailing what I've been seeing that relates to this post here:

AgitationZone | TA-focused cryptocurrency Discord channel discord.gg/atGcaRzz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

AgitationZone | TA-focused cryptocurrency Discord channel discord.gg/atGcaRzz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.