"Watch what they do, but also how they say it."

In the high-stakes world of central banking, few things move markets like the subtle wording of a Fed statement, But beyond the headlines and soundbites, one market absorbs this information faster—and with greater clarity—than almost any other: the bond market.

💬 What Is "Fed Speak"?

"Fed speak" refers to the nuanced and often deliberately vague language used by U.S. Federal Reserve officials when communicating policy expectations. It includes:

FOMC statements

Dot plot projections

Press conferences

Individual speeches from Fed officials

nerdy tip: the Fed aims to influence expectations without committing to specific outcomes, maintaining flexibility while steering market psychology.

📈 The Bond Market as a Decoder

The bond market, particularly the U.S. Treasury market, is where real-time interpretation of Fed policy plays out. Here's how it typically reacts:

1. Short-Term Yields (2Y, 3M) = Fed Expectation Barometer

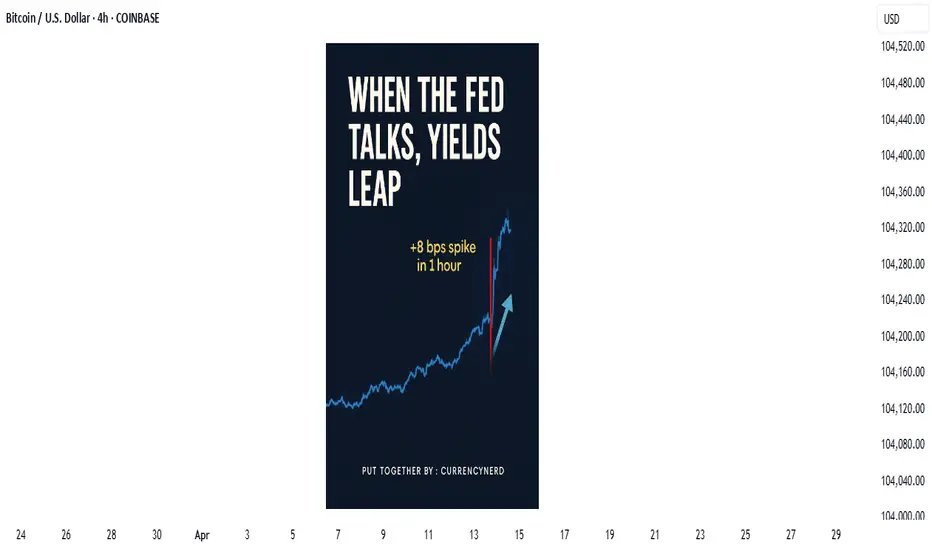

These are the most sensitive to near-term interest rate expectations. If the Fed sounds hawkish (more rate hikes), short-term yields jump. If dovish (hinting cuts), they fall. At the May 7, 2025 FOMC meeting, the 2-year Treasury yield (US02Y) experienced a modest but clear reaction:

Just before the release, yields were hovering around 3.79%.

In the first hour following the 2:00 PM ET (20:00 UTC+2) statement, the yield ticked up by approximately +8 basis points, temporarily reaching about 3.87%.

Later that day, it eased back to around 3.79%, ending the day roughly unchanged—a sharp, immediate spike followed by a reversion.

2. Long-Term Yields (10Y, 30Y) = Growth + Inflation Expectations

Longer-dated yields reflect how the market sees the economy unfolding over time. After a Fed speech:

Rising long-term yields = stronger growth/inflation expected

Falling yields = fears of recession, disinflation, or policy over-tightening

3. The Yield Curve = Market's Policy Verdict

One of the best tools to read the bond market's verdict is the yield curve—specifically, the spread between 10Y and 2Y yields.

Steepening curve → Market thinks growth is picking up (Fed may be behind the curve)

Flattening or Inversion → Market believes the Fed is too aggressive, risking a slowdown or recession

📉 Example: After Jerome Powell’s hawkish Jackson Hole speech in 2022, the 2Y-10Y spread inverted deeply—markets were pricing in recession risks despite a strong Fed tone.

🧠 Why Traders Must Watch Bonds After Fed Speak

🪙 FX Traders:

Higher yields = stronger USD (carry trade advantage)

Falling yields = weaker USD (lower return for holding)

📈 Equity Traders:

Rising yields = pressure on tech/growth stocks (higher discount rates)

Falling yields = relief rally in risk assets

📊 Macro Traders:

The MOVE Index (bond volatility) often spikes around FOMC events

Forward guidance shifts = big rotation opportunities (e.g., bonds > gold > dollar)

(BONUS NERDY TIP) 🔍 How to Analyze Fed Speak Through Bonds

✅ Step 1: Watch the 2Y Yield

First responder to new rate expectations.

✅ Step 2: Check the Fed Funds Futures

Compare market pricing pre- and post-statement.

✅ Step 3: Look at Yield Curve Movement

Steepening or inversion? That’s the market’s macro take.

✅ Step 4: Track TLT or 10Y Yield on Your Chart

Bond ETFs or Treasury yields reveal sentiment instantly.

🧭 Final Nerdy Thought: Bonds React First, Talk Later

When the Fed speaks, don't just read the words. Read the yields. The bond market is often the first to interpret what the Fed really means—and the first to price in what comes next.

So next FOMC meeting, instead of watching only Powell’s facial expressions or CNBC pundits, open a chart of the 2Y and 10Y. That’s where the smart money’s listening.

put together by : currencynerd as Pako Phutietsile

courtesy of : TradingView

In the high-stakes world of central banking, few things move markets like the subtle wording of a Fed statement, But beyond the headlines and soundbites, one market absorbs this information faster—and with greater clarity—than almost any other: the bond market.

💬 What Is "Fed Speak"?

"Fed speak" refers to the nuanced and often deliberately vague language used by U.S. Federal Reserve officials when communicating policy expectations. It includes:

FOMC statements

Dot plot projections

Press conferences

Individual speeches from Fed officials

nerdy tip: the Fed aims to influence expectations without committing to specific outcomes, maintaining flexibility while steering market psychology.

📈 The Bond Market as a Decoder

The bond market, particularly the U.S. Treasury market, is where real-time interpretation of Fed policy plays out. Here's how it typically reacts:

1. Short-Term Yields (2Y, 3M) = Fed Expectation Barometer

These are the most sensitive to near-term interest rate expectations. If the Fed sounds hawkish (more rate hikes), short-term yields jump. If dovish (hinting cuts), they fall. At the May 7, 2025 FOMC meeting, the 2-year Treasury yield (US02Y) experienced a modest but clear reaction:

Just before the release, yields were hovering around 3.79%.

In the first hour following the 2:00 PM ET (20:00 UTC+2) statement, the yield ticked up by approximately +8 basis points, temporarily reaching about 3.87%.

Later that day, it eased back to around 3.79%, ending the day roughly unchanged—a sharp, immediate spike followed by a reversion.

2. Long-Term Yields (10Y, 30Y) = Growth + Inflation Expectations

Longer-dated yields reflect how the market sees the economy unfolding over time. After a Fed speech:

Rising long-term yields = stronger growth/inflation expected

Falling yields = fears of recession, disinflation, or policy over-tightening

3. The Yield Curve = Market's Policy Verdict

One of the best tools to read the bond market's verdict is the yield curve—specifically, the spread between 10Y and 2Y yields.

Steepening curve → Market thinks growth is picking up (Fed may be behind the curve)

Flattening or Inversion → Market believes the Fed is too aggressive, risking a slowdown or recession

📉 Example: After Jerome Powell’s hawkish Jackson Hole speech in 2022, the 2Y-10Y spread inverted deeply—markets were pricing in recession risks despite a strong Fed tone.

🧠 Why Traders Must Watch Bonds After Fed Speak

🪙 FX Traders:

Higher yields = stronger USD (carry trade advantage)

Falling yields = weaker USD (lower return for holding)

📈 Equity Traders:

Rising yields = pressure on tech/growth stocks (higher discount rates)

Falling yields = relief rally in risk assets

📊 Macro Traders:

The MOVE Index (bond volatility) often spikes around FOMC events

Forward guidance shifts = big rotation opportunities (e.g., bonds > gold > dollar)

(BONUS NERDY TIP) 🔍 How to Analyze Fed Speak Through Bonds

✅ Step 1: Watch the 2Y Yield

First responder to new rate expectations.

✅ Step 2: Check the Fed Funds Futures

Compare market pricing pre- and post-statement.

✅ Step 3: Look at Yield Curve Movement

Steepening or inversion? That’s the market’s macro take.

✅ Step 4: Track TLT or 10Y Yield on Your Chart

Bond ETFs or Treasury yields reveal sentiment instantly.

🧭 Final Nerdy Thought: Bonds React First, Talk Later

When the Fed speaks, don't just read the words. Read the yields. The bond market is often the first to interpret what the Fed really means—and the first to price in what comes next.

So next FOMC meeting, instead of watching only Powell’s facial expressions or CNBC pundits, open a chart of the 2Y and 10Y. That’s where the smart money’s listening.

put together by : currencynerd as Pako Phutietsile

courtesy of : TradingView

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.