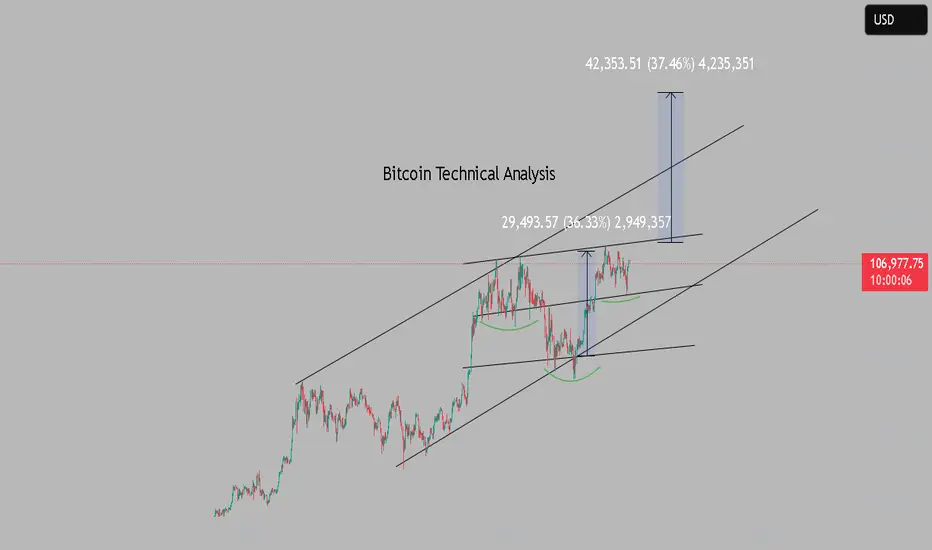

Anyone who has some knowledge of the chart can already see what is what.

A "reverse OBO" (head-shoulders) formation is forming within the ascending channel.

However, the right shoulder does not seem to have formed yet. This rise may be a "fake out".

In the coming days, we may see a sharp sell-off in BTC and a pullback to the 94-95K band.

BTC and a pullback to the 94-95K band.

These levels have both tested the lower support of the ascending channel and are important for the formation of the right shoulder.

If there is a period of accumulation in this support area, "Altcoins and #ethereum may experience a serious rise."

After this accumulation process, #Bitcoin may rise again in the last quarter of the year and move towards the upper resistance of the channel.

Where is this resistance zone?

Exactly the 150-160K range.

In other words, both the target of the technical formation and the resistance of the ascending channel since 2023 point to the same place.

Moreover, 2 strong Fibonacci levels intersect in this area.

In short:

If the right shoulder is read correctly, a short-term decline and accumulation can be expected.

However, a Bitcoin performance of over 150K in the last quarter of the year is not far away.

"This chart can work."

P.S.: If #BTC opens above 110K, the right shoulder formation will be completed at $98,500, and the rise process can be considered to have started.

A "reverse OBO" (head-shoulders) formation is forming within the ascending channel.

However, the right shoulder does not seem to have formed yet. This rise may be a "fake out".

In the coming days, we may see a sharp sell-off in

These levels have both tested the lower support of the ascending channel and are important for the formation of the right shoulder.

If there is a period of accumulation in this support area, "Altcoins and #ethereum may experience a serious rise."

After this accumulation process, #Bitcoin may rise again in the last quarter of the year and move towards the upper resistance of the channel.

Where is this resistance zone?

Exactly the 150-160K range.

In other words, both the target of the technical formation and the resistance of the ascending channel since 2023 point to the same place.

Moreover, 2 strong Fibonacci levels intersect in this area.

In short:

If the right shoulder is read correctly, a short-term decline and accumulation can be expected.

However, a Bitcoin performance of over 150K in the last quarter of the year is not far away.

"This chart can work."

P.S.: If #BTC opens above 110K, the right shoulder formation will be completed at $98,500, and the rise process can be considered to have started.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.