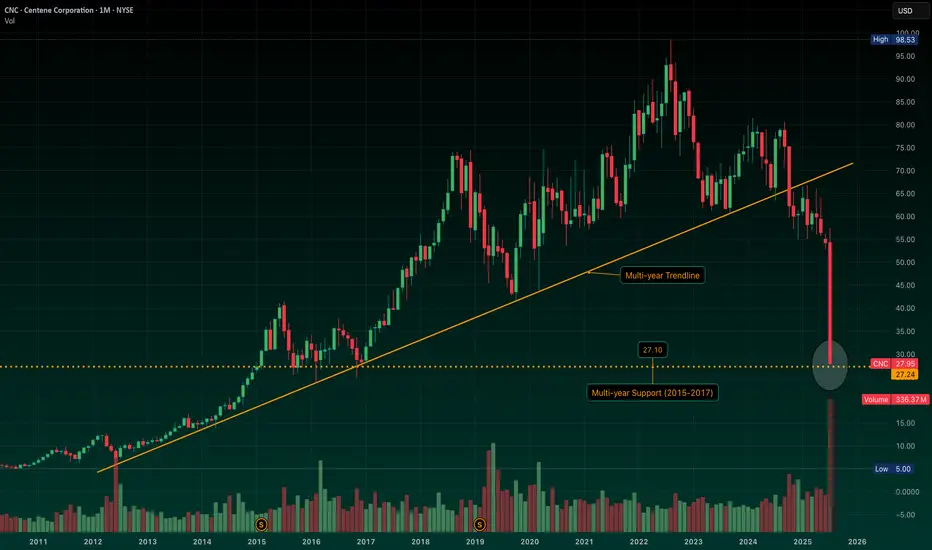

CNC broke its multi-year trendline months ago, and the recent flush drove it straight into key support from the 2015–2017 range (~$27). Big structural break, but also a spot where longer-term buyers may start stepping in.

As noted earlier, I began building a defined-risk long via 2026 LEAPS (Jun $55s, Sep $50s)... a slow-burn recovery setup targeting stabilization and a re-rating back toward the $50–55 range over time.

Once the dust settles and we get clearer signs of fundamental stabilization, I’ll likely begin layering in short puts at levels I’m comfortable owning. If assigned, great... I lower my basis. If not, the premium helps finance the calls.

This is a long-term rebuild. Not trying to nail the bottom... I’m building around time, structure, and optionality. Giddy up.

As noted earlier, I began building a defined-risk long via 2026 LEAPS (Jun $55s, Sep $50s)... a slow-burn recovery setup targeting stabilization and a re-rating back toward the $50–55 range over time.

Once the dust settles and we get clearer signs of fundamental stabilization, I’ll likely begin layering in short puts at levels I’m comfortable owning. If assigned, great... I lower my basis. If not, the premium helps finance the calls.

This is a long-term rebuild. Not trying to nail the bottom... I’m building around time, structure, and optionality. Giddy up.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.