Dow Jones (DJI) Double Top (Strong Incoming Drop Closer)

The Dow Jones Industrial Average Index (DJI) is getting closer to a strong drop.

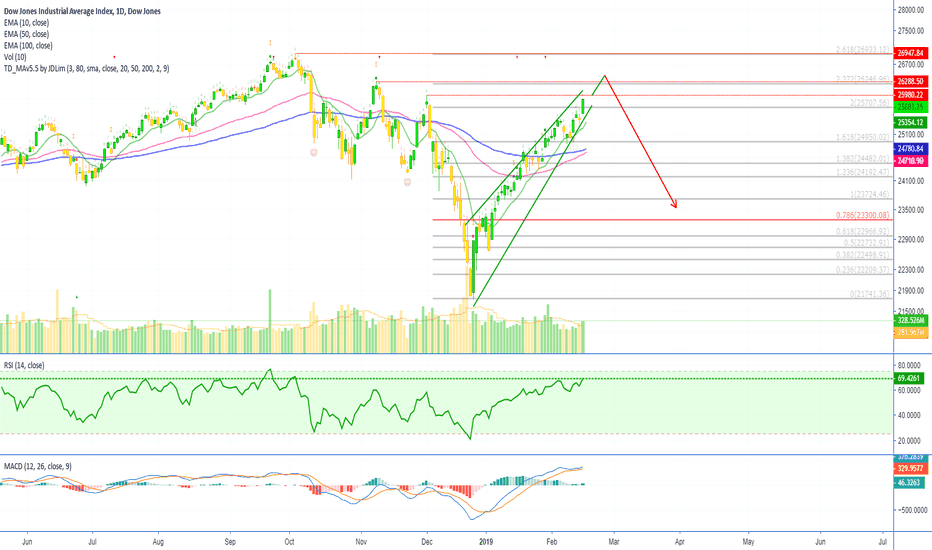

Last time we looked at divergence, the same as with the S&P 500 Index as these charts are almost identical. Today we will be looking at a double top formation plus the same signals we saw on the SPX MACD.

Let's get started... Perhaps you want to hit LIKE now before moving on...

Thanks a lot for the support.

Dow Jones Industrial Average Index (DJI) Chart Analysis

Next, we look at the MACD, here is a screenshot:

As you can see, these signals, coupled with the bearish divergence we saw in my previous analysis, all point to an upcoming crash.

What's your take on the Dow Jones Industrial Average Index (DJI), will it crash or continue moving up?

Leave your thoughts in the comments section below.

Namaste.

Last time we looked at divergence, the same as with the S&P 500 Index as these charts are almost identical. Today we will be looking at a double top formation plus the same signals we saw on the SPX MACD.

Let's get started... Perhaps you want to hit LIKE now before moving on...

Thanks a lot for the support.

Dow Jones Industrial Average Index (DJI) Chart Analysis

- The double top is marked with yellow circles on the chart above. Double tops are normally followed by a drop. There is also a shooting star candlestick on the second 'top'.

Next, we look at the MACD, here is a screenshot:

- MACD Histogram is moving in favor of the bears.

- MACD Bearish crossover.

As you can see, these signals, coupled with the bearish divergence we saw in my previous analysis, all point to an upcoming crash.

What's your take on the Dow Jones Industrial Average Index (DJI), will it crash or continue moving up?

Leave your thoughts in the comments section below.

Namaste.

Note

Going according to the chart.Note

I will take another look at the Dow Jones.🚨 TOP FREE Trades

ETH +1450% · AAVE +1134%

XRP +749% · DOGS +868%

BTC +563% · SOL +658%

t.me/anandatrades/1350

🚨 FREE Analyses & New Results

t.me/masteranandatrades/6499

🚨 PREMIUM LIFETIME (Since 2017)

lamatrades.com

ETH +1450% · AAVE +1134%

XRP +749% · DOGS +868%

BTC +563% · SOL +658%

t.me/anandatrades/1350

🚨 FREE Analyses & New Results

t.me/masteranandatrades/6499

🚨 PREMIUM LIFETIME (Since 2017)

lamatrades.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🚨 TOP FREE Trades

ETH +1450% · AAVE +1134%

XRP +749% · DOGS +868%

BTC +563% · SOL +658%

t.me/anandatrades/1350

🚨 FREE Analyses & New Results

t.me/masteranandatrades/6499

🚨 PREMIUM LIFETIME (Since 2017)

lamatrades.com

ETH +1450% · AAVE +1134%

XRP +749% · DOGS +868%

BTC +563% · SOL +658%

t.me/anandatrades/1350

🚨 FREE Analyses & New Results

t.me/masteranandatrades/6499

🚨 PREMIUM LIFETIME (Since 2017)

lamatrades.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.