Quick Update

The upcoming week is poised to be critical for financial markets as President Donald Trump's so-called "Liberation Day" on April 2 approaches. On this date, the administration plans to implement new tariffs aimed at reducing the U.S. trade deficit by imposing reciprocal duties on imports from various countries.

As April 2 looms, the full impact of these tariffs remains uncertain, leaving markets and investors in a state of heightened anticipation.

- We may get clarity on the tariff situation on April 2, 2025.

- Universal tariff announcement of categories of imports may clarify US administration’s maximum tariff escalation approach.

- A phased out and unclear tariff approach may keep markets in limbo.

Economic Calendar

Keep an eye on the data docket, NFP and other key releases are due this week.

- Tuesday, Apri 1, 2025: ISM Manufacturing PMI, JOLTS Job Openings

- Wednesday April 2, 2025: ADP Employment Change, Factory Orders MoM

- Thursday April 3, 2025: Balance of Trade, Imports, Exports, ISM Services PMI, Initial Jobless Claims

- Friday, April 4, 2025: Non-Farm Payrolls, Unemployment rate, Average Hourly Earnings MoM,Average Hourly Earnings YoY, Fed Chair Powell Speech

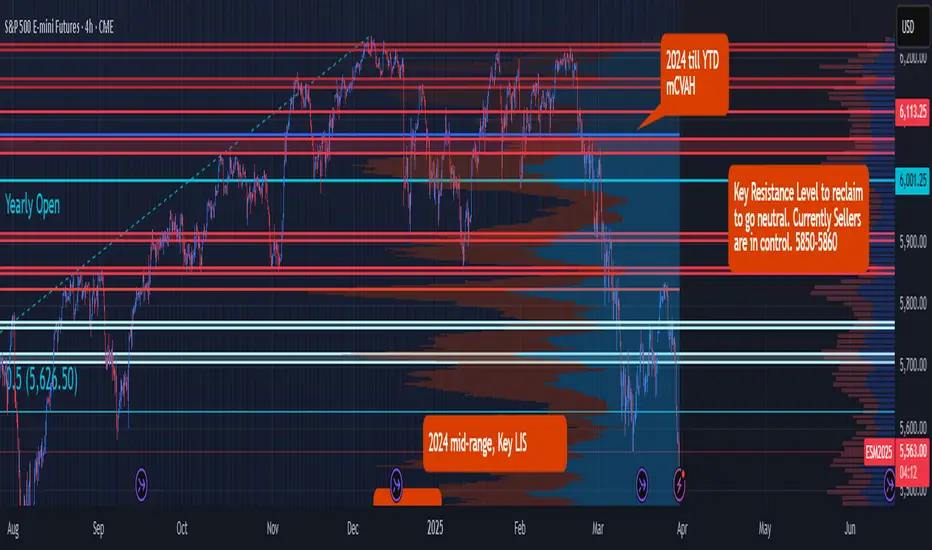

Key Levels to Watch:

- Yearly Open 2025: 6001.25

- Key Resistance: 5850- 5860

- LVN: 5770 -5760

- Neutral Zone: 5705-5720

- Key LIS Mid Range 2024: 5626.50

- 2024-YTD mCVAL: 5381

- 2022 CVAH: 5349.75

- August 5th, 2024 Low: 5306.75

- Scenario 1: Bold but Strategic Tariffs (Effective Use of Tariff to reduce trade deficit and raise revenue): In this scenario, we may see relief rally in ES futures, price reclaiming 2024 mid-range with a move higher towards key resistance level.

- Scenario 2: Maximum pressure, maximum tariff (All out trade war): In this scenario, we anticipate a sell-off with major support levels, such as 2024- YTD mCVAL, 2022 CVAH and August 5th, 2024 low as immediate downside targets.

- Scenario 3: Further delays in Tariff policy (A negotiating tool, with looming uncertainty): In this scenario, sellers remain in control and uncertainty persists, while we anticipate that rallies may be sold, market price action may remain choppy and range bound.

EdgeClear

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

EdgeClear

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.