#Bitcoin – What’s Really Happening?

Daily Structure + Macro Setup = Big Move Loading

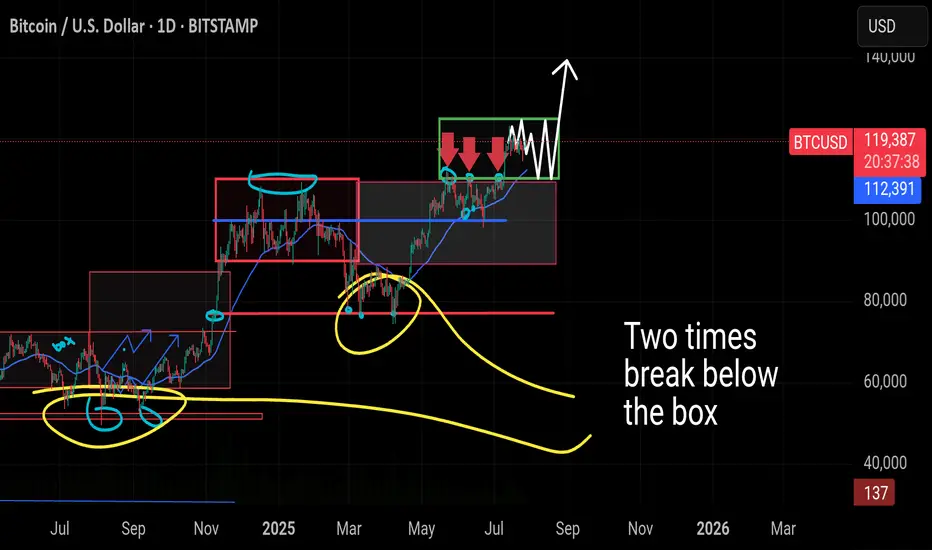

🔸 1D Chart: BTC Range-Bound Between $125K–$110K

BTC Range-Bound Between $125K–$110K

Bitcoin is currently trading inside a tight sideways range, marked by resistance near $125,000 and support around $110,000. This is now the third time we've seen price consolidate in this green zone.

🔸 In the previous two attempts, BTC briefly dipped below support before quickly reclaiming the level — classic fakeouts, not real breakdowns. The current price behavior mirrors that same structure.

🔸 What If BTC Drops Again?

BTC Drops Again?

A dip below $110K or even toward $100K should not trigger panic. Historically, these wicks below the range are liquidity grabs — not signs of weakness. As long as the 200 MA holds and price doesn’t sustain under $100K, the macro trend remains bullish.

🔸 Key Zones:

– Immediate support: $112,398

– Major support: $100K psychological level

– Structure invalidation: Sustained loss below $100K (not expected)

🔸 Macro Outlook: Still Bullish

While BTC chops sideways, the broader environment is heating up:

🔸 Trump-EU Mega Trade Deal

Markets just got a major catalyst — a massive U.S.–EU agreement that includes:

– $750B in U.S. energy exports

– $600B in EU investment

– $150B in energy purchases from U.S.

This clears out tariff fears and opens the door for stocks and crypto to run. Risk appetite is returning fast.

🔸 Whale Activity Panic = Noise

Galaxy Digital wallet movement spooked the market temporarily, pushing BTC to $114,500. But zoom out:

– ETF inflows still dominate daily sell volume

– BlackRock continues absorbing supply

– Long-term whales haven’t sold — they’re holding

This was not a breakdown. It was a shakeout. Accumulation is still happening.

🔸 The Real Fuel: M2 Money Supply

Here’s where things really align for the bulls:

– In 2020, a 25% rise in M2 → BTC 800% rally

– In 2025 so far: +2.3% increase, and we’re still in “tightening”

– Largest M2 spike: +0.63% in June

Given BTC typically lags M2 by 60–90 days, the June print is setting up for a 15–17.5% upside over the coming weeks. That puts us on a clear path toward $130,000+

🔸 Bitcoin is sideways, not weak. Range-bound price action is accumulation, not distribution. Macro signals are aligning, M2 is expanding, and whale panic was short-lived.

We’re not just holding a range — we’re coiling for the breakout.

You’re early. Stay ready.

#bitcoin

Daily Structure + Macro Setup = Big Move Loading

🔸 1D Chart:

Bitcoin is currently trading inside a tight sideways range, marked by resistance near $125,000 and support around $110,000. This is now the third time we've seen price consolidate in this green zone.

🔸 In the previous two attempts, BTC briefly dipped below support before quickly reclaiming the level — classic fakeouts, not real breakdowns. The current price behavior mirrors that same structure.

🔸 What If

A dip below $110K or even toward $100K should not trigger panic. Historically, these wicks below the range are liquidity grabs — not signs of weakness. As long as the 200 MA holds and price doesn’t sustain under $100K, the macro trend remains bullish.

🔸 Key Zones:

– Immediate support: $112,398

– Major support: $100K psychological level

– Structure invalidation: Sustained loss below $100K (not expected)

🔸 Macro Outlook: Still Bullish

While BTC chops sideways, the broader environment is heating up:

🔸 Trump-EU Mega Trade Deal

Markets just got a major catalyst — a massive U.S.–EU agreement that includes:

– $750B in U.S. energy exports

– $600B in EU investment

– $150B in energy purchases from U.S.

This clears out tariff fears and opens the door for stocks and crypto to run. Risk appetite is returning fast.

🔸 Whale Activity Panic = Noise

Galaxy Digital wallet movement spooked the market temporarily, pushing BTC to $114,500. But zoom out:

– ETF inflows still dominate daily sell volume

– BlackRock continues absorbing supply

– Long-term whales haven’t sold — they’re holding

This was not a breakdown. It was a shakeout. Accumulation is still happening.

🔸 The Real Fuel: M2 Money Supply

Here’s where things really align for the bulls:

– In 2020, a 25% rise in M2 → BTC 800% rally

– In 2025 so far: +2.3% increase, and we’re still in “tightening”

– Largest M2 spike: +0.63% in June

Given BTC typically lags M2 by 60–90 days, the June print is setting up for a 15–17.5% upside over the coming weeks. That puts us on a clear path toward $130,000+

🔸 Bitcoin is sideways, not weak. Range-bound price action is accumulation, not distribution. Macro signals are aligning, M2 is expanding, and whale panic was short-lived.

We’re not just holding a range — we’re coiling for the breakout.

You’re early. Stay ready.

#bitcoin

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.