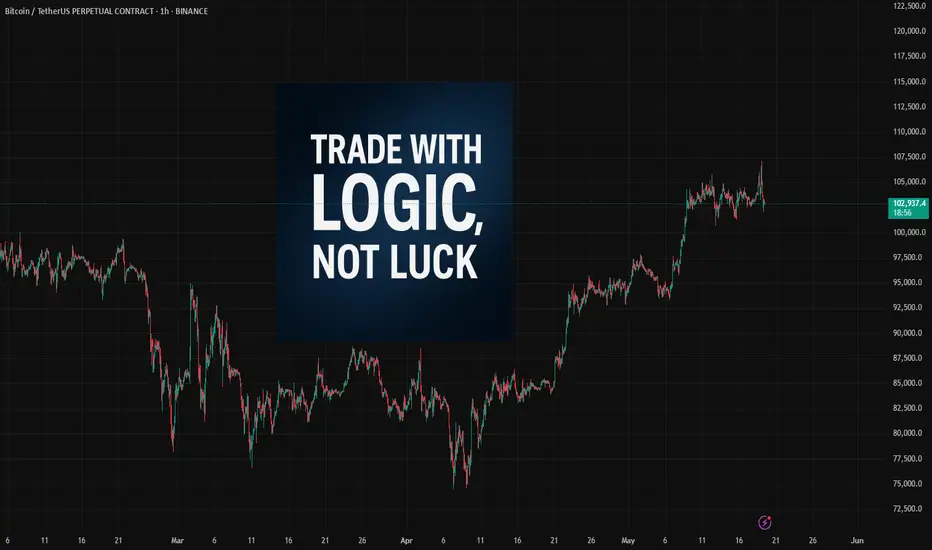

Breakout or Rejection? What the Daily Opening Range Really Tells

Every single day, the market makes a choice:

Break out — or reject.

That’s why the opening range — defined by the high and low during the first part of the day — acts like a psychological boundary.

When price breaks out of that range, momentum often follows.

When it fails to break, we get fake moves, consolidations, and traps.

At CMA Technologies, our systems start by defining this key range.

Then, we wait. No prediction. Just price confirmation.

✅ True breakouts often initiate the largest directional moves.

❌ False ones usually fade back into noise.

We encourage every strategy builder to test one simple condition:

"What does the price do after crossing outside of its initial daily range?"

The results will surprise you — especially on high-volatility pairs.

📊 If you're curious, our “Daily Open Range Breakout Bot” is available on our profile now.

Break out — or reject.

That’s why the opening range — defined by the high and low during the first part of the day — acts like a psychological boundary.

When price breaks out of that range, momentum often follows.

When it fails to break, we get fake moves, consolidations, and traps.

At CMA Technologies, our systems start by defining this key range.

Then, we wait. No prediction. Just price confirmation.

✅ True breakouts often initiate the largest directional moves.

❌ False ones usually fade back into noise.

We encourage every strategy builder to test one simple condition:

"What does the price do after crossing outside of its initial daily range?"

The results will surprise you — especially on high-volatility pairs.

📊 If you're curious, our “Daily Open Range Breakout Bot” is available on our profile now.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.