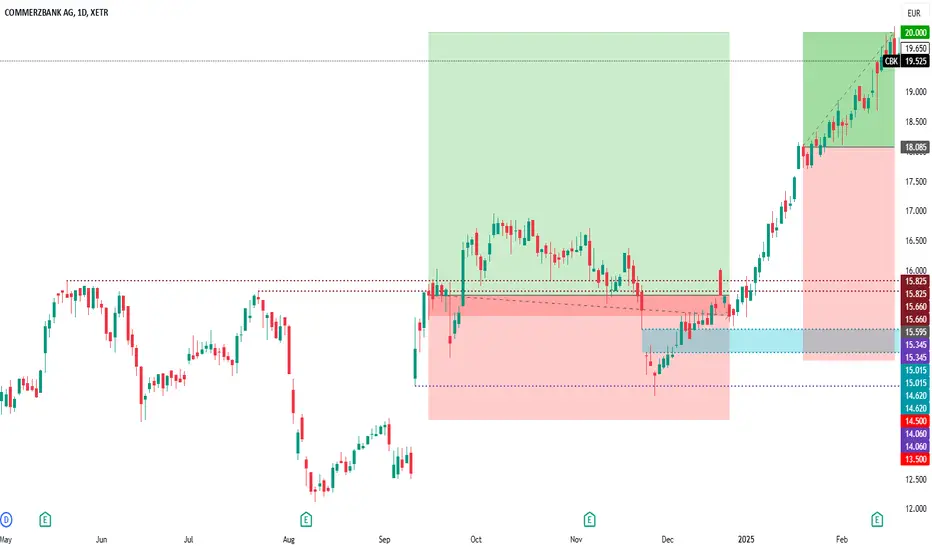

2025/02/20 - 8th Calendar Week

Daily 4XSetUps - Target Price Of €20 In CBK Reached Yesterday

“commerzbank has done well, was bullish during the last 12 months!

what is worth doing now? buy bullish? sell bearishly? why? why not?”

Weak US stock markets have further clouded the mood on the German stock market this Thursday, February 20, 2025. In addition, there were also worse than expected quarterly reports, especially after the recent strong price gains of individual companies, such as our long WMT 4XSetUps. After a rally of more than +10% in less than two months, a first small sell-off seems to be taking place in terms of price action. It could possibly be stormy at the beginning of next week, after we have federal elections here in Germany at the weekend - which our previous government had called. And so our German leading index DAX

However, Wall Street's best-known index, the Dow Jones Industrial

“Don’t mistake possibilities for probabilities. Anything is possible. It’s the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritized.”

Ray Dalio

Commerzbank

--------------------------------------------------------

€20.000 : 2025/12/31 - Target Price

--------------------------------------------------------

€20.000 : 2025/02/19 - Target Price REACHED

€18.085 : 2025/01/21 - Entry Price

--------------------------------------------------------

€14.500 : 2025/12/31 - Stop Price

--------------------------------------------------------

Have a good time

- regardless of the price action!

Aaron

“daily 4XSetUps - …” is pure information material!

By trying to give you even more information about some trading capabilities to trade and/or invest in some securities. This post is not a call to action - it only provides information. You decide (not) to decide. Even if I am writing daily 4XSetUps with concrete entry prices, target prices and/or also stop prices! It is like it is - like I said; You decide to respond to the analysis I just formulated to buy, to sell, or to do nothing! More information about my approaches to investing in something specific or just trading it, or even just describing it, can be found in the daily "Another 48h - DXY ...! Analysis Post. Where I try to track the price action in

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.