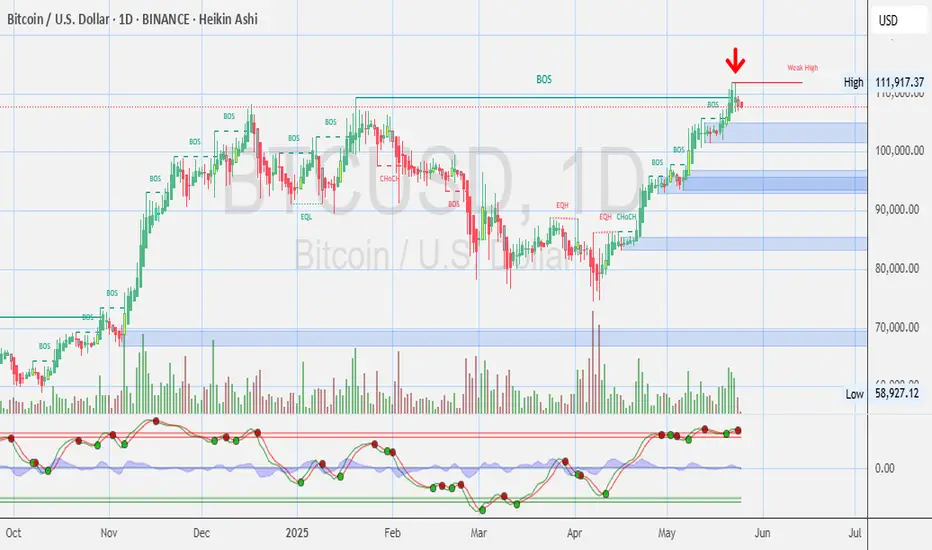

📊 Smart Money Concepts (SMC) Breakdown:

BOS (Break of Structure):

Several BOS labels indicate strong upward momentum and bullish market structure continuation.

Recent BOS at the top signals bulls still in control — until shown otherwise.

CHoCH (Change of Character):

Previous CHoCH in March signaled a bullish reversal (from a downtrend to an uptrend).

No current CHoCH suggesting trend reversal — but watch for signs near the top.

EQH (Equal Highs) near the current price:

These suggest liquidity resting above — potential target for market makers.

"Weak High" label suggests this area might be swept before a stronger move down.

🧠 Liquidity and Trap Zones:

Liquidity Pool: The red “Weak High” is likely an area where short sellers place stop-losses. Price may wick above to hunt this liquidity before a reversal.

Possible Fakeout: If the red arrow is correct, we may see a short-term spike up to grab liquidity followed by a reversal (potential short setup).

📉 Bearish Signs:

Bearish Heikin Ashi Candle near major resistance

Volume divergence: Price rising but volume not supporting the move (volume tapering off)

Overbought oscillator (bottom of the chart): Suggests exhaustion in bullish momentum

Price struggling to stay above $108K–$111K

🎯 Key Support/Resistance Levels:

Immediate Resistance: ~$111,917 (“Weak High”)

Support Zones:

$100,000 – round psychological level

$90,000 – visible previous demand area

$86,681 – midpoint equilibrium zone

$58,927 – major historical support

✅ Conclusion & Trade Ideas:

🔺 Bullish Scenario: Price breaks and holds above $112K → continuation to new highs

🔻 Bearish Scenario: Price fakes out above $112K → rejection → returns below BOS → retests $100K or deeper zones like $90K

📌 Neutral/Wait Mode: If consolidation continues near the top with decreasing volume

----------------------------

Low Market Cap #RWA #RealEstate #Tokenization Platforms by FDV

SQRB $100K on PROBIT

$RNB $310K

$HTS $1.9M

$STBU $3.5M

LAND $3.6M

-----

Not for recommendations to BUY SELL any stocks, cryptos, FX or securities

Not for Financial Advise

DYOR

BOS (Break of Structure):

Several BOS labels indicate strong upward momentum and bullish market structure continuation.

Recent BOS at the top signals bulls still in control — until shown otherwise.

CHoCH (Change of Character):

Previous CHoCH in March signaled a bullish reversal (from a downtrend to an uptrend).

No current CHoCH suggesting trend reversal — but watch for signs near the top.

EQH (Equal Highs) near the current price:

These suggest liquidity resting above — potential target for market makers.

"Weak High" label suggests this area might be swept before a stronger move down.

🧠 Liquidity and Trap Zones:

Liquidity Pool: The red “Weak High” is likely an area where short sellers place stop-losses. Price may wick above to hunt this liquidity before a reversal.

Possible Fakeout: If the red arrow is correct, we may see a short-term spike up to grab liquidity followed by a reversal (potential short setup).

📉 Bearish Signs:

Bearish Heikin Ashi Candle near major resistance

Volume divergence: Price rising but volume not supporting the move (volume tapering off)

Overbought oscillator (bottom of the chart): Suggests exhaustion in bullish momentum

Price struggling to stay above $108K–$111K

🎯 Key Support/Resistance Levels:

Immediate Resistance: ~$111,917 (“Weak High”)

Support Zones:

$100,000 – round psychological level

$90,000 – visible previous demand area

$86,681 – midpoint equilibrium zone

$58,927 – major historical support

✅ Conclusion & Trade Ideas:

🔺 Bullish Scenario: Price breaks and holds above $112K → continuation to new highs

🔻 Bearish Scenario: Price fakes out above $112K → rejection → returns below BOS → retests $100K or deeper zones like $90K

📌 Neutral/Wait Mode: If consolidation continues near the top with decreasing volume

----------------------------

Low Market Cap #RWA #RealEstate #Tokenization Platforms by FDV

SQRB $100K on PROBIT

$RNB $310K

$HTS $1.9M

$STBU $3.5M

LAND $3.6M

-----

Not for recommendations to BUY SELL any stocks, cryptos, FX or securities

Not for Financial Advise

DYOR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.